Answered step by step

Verified Expert Solution

Question

1 Approved Answer

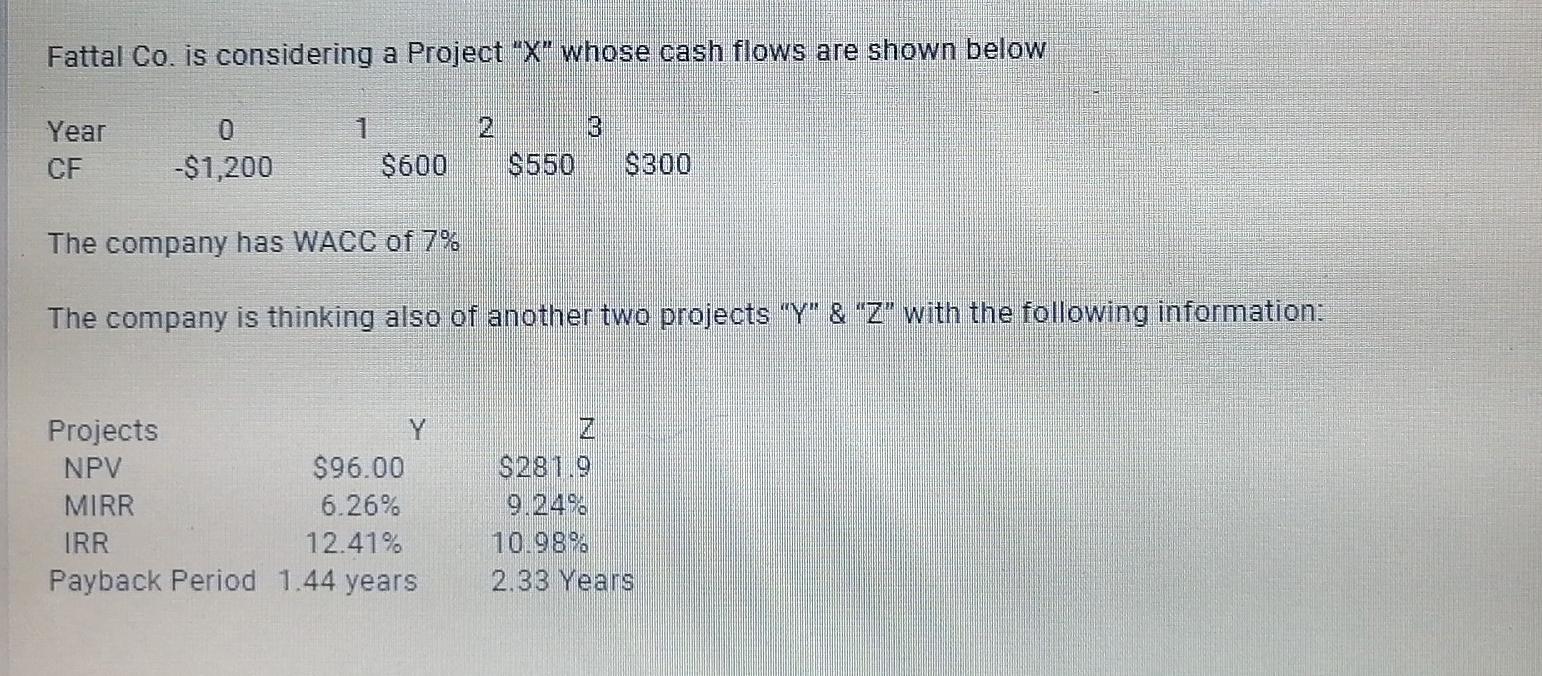

Fattal Co. is considering a Project X whose cash flows are shown below 1 Year CF 0 -$1,200 $600 $550 $300 The company has WACC

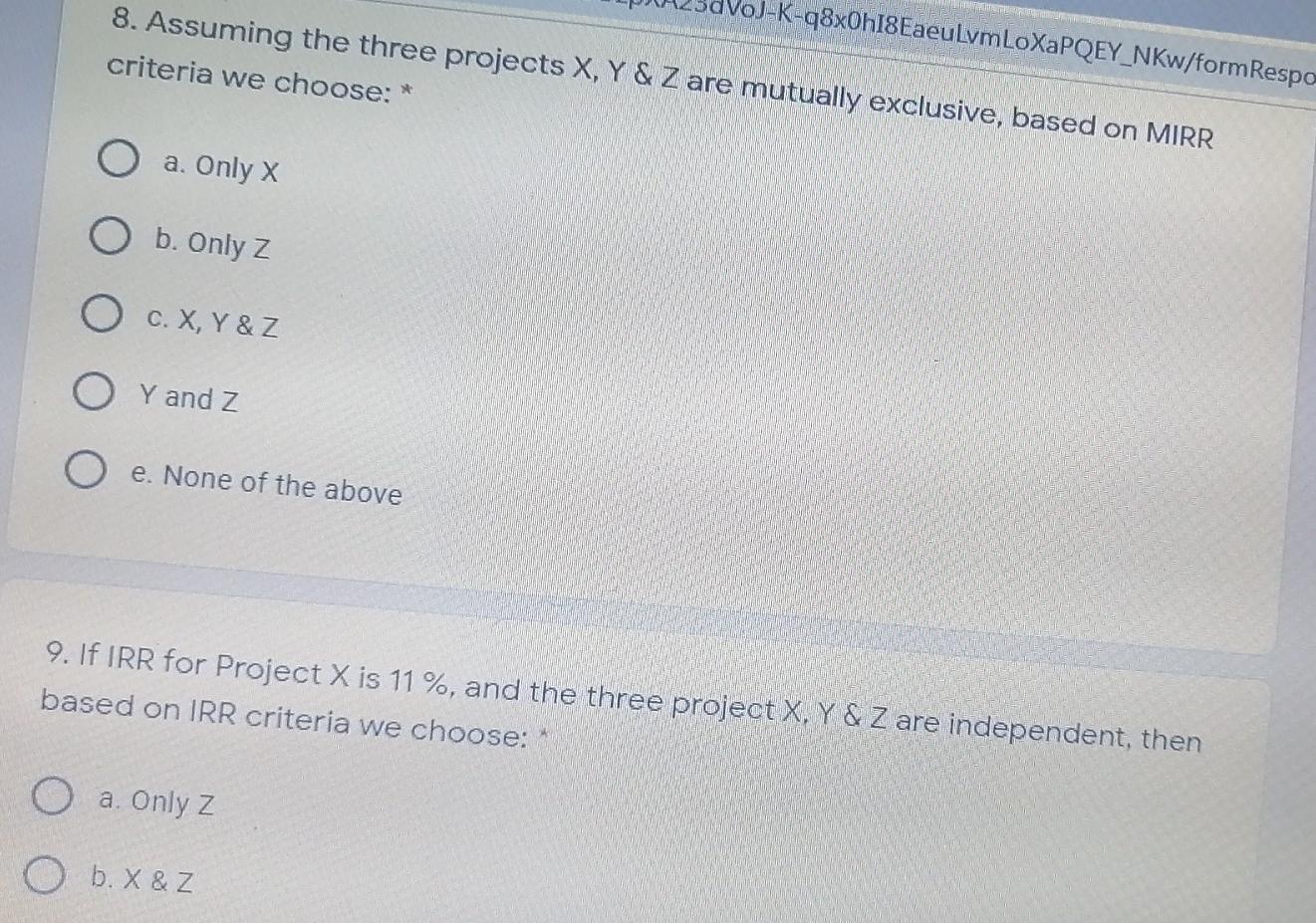

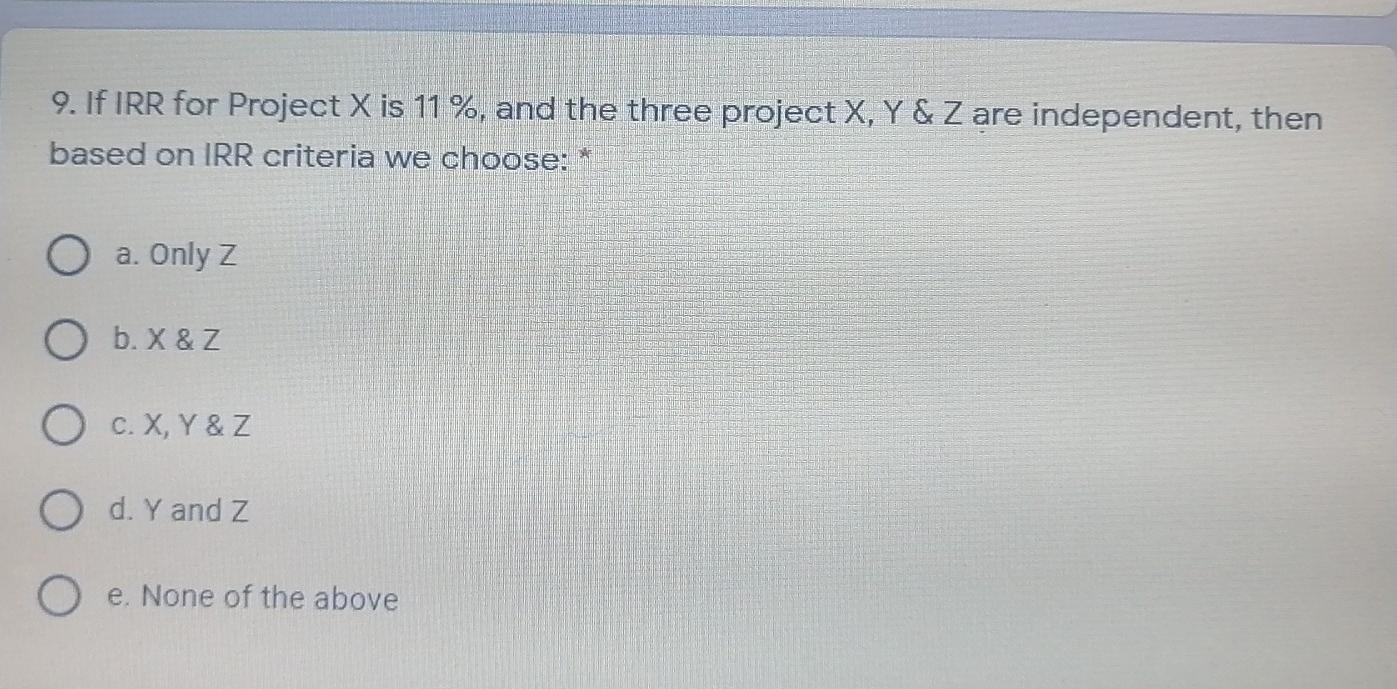

Fattal Co. is considering a Project "X" whose cash flows are shown below 1 Year CF 0 -$1,200 $600 $550 $300 The company has WACC of 7% The company is thinking also of another two projects "Y" & "Z" with the following information: Projects NPV $96.00 MIRR 6.26% IRR 12.41% Payback Period 1.44 years $281.9 9.24% 10.98% 2.33 Years -K-q8x0h18EaeulvmLoXaPQEY_NKw/formRespo 8. Assuming the three projects X, Y & Z are mutually exclusive, based on MIRR criteria we choose: * O a Only X O b. Only z O c. X, Y&Z Y and Z O e. None of the above 9. If IRR for Project X is 11 %, and the three project X, Y & Z are independent, then based on IRR criteria we choose: O a. Only z O b. X&z 9. If IRR for Project X is 11 %, and the three project X, Y & Z are independent, then based on IRR criteria we choose: * O a. Only Z O b. X & Z O c., Y & Z O d. Y and Z O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started