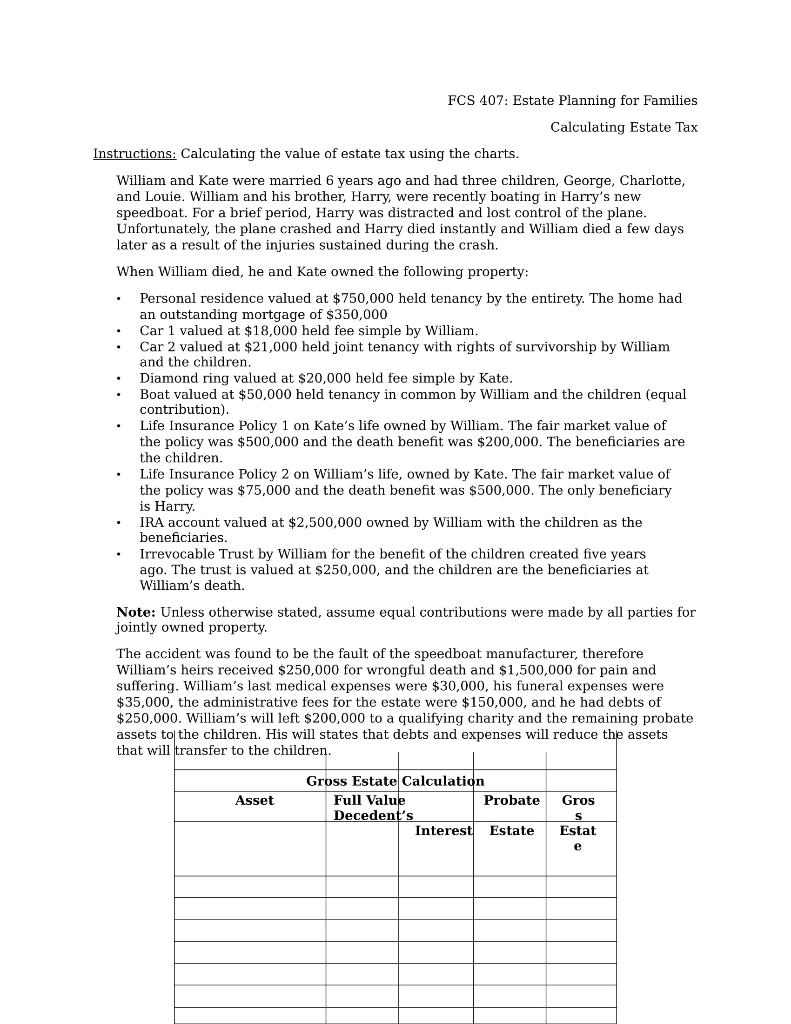

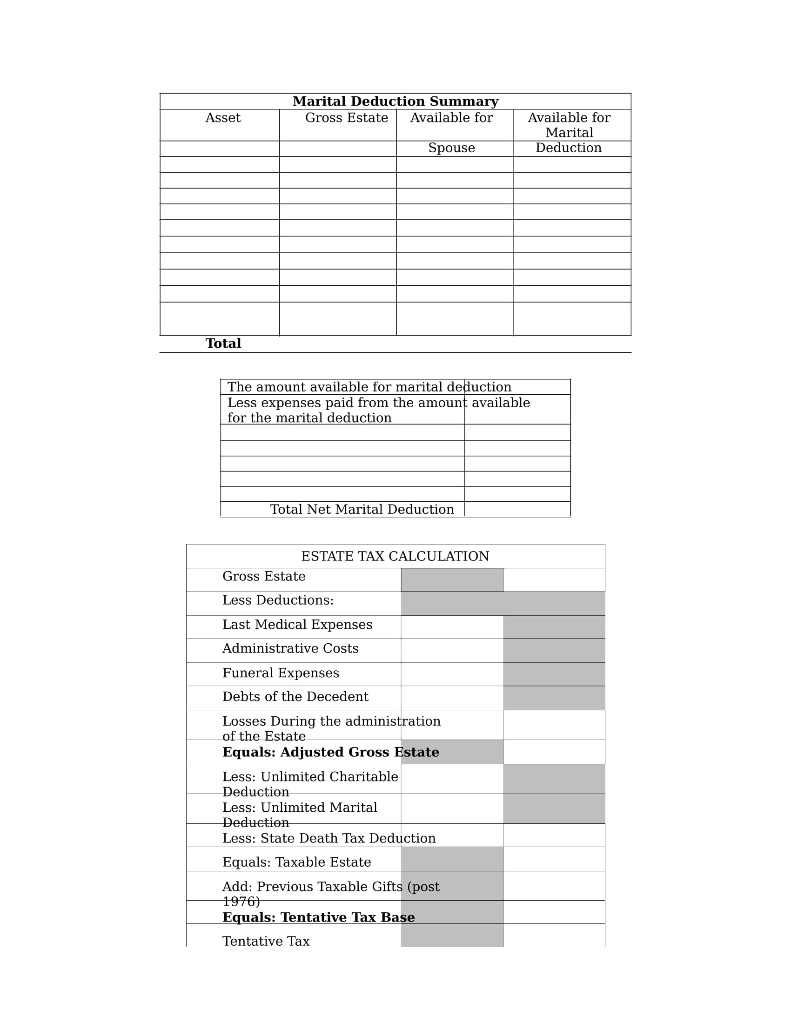

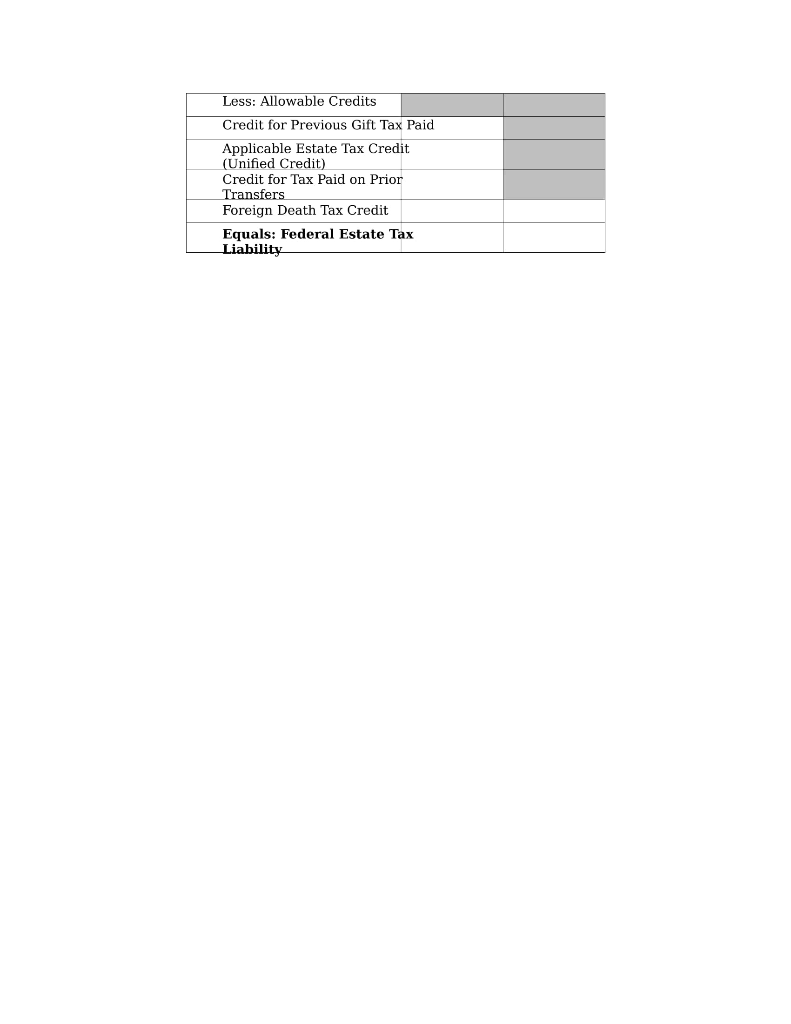

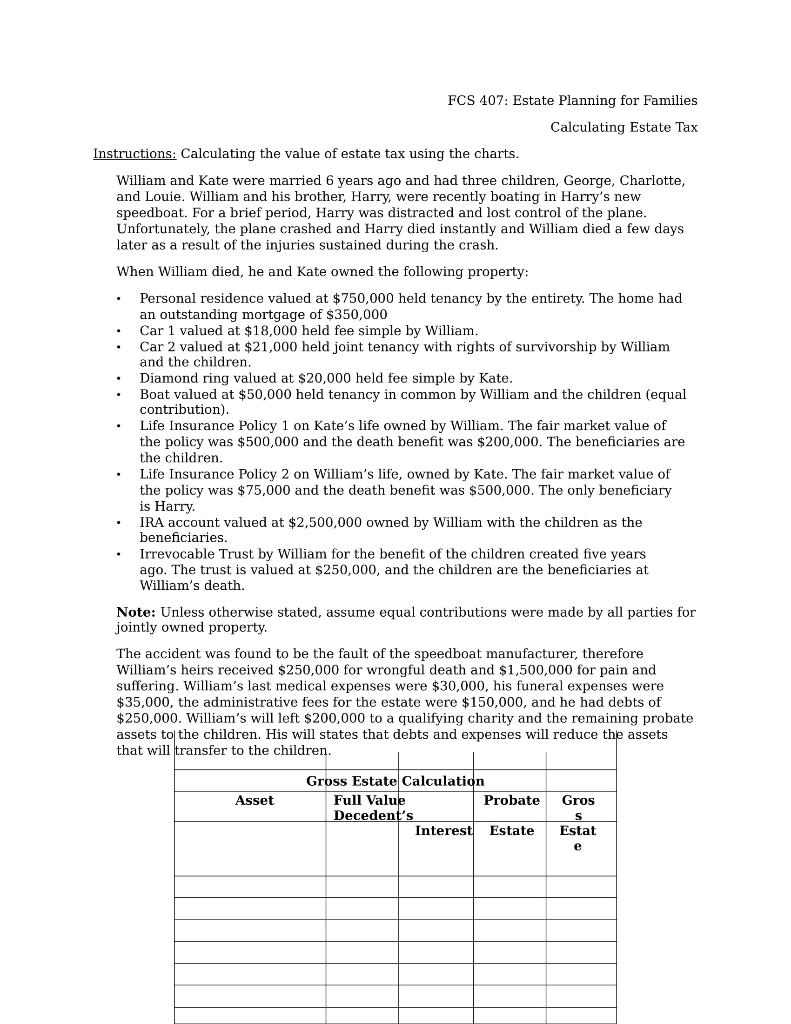

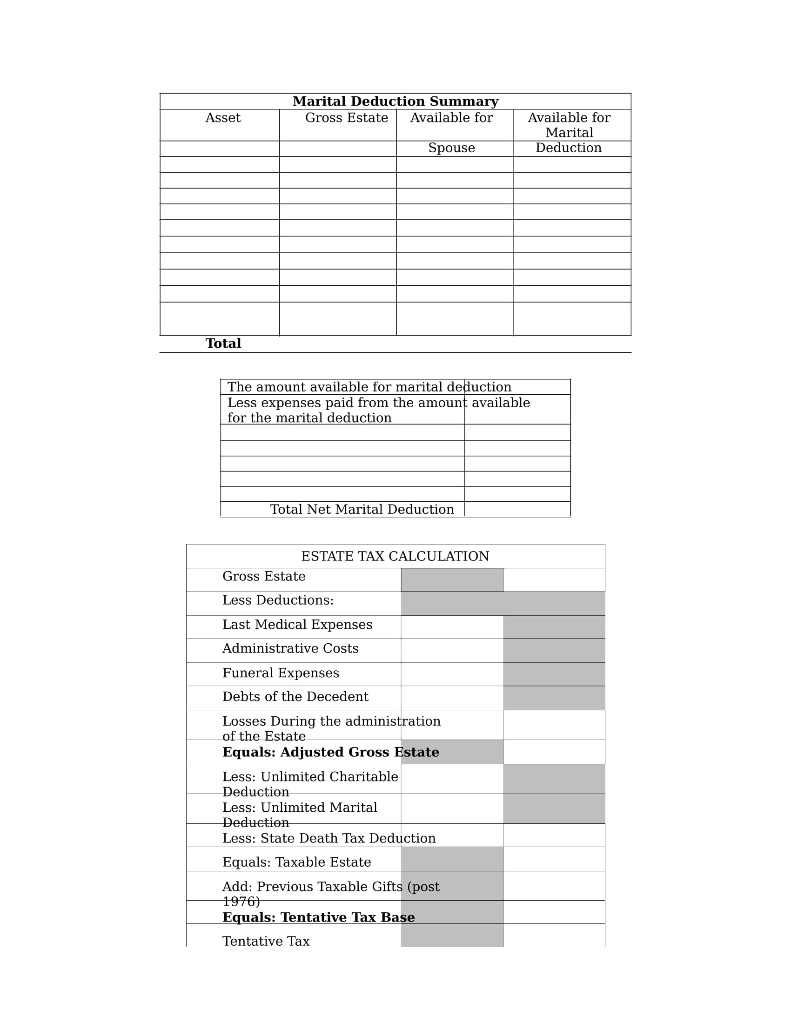

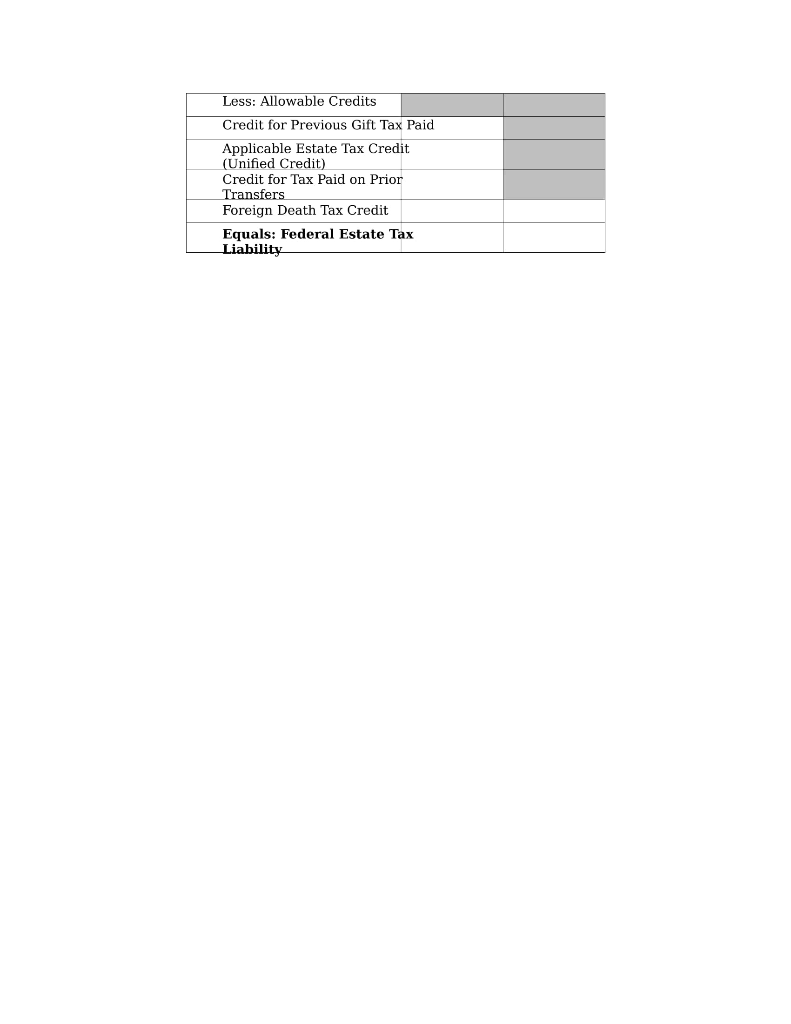

FCS 407: Estate Planning for Families Calculating Estate Tax Instructions: Calculating the value of estate tax using the charts William and Kate were married 6 years ago and had three children, George, Charlotte and Louie. William and his brother, Harry, were recently boating in Harry's new speedboat. For a brief period, Harry was distracted and lost control of the plane Unfortunately, the plane crashed and Harry died instantly and William died a few days later as a result of the injuries sustained during the crash. When William died, he and Kate owned the following property .Personal residence valued at $750,000 held tenancy by the entirety. The home had an outstanding mortgage of $350,000 .Car 1 valued at $18,000 held fee simple by William .Car 2 valued at $21,000 held joint tenancy with rights of survivorship by William and the children Diamond ring valued at $20,000 held fee simple by Kate contribution) the policy was $500,000 and the death benefit was $200,000. The beneficiaries are .Boat valued at $50,000 held tenancy in common by William and the children (equal Life Insurance Policy 1 on Kate's life owned by William. The fair market value of the children .Life Insurance Policy 2 on William's life, owned by Kate. The fair market value of the policy was $75,000 and the death benefit was $500,000. The only beneficiary is Harry IRA account valued at $2,500,000 owned by William with the children as the beneficiaries Irrevocable Trust by William for the benefit of the children created five years ago. The trust is valued at $250,000, and the children are the beneficiaries at William's death Note: Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property The accident was found to be the fault of the speedboat manufacturer, therefore William's heirs received $250,000 for wrongful death and $1,500,000 for pain and suffering. William's last medical expenses were $30,000, his funeral expenses were $35,000, the administrative fees for the estate were $150,000, and he had debts of $250,000. William's will left $200,000 to a qualifying charity and the remaining probate assets to the children. His will states that debts and expenses will reduce the assets that will transfer to the children Gross Estate Calculation Asset Full Valu Decedent's Probate Gros Interest Estate Estat Marital Deduction Summa Gross Estate Available for Available for Marital eduction Asset ouse Total The amount available for marital deduction Less expenses paid from the amount available for the marital deduction Total Net Marital Deduction ESTATE TAX CALCULATION Gross Estate Less Deductions: Last Medical Expenses Administrative Costs Funeral Expenses Debts of the Decedent Losses During the administration of the Estate Equals: Adjusted Gross Estate Less: Unlimited Charitable Dedu Less: Unlimited Marital Less: State Death Tax Deduction Equals: Taxable Estate Add: Previous Taxable Gifts (post Equals: TentativeTax Base Tentative Tax FCS 407: Estate Planning for Families Calculating Estate Tax Instructions: Calculating the value of estate tax using the charts William and Kate were married 6 years ago and had three children, George, Charlotte and Louie. William and his brother, Harry, were recently boating in Harry's new speedboat. For a brief period, Harry was distracted and lost control of the plane Unfortunately, the plane crashed and Harry died instantly and William died a few days later as a result of the injuries sustained during the crash. When William died, he and Kate owned the following property .Personal residence valued at $750,000 held tenancy by the entirety. The home had an outstanding mortgage of $350,000 .Car 1 valued at $18,000 held fee simple by William .Car 2 valued at $21,000 held joint tenancy with rights of survivorship by William and the children Diamond ring valued at $20,000 held fee simple by Kate contribution) the policy was $500,000 and the death benefit was $200,000. The beneficiaries are .Boat valued at $50,000 held tenancy in common by William and the children (equal Life Insurance Policy 1 on Kate's life owned by William. The fair market value of the children .Life Insurance Policy 2 on William's life, owned by Kate. The fair market value of the policy was $75,000 and the death benefit was $500,000. The only beneficiary is Harry IRA account valued at $2,500,000 owned by William with the children as the beneficiaries Irrevocable Trust by William for the benefit of the children created five years ago. The trust is valued at $250,000, and the children are the beneficiaries at William's death Note: Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property The accident was found to be the fault of the speedboat manufacturer, therefore William's heirs received $250,000 for wrongful death and $1,500,000 for pain and suffering. William's last medical expenses were $30,000, his funeral expenses were $35,000, the administrative fees for the estate were $150,000, and he had debts of $250,000. William's will left $200,000 to a qualifying charity and the remaining probate assets to the children. His will states that debts and expenses will reduce the assets that will transfer to the children Gross Estate Calculation Asset Full Valu Decedent's Probate Gros Interest Estate Estat Marital Deduction Summa Gross Estate Available for Available for Marital eduction Asset ouse Total The amount available for marital deduction Less expenses paid from the amount available for the marital deduction Total Net Marital Deduction ESTATE TAX CALCULATION Gross Estate Less Deductions: Last Medical Expenses Administrative Costs Funeral Expenses Debts of the Decedent Losses During the administration of the Estate Equals: Adjusted Gross Estate Less: Unlimited Charitable Dedu Less: Unlimited Marital Less: State Death Tax Deduction Equals: Taxable Estate Add: Previous Taxable Gifts (post Equals: TentativeTax Base Tentative Tax