Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Feel n' Gone Systems Ltd (FnG) has a capital structure that consists of 80% common stock and 20% long-term debt. To calculate FnG weighted

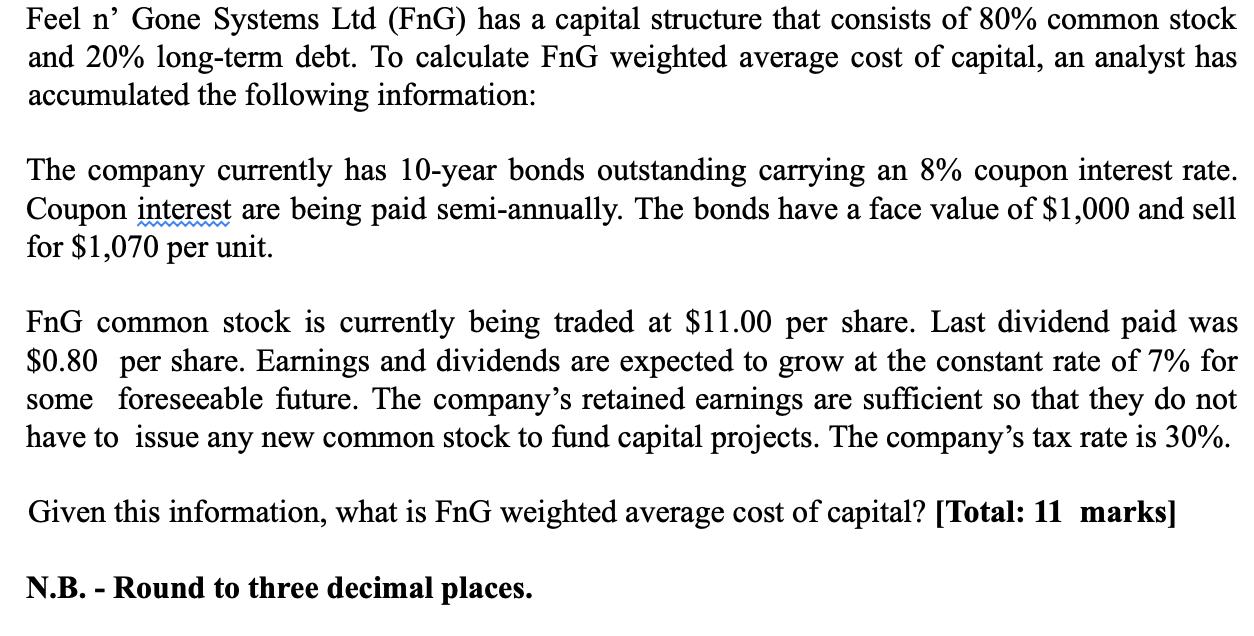

Feel n' Gone Systems Ltd (FnG) has a capital structure that consists of 80% common stock and 20% long-term debt. To calculate FnG weighted average cost of capital, an analyst has accumulated the following information: The company currently has 10-year bonds outstanding carrying an 8% coupon interest rate. Coupon interest are being paid semi-annually. The bonds have a face value of $1,000 and sell for $1,070 per unit. FnG common stock is currently being traded at $11.00 per share. Last dividend paid was $0.80 per share. Earnings and dividends are expected to grow at the constant rate of 7% for some foreseeable future. The company's retained earnings are sufficient so that they do not have to issue any new common stock to fund capital projects. The company's tax rate is 30%. Given this information, what is FnG weighted average cost of capital? [Total: 11 marks] N.B. - Round to three decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating FnGs Weighted Average Cost of Capital WACC Heres how we can calculate FnGs WACC Step 1 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started