Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FCFE Valution practice IPO Valuation: FCFE valuation practice. Suppose Company A is in a maturity market, which as regulations on product pricing. Therefore, it is

FCFE Valution practice

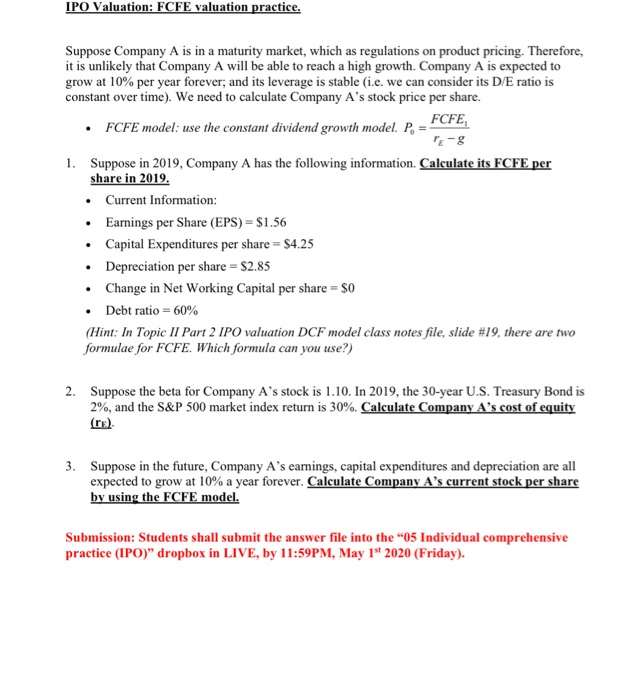

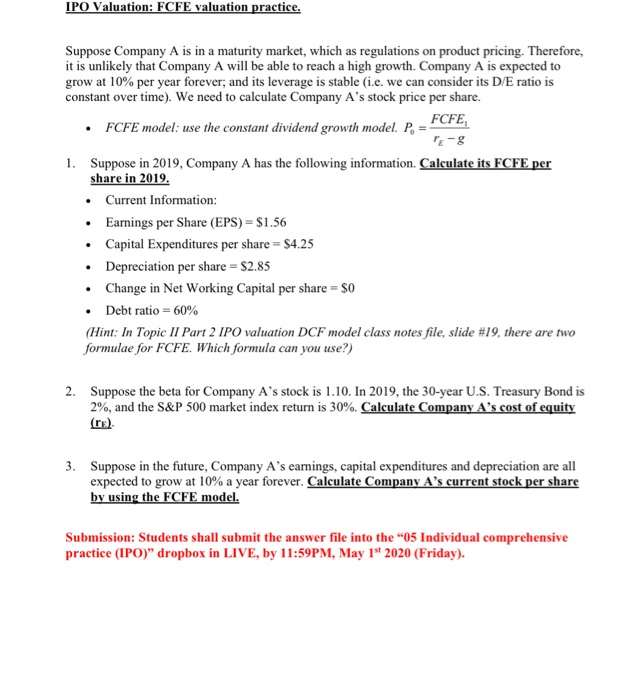

IPO Valuation: FCFE valuation practice. Suppose Company A is in a maturity market, which as regulations on product pricing. Therefore, it is unlikely that Company A will be able to reach a high growth. Company A is expected to grow at 10% per year forever, and its leverage is stable (i.e. we can consider its D/E ratio is constant over time). We need to calculate Company A's stock price per share. 1. FCFE model: use the constant dividend growth model. P= 0 "E-8 Suppose in 2019, Company A has the following information. Calculate its FCFE per share in 2019. Current Information: Earnings per Share (EPS) - $1.56 Capital Expenditures per share = $4.25 Depreciation per share = $2.85 Change in Net Working Capital per share = $0 Debt ratio = 60% (Hint: In Topic II Part 2 IPO valuation DCF model class notes file, slide #19, there are two formulae for FCFE. Which formula can you use?) 2. Suppose the beta for Company A's stock is 1.10. In 2019, the 30-year U.S. Treasury Bond is 2%, and the S&P 500 market index return is 30%. Calculate Company A's cost of equity 3. Suppose in the future, Company A's earnings, capital expenditures and depreciation are all expected to grow at 10% a year forever. Calculate Company A's current stock per share by using the FCFE model. Submission: Students shall submit the answer file into the "05 Individual comprehensive practice (IPO)" dropbox in LIVE, by 11:59PM, May 1" 2020 (Friday)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started