Answered step by step

Verified Expert Solution

Question

1 Approved Answer

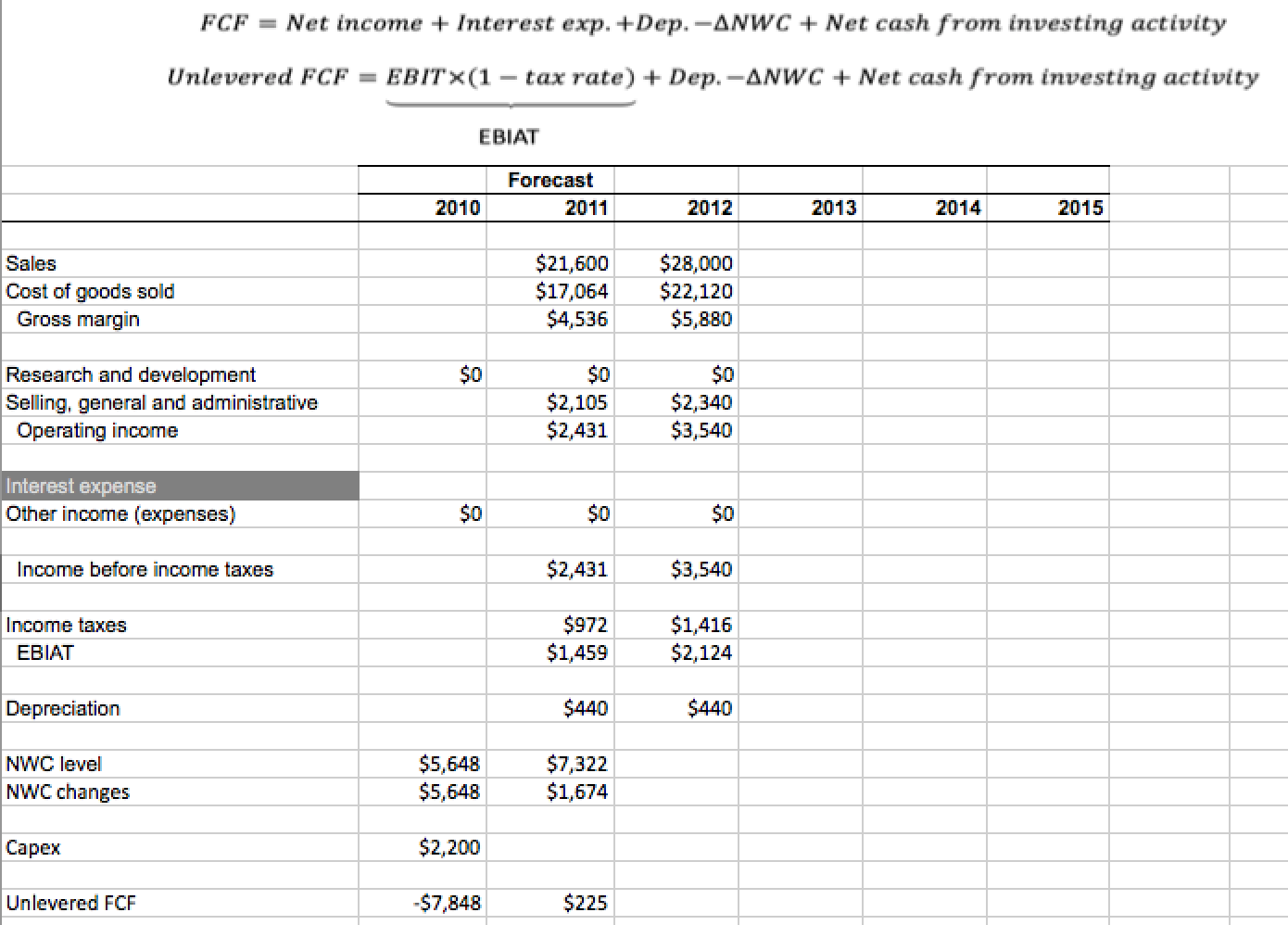

FCF = Net income + Interest exp. +Dep.ANWC + Net cash from investing activity - Unlevered FCF = EBIT(1 tax rate) + Dep. -ANWC

FCF = Net income + Interest exp. +Dep.ANWC + Net cash from investing activity - Unlevered FCF = EBIT(1 tax rate) + Dep. -ANWC + Net cash from investing activity EBIAT Forecast 2010 2011 2012 2013 2014 2015 Sales Cost of goods sold $21,600 $28,000 $17,064 $22,120 Gross margin $4,536 $5,880 Research and development $0 $0 $0 Selling, general and administrative $2,105 $2,340 Operating income $2,431 $3,540 Interest expense Other income (expenses) $0 $0 $0 Income before income taxes $2,431 $3,540 Income taxes $972 $1,416 EBIAT $1,459 $2,124 Depreciation $440 $440 NWC level $5,648 $7,322 NWC changes $5,648 $1,674 Capex $2,200 Unlevered FCF -$7,848 $225

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Unlevered Free Cash Flow FCF for each year based on the provide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started