Answered step by step

Verified Expert Solution

Question

1 Approved Answer

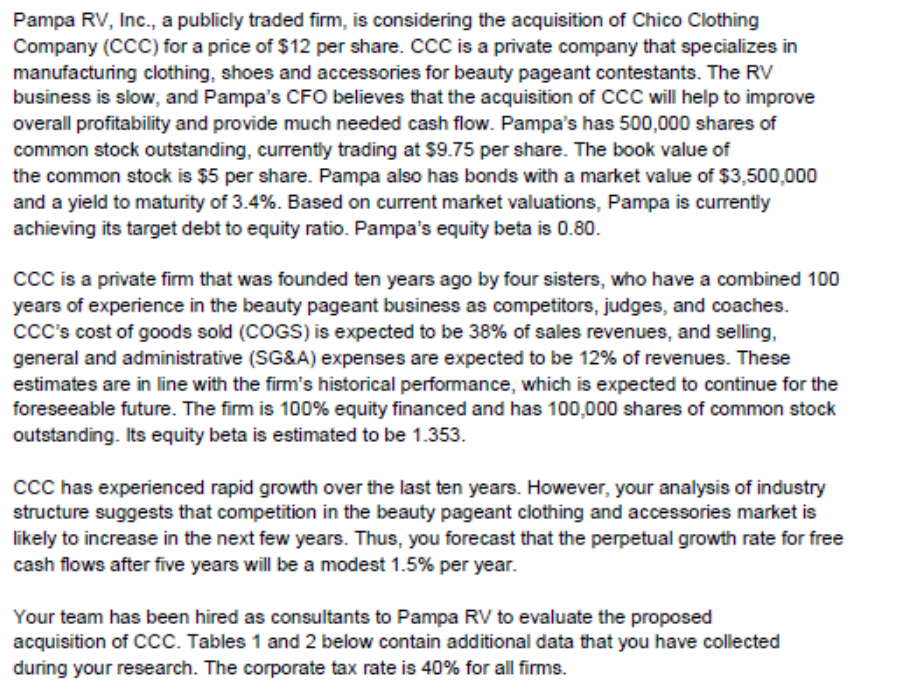

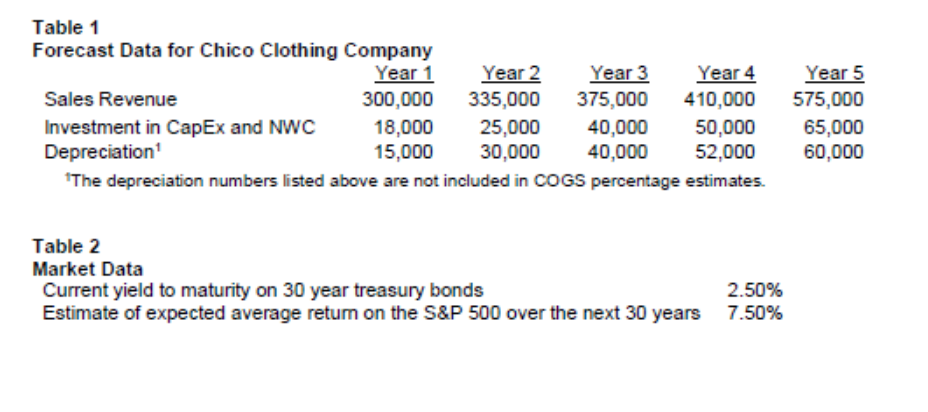

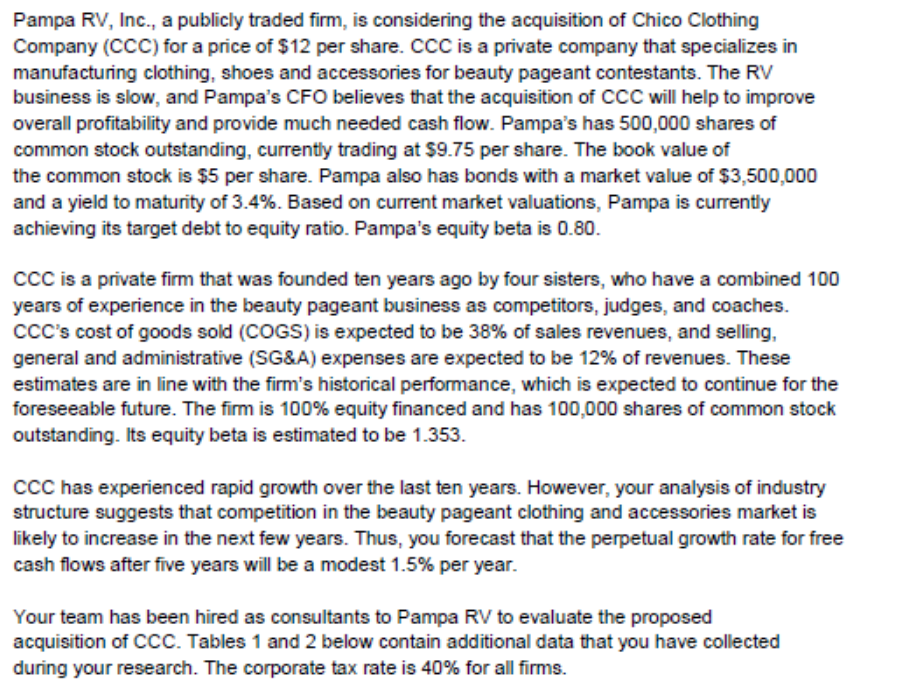

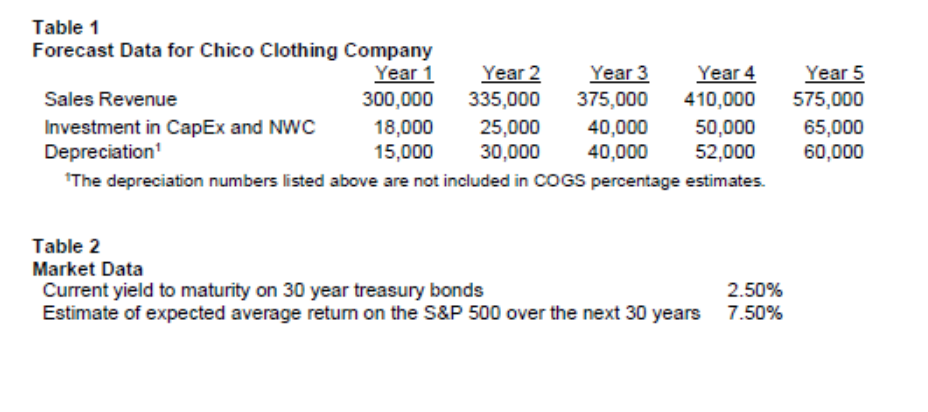

Pampa RV, Inc., a publicly traded firm, is considering the acquisition of Chico Cbthing Company (CCC) for a price of $12 per share. CCC

Pampa RV, Inc., a publicly traded firm, is considering the acquisition of Chico Cbthing Company (CCC) for a price of $12 per share. CCC is a private company that specializes in manufacturing clothing, shoes and accessories for beauty pageant contestants. The RV business is slow, and Pampa's CFO believes the acquisiton of CCC will help to improve overan profitability and provide much needed cash flow. Pampa's has 500,000 shares of common stock outstanding, currenty trading at S9.75 per share. The book value of the common stock is $5 per share. Pampa also has bonds with a market value of and a yield to maturity of 3.4%. Based on current market valuations, Pampa is currently achieving its target debt to equity ratio. Pampa's equity beta is 0.80. CCC is a private firm that was founded ten years ago by four sisters, who have a combined 100 years of experience in the beauty pageant business as competitors, judges, and coaches. CCC's cost of goods (COGS) is expected to be 38% of sabes revenues, and selling, general and administrative (SG&A) expenses are expected to be 12% of revenues. These estimates are line with the firm's historical performance, which is expected to continue for the foreseeable future. The firm is 100% equity financed and has 100,000 shares of common stock outstandhg- Its equity beta is estimated to be I -353. CCC has experienced rapid growth over the last ten years. However, your analysis of industry structure suggests that competition in the beauty pageant clothing and accessories market is likely to increase in the next few years. Thus, you forecast that the perpetual growth rate for free cash flows after five years will be a modest I per year. Your team has been hired as consultants to Pampa RV to evaluate the proposed acquisition of CCC. Tables 1 and 2 below contain additional data tlat you have collected during your research. The corporate tax rate is 40% for all firms.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started