Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FEDERAL GIFT TAX FORMULA SPREADSHEET INSTRUCTIONS Abe & Betty Call FACTS Abe ( SS# 1 1 1 - 1 1 - 1 1 1 1

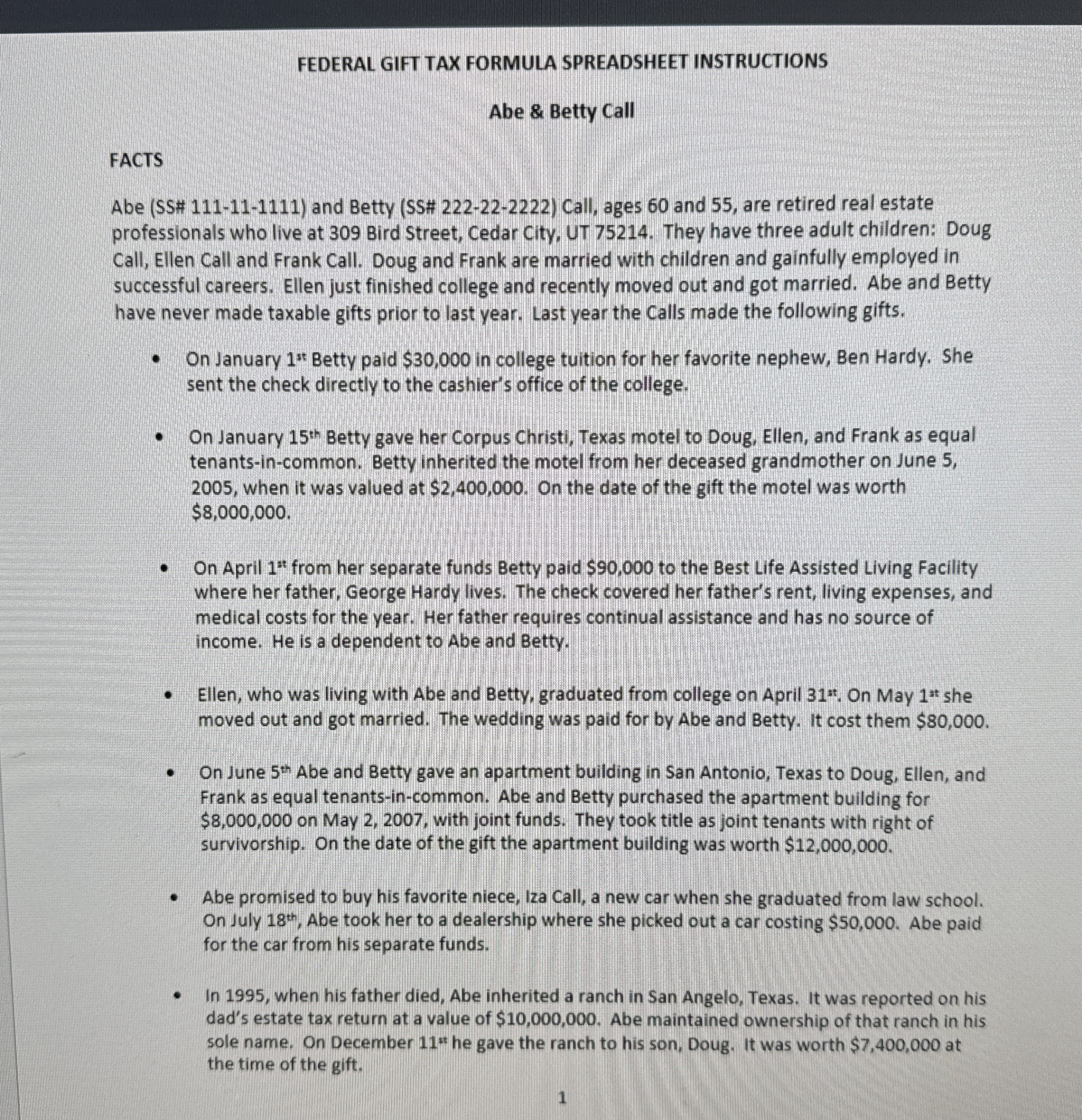

FEDERAL GIFT TAX FORMULA SPREADSHEET INSTRUCTIONS

Abe & Betty Call

FACTS

Abe SS# and Betty SS# Call, ages and are retired real estate professionals who live at Bird Street, Cedar City, UT They have three adult children: Doug Call, Ellen Call and Frank Call. Doug and Frank are married with children and gainfully employed in successful careers. Ellen just finished college and recently moved out and got married. Abe and Betty have never made taxable gifts prior to last year. Last year the Calls made the following gifts.

On January Betty paid $ in college tuition for her favorite nephew, Ben Hardy. She sent the check directly to the cashier's office of the college.

On January Betty gave her Corpus Christi, Texas motel to Doug, Ellen, and Frank as equal tenantsincommon. Betty inherited the motel from her deceased grandmother on June when it was valued at $ On the date of the gift the motel was worth $

On April from her separate funds Betty paid $ to the Best Life Assisted Living Facility where her father, George Hardy lives. The check covered her father's rent, living expenses, and medical costs for the year. Her father requires continual assistance and has no source of income. He is a dependent to Abe and Betty.

Ellen, who was living with Abe and Betty, graduated from college on April On May she moved out and got married. The wedding was paid for by Abe and Betty. It cost them $

On June Abe and Betty gave an apartment building in San Antonio, Texas to Doug, Ellen, and Frank as equal tenantsincommon. Abe and Betty purchased the apartment building for $ on May with joint funds. They took title as joint tenants with right of survivorship. On the date of the gift the apartment building was worth $

Abe promised to buy his favorite niece, Iza Call, a new car when she graduated from law school. On July Abe took her to a dealership where she picked out a car costing $ Abe paid for the car from his separate funds.

In when his father died, Abe inherited a ranch in San Angelo, Texas. It was reported on his dad's estate tax return at a value of $ Abe maintained ownership of that ranch in his sole name. On December e gave the ranch to his son, Doug. It was worth $ at the time of the gift.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started