Question

Easy Money, Inc., has the following capital structure. Preferred stock $100 par value, 20,000 shares authorized, 61,000 shares issued and outstanding $ 100,000 Common stock$10

Easy Money, Inc., has the following capital structure.

| Preferred stock— $100 par value, 20,000 shares authorized, 61,000 shares issued and outstanding | $ | 100,000 | |

| Common stock—$10 par value, 200,000 shares authorized, 80,000 shares issued and outstanding | 800,000 | ||

| Additional paid-in capital | 1,032,000 | ||

| Total contributed capital | $ | 1,932,000 | |

| Retained earnings | 581,000 | ||

| Total stockholders’ equity | $ | 2,513,000 | |

The number of issued and outstanding shares of both preferred and common stock have been the same for the last two years. Dividends on preferred stock are 8 percent of par value and have been paid each year the stock was outstanding except for the immediate past year. In the current year, management declares a total dividend of $50,000.

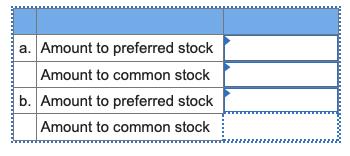

a. Indicate the amount that will be paid to both preferred and common stockholders assuming the preferred stock is not cumulative.

b. Indicate the amount that will be paid to both preferred and common stockholders assuming the preferred stock is cumulative.

a. Amount to preferred stock Amount to common stock b. Amount to preferred stock Amount to common stock

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Kasy money Inc has following Preffered slove 100 Ri 20000 Share Qulhonzed Clo Shares Issued G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started