Answered step by step

Verified Expert Solution

Question

1 Approved Answer

federal tax 2021 Which of the following statements regarding dependents is false? An individual who qualifies as a dependent of another taxpayer may not claim

federal tax 2021

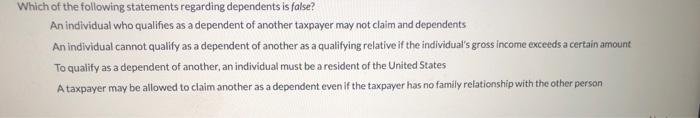

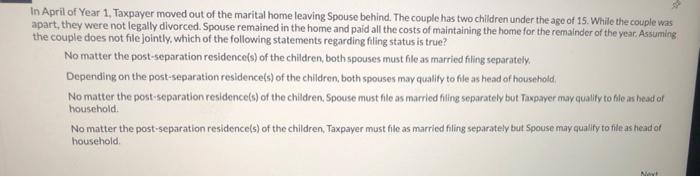

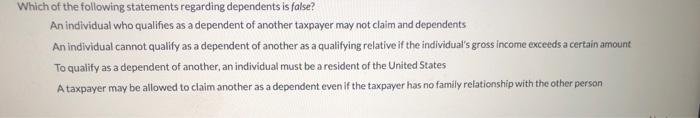

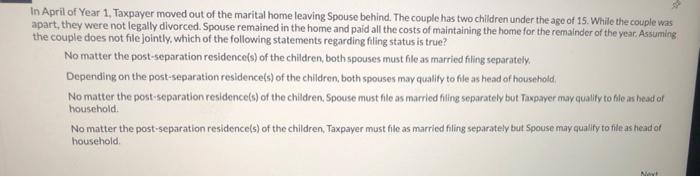

Which of the following statements regarding dependents is false? An individual who qualifies as a dependent of another taxpayer may not claim and dependents An individual cannot qualify as a dependent of another as a qualifying relative if the individual's gross income exceeds a certain amount To qualify as a dependent of another, an individual must be a resident of the United States A taxpayer may be allowed to claim another as a dependent even if the taxpayer has no family relationship with the other person In April of Year 1, Taxpayer moved out of the marital home leaving Spouse behind. The couple has two children under the age of 15. While the couple was apart, they were not legally divorced. Spouse remained in the home and paid all the costs of maintaining the home for the remainder of the year. Assuming the couple does not file jointly, which of the following statements regarding filing status is true? No matter the post-separation residence(s) of the children, both spouses must file as married filing separately. Depending on the post-separation residence(s) of the children, both spouses may qualify to file as head of household. No matter the post-separation residence(s) of the children, Spouse must file as married filling separately but Taxpayer may qualify to file as head of household. No matter the post-separation residence(s) of the children, Taxpayer must file as married filing separately but Spouse may qualify to file as head of household

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started