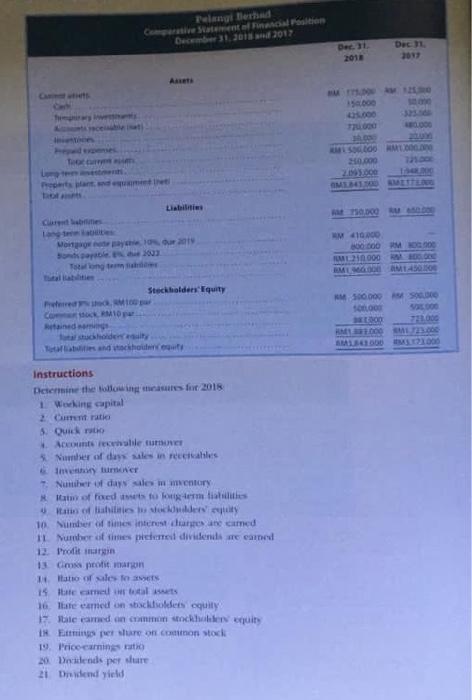

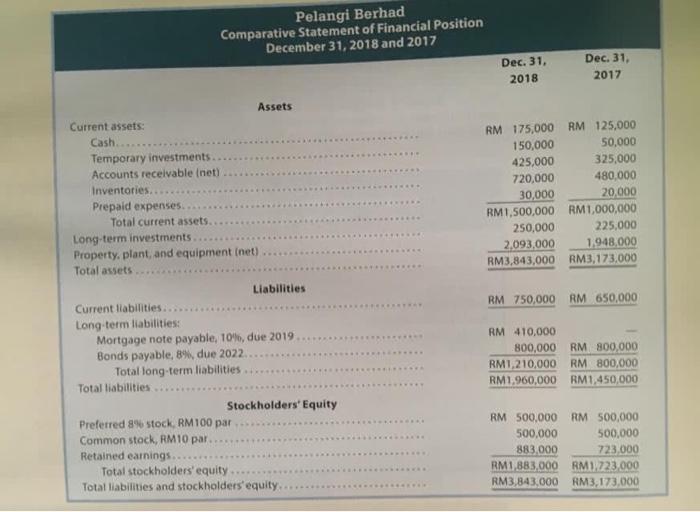

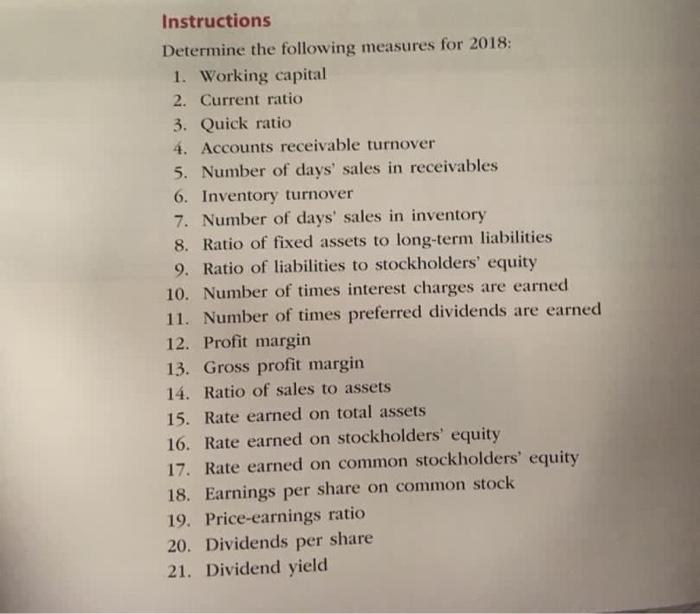

Felang Berta Come Statement of Position Dec 11 2013 DOO SOOME 10.00 295.000 Nerpayroys as 300 4100 00 ODM OG IM000 BMW MTA500 Stockholders Equity RM 500.000 sonood ained AM 600.00 and child Instructions Determine the following us for 2018 1 Working capital 2 Cuentrati Quick ratio Accounts while fume Numer of days les in reales In turner Number of days she wentary Ray of foed folosem tists of this weers 10. Sumber of time interest desnecamed IL Number of times petere dividend we earned 12. Profit margin 13 cm proti vargon Tatoorses 15 came balts 16. late eamed on schets equity Se amed on common chien quins TR Emig et sure on Common stock 19. Price carings to 20 Decadende per dure 21 Dividend yield Pelangi Berhad Comparative Statement of Financial Position December 31, 2018 and 2017 Dec. 31. 2018 Dec. 31, 2017 RM 175,000 RM 125,000 150,000 50,000 425,000 325,000 720,000 480,000 30,000 20,000 RM1,500,000 RM 1,000,000 250,000 225,000 2,093,000 1948,000 RM3,843,000 RM3,173,000 - Assets Current assets: Cash Temporary investments Accounts receivable (net) Inventories..... Prepaid expenses Total current assets. Long-term investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities. Long-term liabilities: Mortgage note payable, 10%, due 2019 Bonds payable, 8% due 2022 Total long-term liabilities Total liabilities Stockholders' Equity Preferred 8% stock RM100 par Common stock, RM10 par Retained earnings Total stockholders' equity Total liabilities and stockholders'equity, RM 750,000 RM 650,000 RM 410.000 800,000 RM 800,000 RM1,210,000 RM 800,000 RM1.960,000 RM1,450,000 RM 500,000 RM 500,000 500,000 500,000 883.000 723,000 RM1 883,000 RM1.223.000 RM3,843,000 RM3,173,000 Instructions Determine the following measures for 2018: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Number of times interest charges are earned 11. Number of times preferred dividends are earned 12. Profit margin 13. Gross profit margin 14. Ratio of sales to assets 15. Rate earned on total assets 16. Rate earned on stockholders' equity 17. Rate earned on common stockholders' equity 18. Earnings per share on common stock 19. Price-earnings ratio 20. Dividends per share 21. Dividend yield Felang Berta Come Statement of Position Dec 11 2013 DOO SOOME 10.00 295.000 Nerpayroys as 300 4100 00 ODM OG IM000 BMW MTA500 Stockholders Equity RM 500.000 sonood ained AM 600.00 and child Instructions Determine the following us for 2018 1 Working capital 2 Cuentrati Quick ratio Accounts while fume Numer of days les in reales In turner Number of days she wentary Ray of foed folosem tists of this weers 10. Sumber of time interest desnecamed IL Number of times petere dividend we earned 12. Profit margin 13 cm proti vargon Tatoorses 15 came balts 16. late eamed on schets equity Se amed on common chien quins TR Emig et sure on Common stock 19. Price carings to 20 Decadende per dure 21 Dividend yield Pelangi Berhad Comparative Statement of Financial Position December 31, 2018 and 2017 Dec. 31. 2018 Dec. 31, 2017 RM 175,000 RM 125,000 150,000 50,000 425,000 325,000 720,000 480,000 30,000 20,000 RM1,500,000 RM 1,000,000 250,000 225,000 2,093,000 1948,000 RM3,843,000 RM3,173,000 - Assets Current assets: Cash Temporary investments Accounts receivable (net) Inventories..... Prepaid expenses Total current assets. Long-term investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities. Long-term liabilities: Mortgage note payable, 10%, due 2019 Bonds payable, 8% due 2022 Total long-term liabilities Total liabilities Stockholders' Equity Preferred 8% stock RM100 par Common stock, RM10 par Retained earnings Total stockholders' equity Total liabilities and stockholders'equity, RM 750,000 RM 650,000 RM 410.000 800,000 RM 800,000 RM1,210,000 RM 800,000 RM1.960,000 RM1,450,000 RM 500,000 RM 500,000 500,000 500,000 883.000 723,000 RM1 883,000 RM1.223.000 RM3,843,000 RM3,173,000 Instructions Determine the following measures for 2018: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Number of times interest charges are earned 11. Number of times preferred dividends are earned 12. Profit margin 13. Gross profit margin 14. Ratio of sales to assets 15. Rate earned on total assets 16. Rate earned on stockholders' equity 17. Rate earned on common stockholders' equity 18. Earnings per share on common stock 19. Price-earnings ratio 20. Dividends per share 21. Dividend yield