Answered step by step

Verified Expert Solution

Question

1 Approved Answer

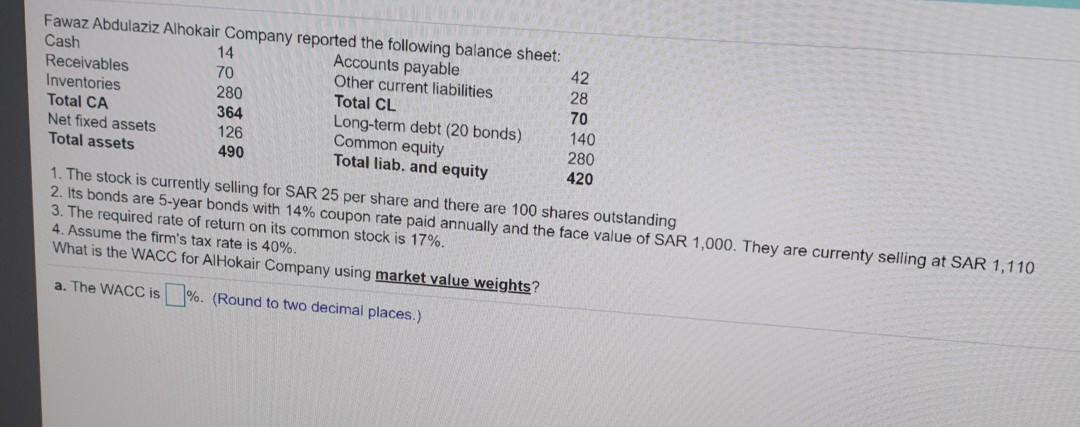

Fawaz Abdulaziz Alhokair Company reported the following balance sheet: Cash 14 Accounts payable Receivables 70 Other current liabilities Inventories 280 Total CL Total CA 364

Fawaz Abdulaziz Alhokair Company reported the following balance sheet: Cash 14 Accounts payable Receivables 70 Other current liabilities Inventories 280 Total CL Total CA 364 Long-term debt (20 bonds) Net fixed assets 126 Common equity Total assets 490 Total liab. and equity 42 28 70 140 280 420 1. The stock is currently selling for SAR 25 per share and there are 100 shares outstanding 2. Its bonds are 5-year bonds with 14% coupon rate paid annually and the face value of SAR 1,000. They are currenty selling at SAR 1,110 3. The required rate of return on its common stock is 17%. 4. Assume the firm's tax rate is 40%. What is the WACC for AlHokair Company using market value weights? a. The WACC is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started