Answered step by step

Verified Expert Solution

Question

1 Approved Answer

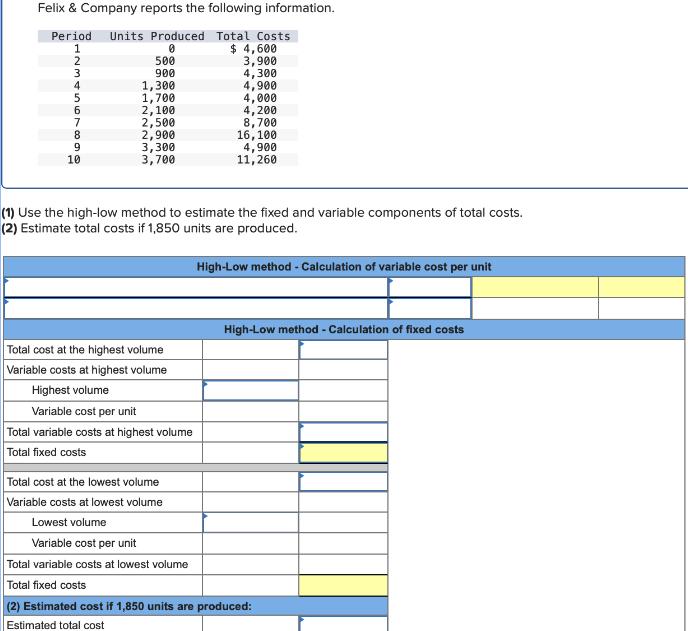

Felix & Company reports the following information. Units Produced Total Costs Period 1 2 0 500 $ 4,600 3,900 3 900 4,300 4 10

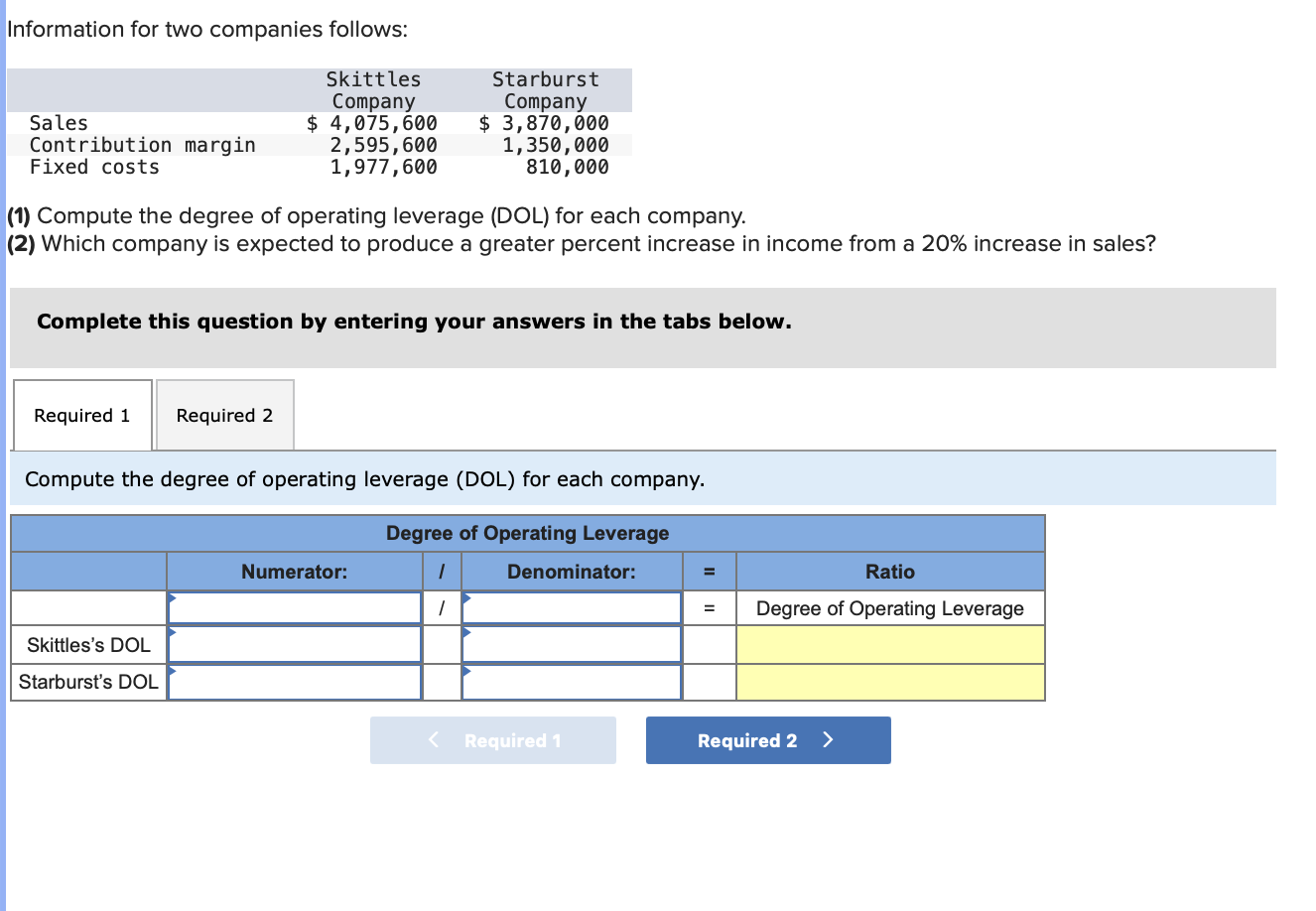

Felix & Company reports the following information. Units Produced Total Costs Period 1 2 0 500 $ 4,600 3,900 3 900 4,300 4 10 1567899 1,300 4,900 1,700 4,000 2,100 4,200 2,500 8,700 2,900 16,100 3,300 4,900 3,700 11,260 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 1,850 units are produced. High-Low method - Calculation of variable cost per unit High-Low method - Calculation of fixed costs Total cost at the highest volume Variable costs at highest volume Highest volume Variable cost per unit Total variable costs at highest volume Total fixed costs Total cost at the lowest volume Variable costs at lowest volume Lowest volume Variable cost per unit Total variable costs at lowest volume Total fixed costs (2) Estimated cost if 1,850 units are produced: Estimated total cost Information for two companies follows: Skittles Company Sales Contribution margin Fixed costs $ 4,075,600 2,595,600 1,977,600 Starburst Company $ 3,870,000 1,350,000 810,000 (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the degree of operating leverage (DOL) for each company. Degree of Operating Leverage Skittles's DOL Starburst's DOL Numerator: > 1 Denominator: = Ratio = Degree of Operating Leverage Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started