fCan someone explain the answer Im detail with step by steps of what to do with the maths equations and formulas. Thank you

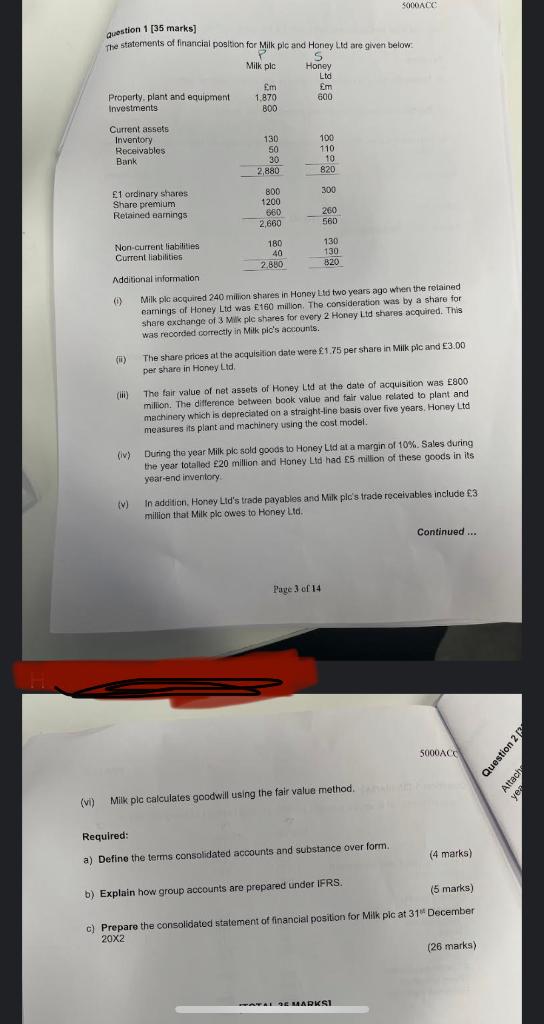

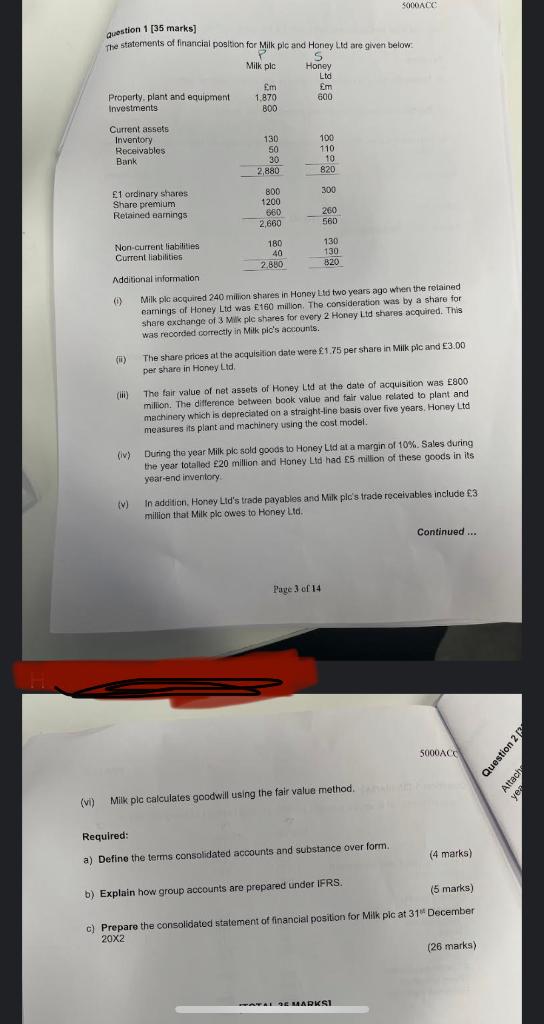

auestion 1 [35 marks] the statements of financial position for Milk ple and Honey Ltd are given below: (i) Milk ple acquired 240 milicn shares in Honcy Ltd two years ago when the relained eamings of Honey Lid was E160 million. The consideration was by a share for share exchange of 3 Milk ple shares for every 2 Honey Ltd shares acquired. This was recorded correctly in Milk pic's accounts. (ii) The share prices at the acquisilion date ware 1.75 per share in Milk plc and 3.00 per share in Honey Lid. (iii) The tair value of net assets of Honey Ltd at the date of acquisition was 800 million. The difference between book value and fair value related to plant and machinery which is depreciated on a straight-line basis over five years, Honey Ltd measures its plant and machinery using the cost model. (iv) During the year Milk ple sold goods to Honey Lid at a margin of 10%. Sales during the year totalled 220 million and Honey Ltd had 5 million of these goods in its year-end inventory. (v) In addition. Honey Lid's trade payables and Milk plc's trade receivables include 3 million that Milk ple owes to Honey Lid. Continued ... Page 3 of 14 (vi) Milk ple calculates goodwill using the fair value method. Required: a) Define the terms consolidated accounts and substance over form. (4 marks) b) Explain how group accounts are prepared under IFRS. ( 5 marks) c) Prepare the consolidated statement of financial position for Milk pic at 31 December 202 ( 26 marks) auestion 1 [35 marks] the statements of financial position for Milk ple and Honey Ltd are given below: (i) Milk ple acquired 240 milicn shares in Honcy Ltd two years ago when the relained eamings of Honey Lid was E160 million. The consideration was by a share for share exchange of 3 Milk ple shares for every 2 Honey Ltd shares acquired. This was recorded correctly in Milk pic's accounts. (ii) The share prices at the acquisilion date ware 1.75 per share in Milk plc and 3.00 per share in Honey Lid. (iii) The tair value of net assets of Honey Ltd at the date of acquisition was 800 million. The difference between book value and fair value related to plant and machinery which is depreciated on a straight-line basis over five years, Honey Ltd measures its plant and machinery using the cost model. (iv) During the year Milk ple sold goods to Honey Lid at a margin of 10%. Sales during the year totalled 220 million and Honey Ltd had 5 million of these goods in its year-end inventory. (v) In addition. Honey Lid's trade payables and Milk plc's trade receivables include 3 million that Milk ple owes to Honey Lid. Continued ... Page 3 of 14 (vi) Milk ple calculates goodwill using the fair value method. Required: a) Define the terms consolidated accounts and substance over form. (4 marks) b) Explain how group accounts are prepared under IFRS. ( 5 marks) c) Prepare the consolidated statement of financial position for Milk pic at 31 December 202 ( 26 marks)