Answered step by step

Verified Expert Solution

Question

1 Approved Answer

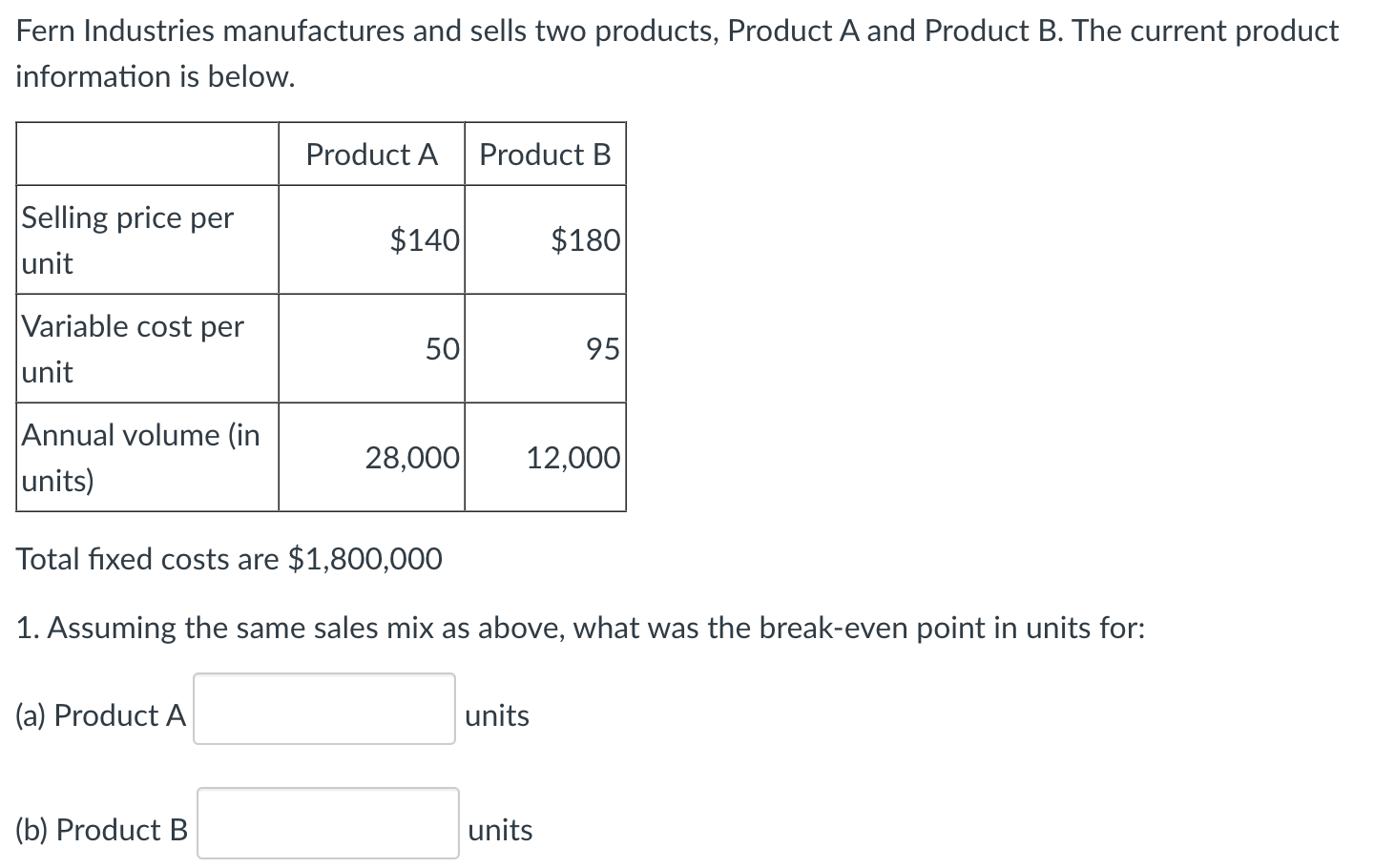

Fern Industries manufactures and sells two products, Product A and Product B. The current product information is below. Product A Product B Selling price

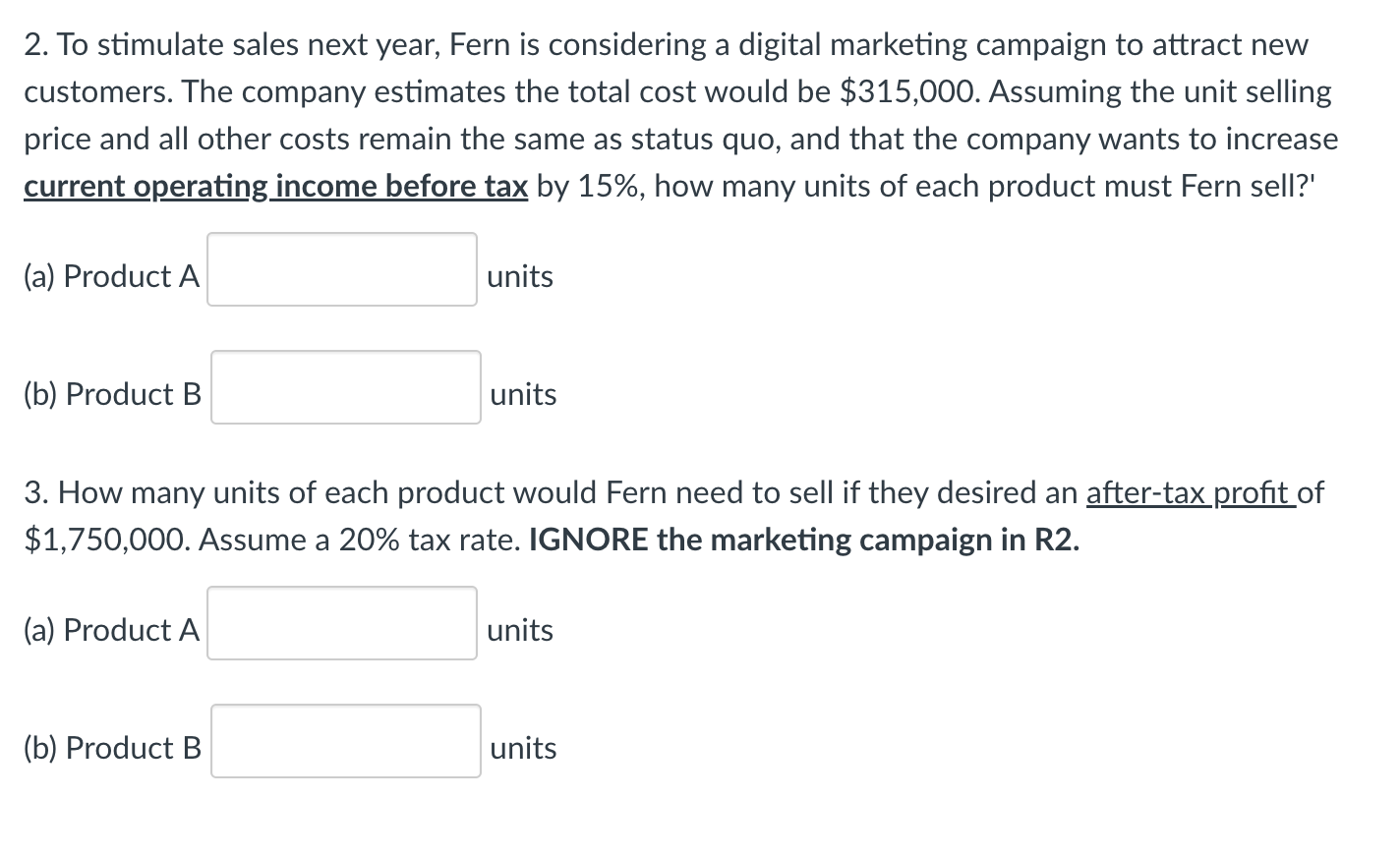

Fern Industries manufactures and sells two products, Product A and Product B. The current product information is below. Product A Product B Selling price per $140 $180 unit Variable cost per 50 95 unit Annual volume (in units) 28,000 12,000 Total fixed costs are $1,800,000 1. Assuming the same sales mix as above, what was the break-even point in units for: (a) Product A units (b) Product B units 2. To stimulate sales next year, Fern is considering a digital marketing campaign to attract new customers. The company estimates the total cost would be $315,000. Assuming the unit selling price and all other costs remain the same as status quo, and that the company wants to increase current operating income before tax by 15%, how many units of each product must Fern sell?' (a) Product A units (b) Product B units 3. How many units of each product would Fern need to sell if they desired an after-tax profit of $1,750,000. Assume a 20% tax rate. IGNORE the marketing campaign in R2. (a) Product A units (b) Product B units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started