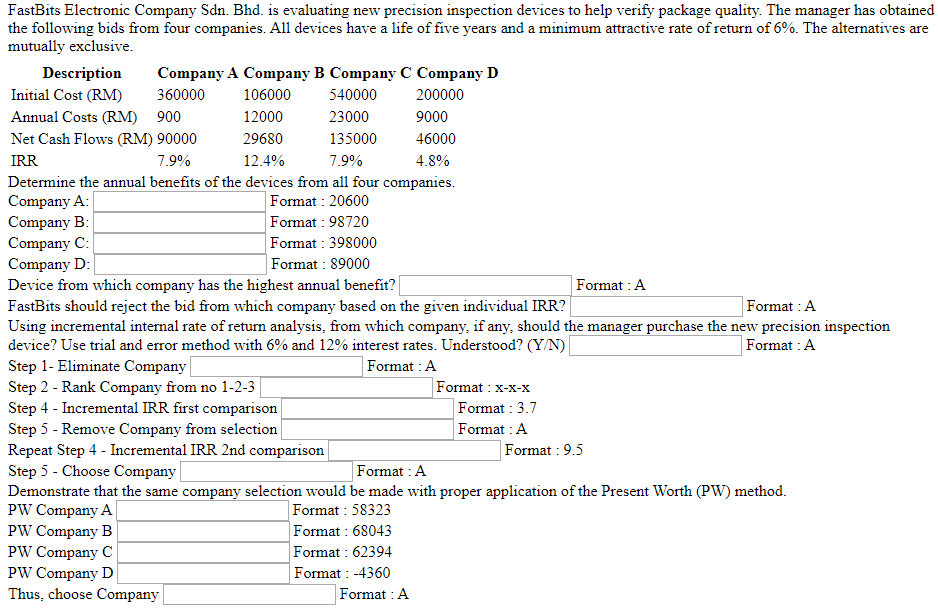

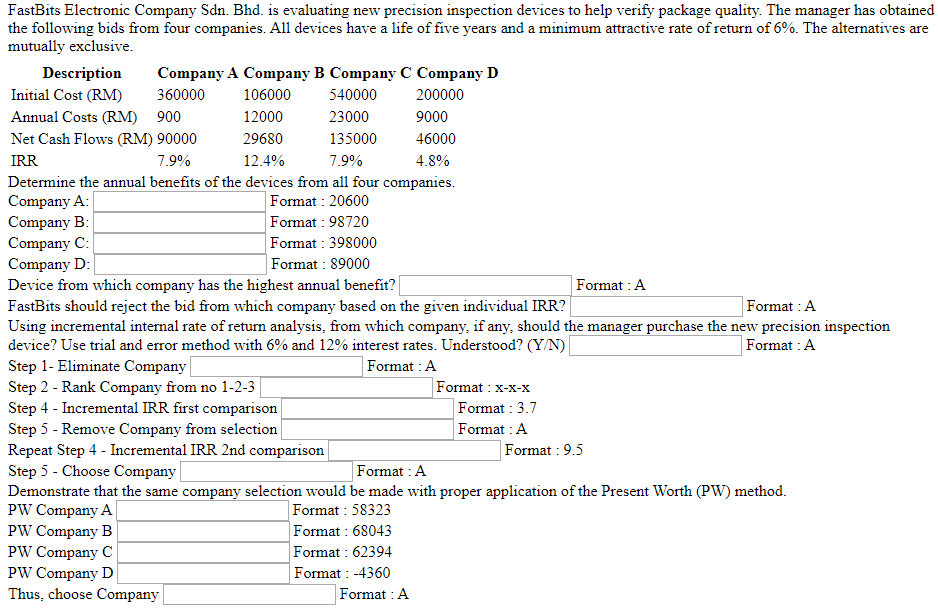

FastBits Electronic Company Sdn. Bhd. is evaluating new precision inspection devices to help verify package quality. The manager has obtained the following bids from four companies. All devices have a life of five years and a minimum attractive rate of return of 6%. The alternatives are mutually exclusive. Description Company A Company B Company C Company D Initial Cost (RM) 360000 106000 540000 200000 Annual Costs (RM) 900 12000 23000 9000 Net Cash Flows (RM) 90000 2 9680 135000 46000 IRR 7.9% 12.4% 7.9% 4.8% Determine the annual benefits of the devices from all four companies. Company A: Format : 20600 Company B: Format : 98720 Company C: Format: 398000 Company D: Format : 89000 Device from which company has the highest annual benefit? Format : A FastBits should reject the bid from which company based on the given individual IRR? Format : A Using incremental internal rate of return analysis, from which company, if any, should the manager purchase the new precision inspection device? Use trial and error method with 6% and 12% interest rates. Understood? (Y/N) Format : A Step 1- Eliminate Company Format : A Step 2 - Rank Company from no 1-2-3 Format : X-X-X Step 4 - Incremental IRR first comparison Format : 3.7 Step 5 - Remove Company from selection Format : A Repeat Step 4 - Incremental IRR 2nd comparison Format: 9.5 Step 5 - Choose Company Format: A Demonstrate that the same company selection would be made with proper application of the Present Worth (PW) method. PW Company A Format : 58323 PW Company B Format : 68043 PW Company C Format : 62394 PW Company D Format : -4360 Thus, choose Company Format : A FastBits Electronic Company Sdn. Bhd. is evaluating new precision inspection devices to help verify package quality. The manager has obtained the following bids from four companies. All devices have a life of five years and a minimum attractive rate of return of 6%. The alternatives are mutually exclusive. Description Company A Company B Company C Company D Initial Cost (RM) 360000 106000 540000 200000 Annual Costs (RM) 900 12000 23000 9000 Net Cash Flows (RM) 90000 2 9680 135000 46000 IRR 7.9% 12.4% 7.9% 4.8% Determine the annual benefits of the devices from all four companies. Company A: Format : 20600 Company B: Format : 98720 Company C: Format: 398000 Company D: Format : 89000 Device from which company has the highest annual benefit? Format : A FastBits should reject the bid from which company based on the given individual IRR? Format : A Using incremental internal rate of return analysis, from which company, if any, should the manager purchase the new precision inspection device? Use trial and error method with 6% and 12% interest rates. Understood? (Y/N) Format : A Step 1- Eliminate Company Format : A Step 2 - Rank Company from no 1-2-3 Format : X-X-X Step 4 - Incremental IRR first comparison Format : 3.7 Step 5 - Remove Company from selection Format : A Repeat Step 4 - Incremental IRR 2nd comparison Format: 9.5 Step 5 - Choose Company Format: A Demonstrate that the same company selection would be made with proper application of the Present Worth (PW) method. PW Company A Format : 58323 PW Company B Format : 68043 PW Company C Format : 62394 PW Company D Format : -4360 Thus, choose Company Format : A