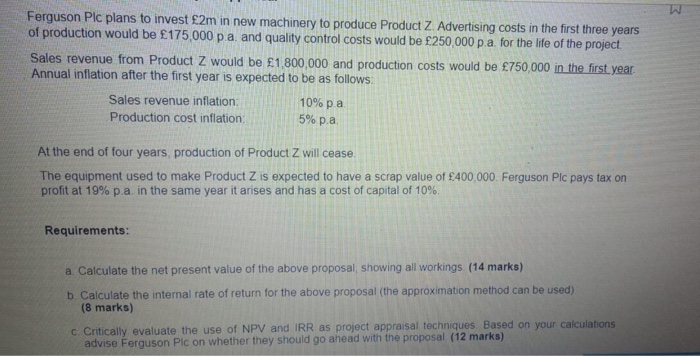

Ferguson Plc plans to invest 2m in new machinery to produce Product Z. Advertising costs in the first three years of production would be 175,000 p. a. and quality control costs would be 250,000 p.a. for the life of the project Sales revenue from Product Z would be 1,800,000 and production costs would be 750,000 in the first year Annual inflation after the first year is expected to be as follows: Sales revenue inflation: 10% pa Production cost inflation 5% pa At the end of four years production of Product Z will cease The equipment used to make Product Z is expected to have a scrap value of 400,000. Ferguson Plc pays tax on profit at 19% p.a. in the same year it arises and has a cost of capital of 10%. Requirements: a. Calculate the net present value of the above proposal showing all workings (14 marks) b. Calculate the internal rate of return for the above proposal (the approximation method can be used) (8 marks) c Critically evaluate the use of NPV and IRR as project appraisal techniques. Based on your calculations advise Ferguson Pic on whether they should go ahead with the proposal (12 marks) Ferguson Plc plans to invest 2m in new machinery to produce Product Z. Advertising costs in the first three years of production would be 175,000 p. a. and quality control costs would be 250,000 p.a. for the life of the project Sales revenue from Product Z would be 1,800,000 and production costs would be 750,000 in the first year Annual inflation after the first year is expected to be as follows: Sales revenue inflation: 10% pa Production cost inflation 5% pa At the end of four years production of Product Z will cease The equipment used to make Product Z is expected to have a scrap value of 400,000. Ferguson Plc pays tax on profit at 19% p.a. in the same year it arises and has a cost of capital of 10%. Requirements: a. Calculate the net present value of the above proposal showing all workings (14 marks) b. Calculate the internal rate of return for the above proposal (the approximation method can be used) (8 marks) c Critically evaluate the use of NPV and IRR as project appraisal techniques. Based on your calculations advise Ferguson Pic on whether they should go ahead with the proposal (12 marks)