Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fearing that market interest rate will fluctuate, Bethlehem with credit rating of Baa decides to engage in an interest rate swaps for their 100

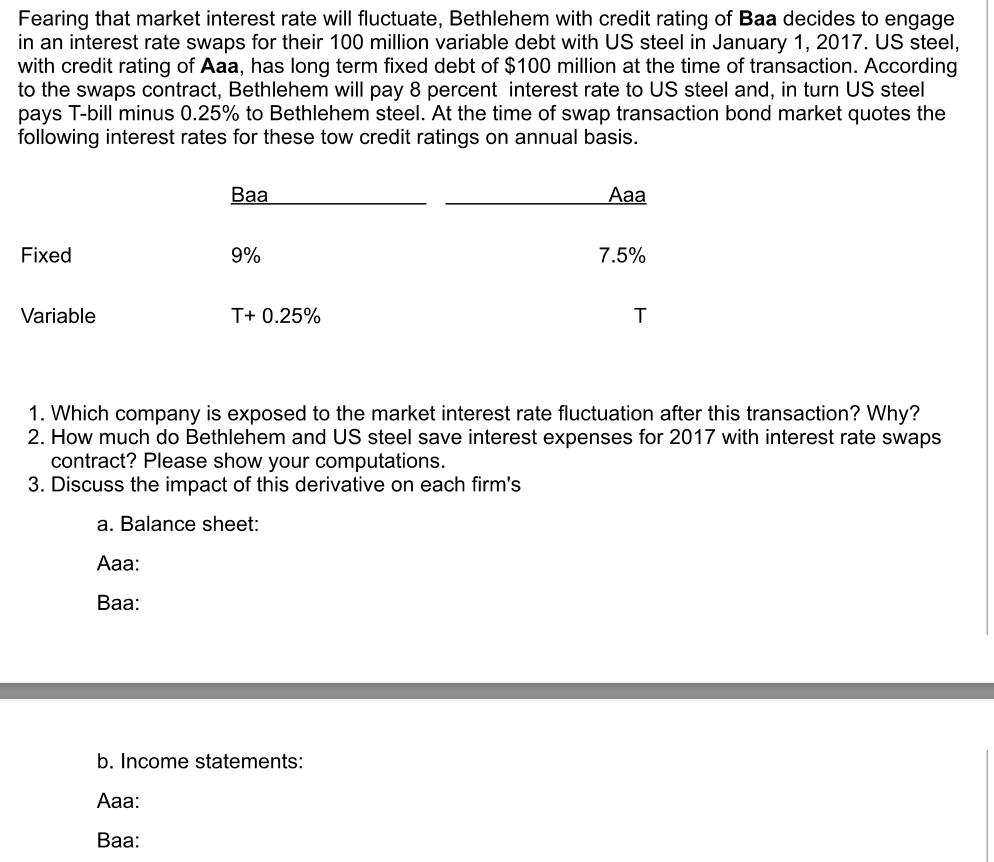

Fearing that market interest rate will fluctuate, Bethlehem with credit rating of Baa decides to engage in an interest rate swaps for their 100 million variable debt with US steel in January 1, 2017. US steel, with credit rating of Aaa, has long term fixed debt of $100 million at the time of transaction. According to the swaps contract, Bethlehem will pay 8 percent interest rate to US steel and, in turn US steel pays T-bill minus 0.25% to Bethlehem steel. At the time of swap transaction bond market quotes the following interest rates for these tow credit ratings on annual basis. Fixed Variable Baa 9% T+ 0.25% Aaa b. Income statements: Aaa: Baa: 7.5% T 1. Which company is exposed to the market interest rate fluctuation after this transaction? Why? 2. How much do Bethlehem and US steel save interest expenses for 2017 with interest rate swaps contract? Please show your computations. 3. Discuss the impact of this derivative on each firm's a. Balance sheet: Aaa: Baa:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

2 Bethlehem saving out of swap is as follows Cost under no swap for Bethlemhem and U...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started