Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom Company paid for 80% of the voting stock of Brad Company on January 1, 2011. It is now December 31, 2018. Tom accounts

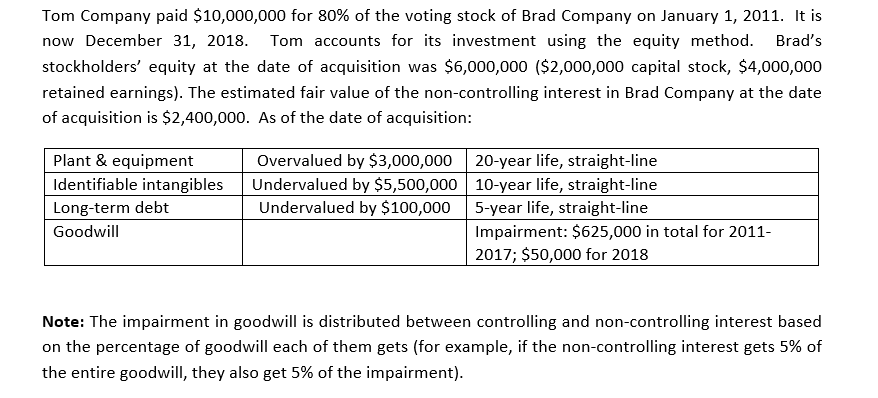

Tom Company paid for 80% of the voting stock of Brad Company on January 1, 2011. It is now December 31, 2018. Tom accounts for its investment using the equity method. Brad's stockholders' equity at the date of acquisition was $6,000,000 ($2,000,000 capital stock, $4,000,000 retained earnings). The estimated fair value of the non-controlling interest in Brad Company at the date of acquisition is $2,400,000. As of the date of acquisition: Plant & equipment Identifiable intangibles Long-term debt Goodwill Overvalued by Undervalued by $5,500,000 Undervalued by $100,000 20-year life, straight-line 10-year life, straight-line 5-year life, straight-line Impairment: $625,000 in total for 2011- 2017; $50,000 for 2018 Note: The impairment in goodwill is distributed between controlling and non-controlling interest based on the percentage of goodwill each of them gets (for example, if the non-controlling interest gets 5% of the entire goodwill, they also get 5% of the impairment).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started