Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Few years ago you had bought a 30 -year US bond with par value 1,000 USD and a coupon rate of 4%. Your goal was

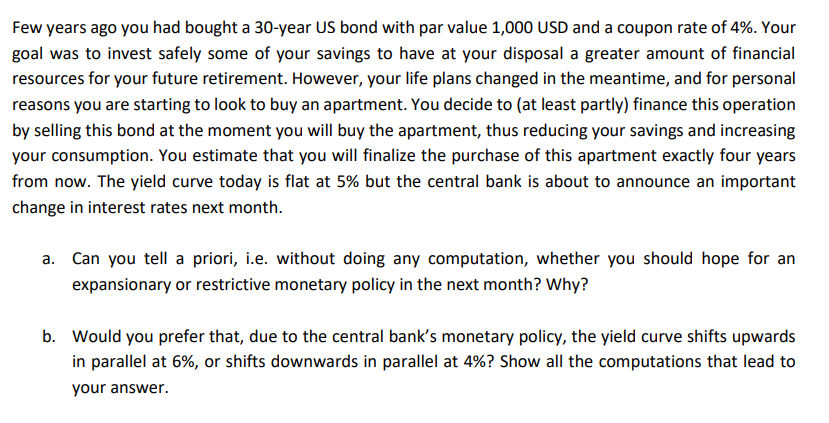

Few years ago you had bought a 30 -year US bond with par value 1,000 USD and a coupon rate of 4%. Your goal was to invest safely some of your savings to have at your disposal a greater amount of financial resources for your future retirement. However, your life plans changed in the meantime, and for personal reasons you are starting to look to buy an apartment. You decide to (at least partly) finance this operation by selling this bond at the moment you will buy the apartment, thus reducing your savings and increasing your consumption. You estimate that you will finalize the purchase of this apartment exactly four years from now. The yield curve today is flat at 5% but the central bank is about to announce an important change in interest rates next month. a. Can you tell a priori, i.e. without doing any computation, whether you should hope for an expansionary or restrictive monetary policy in the next month? Why? b. Would you prefer that, due to the central bank's monetary policy, the yield curve shifts upwards in parallel at 6%, or shifts downwards in parallel at 4% ? Show all the computations that lead to your

Few years ago you had bought a 30 -year US bond with par value 1,000 USD and a coupon rate of 4%. Your goal was to invest safely some of your savings to have at your disposal a greater amount of financial resources for your future retirement. However, your life plans changed in the meantime, and for personal reasons you are starting to look to buy an apartment. You decide to (at least partly) finance this operation by selling this bond at the moment you will buy the apartment, thus reducing your savings and increasing your consumption. You estimate that you will finalize the purchase of this apartment exactly four years from now. The yield curve today is flat at 5% but the central bank is about to announce an important change in interest rates next month. a. Can you tell a priori, i.e. without doing any computation, whether you should hope for an expansionary or restrictive monetary policy in the next month? Why? b. Would you prefer that, due to the central bank's monetary policy, the yield curve shifts upwards in parallel at 6%, or shifts downwards in parallel at 4% ? Show all the computations that lead to your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started