Answered step by step

Verified Expert Solution

Question

1 Approved Answer

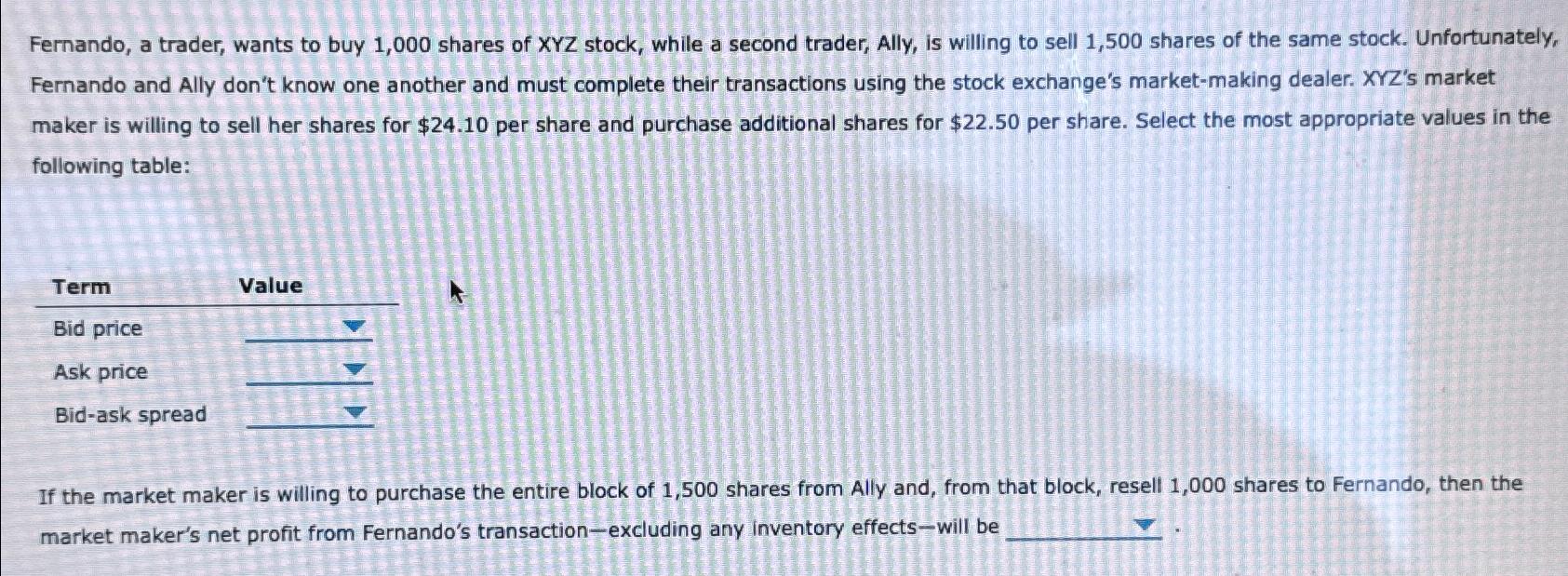

Fernando, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Ally, is willing to sell 1,500 shares of the

Fernando, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Ally, is willing to sell 1,500 shares of the same stock. Unfortunately, Fernando and Ally don't know one another and must complete their transactions using the stock exchange's market-making dealer. XYZ's market maker is willing to sell her shares for $24.10 per share and purchase additional shares for $22.50 per share. Select the most appropriate values in the following table: Term Value Bid price Ask price Bid-ask spread If the market maker is willing to purchase the entire block of 1,500 shares from Ally and, from that block, resell 1,000 shares to Fernando, then the market maker's net profit from Fernando's transaction-excluding any inventory effects-will be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Term Value Bid price 2250 Ask price 2410 Bidask spread 160 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started