Answered step by step

Verified Expert Solution

Question

1 Approved Answer

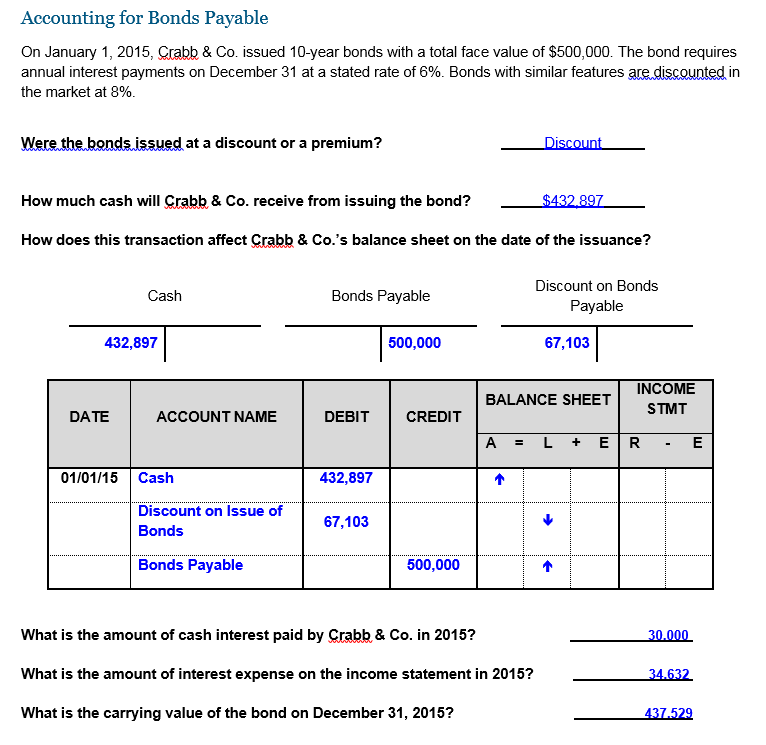

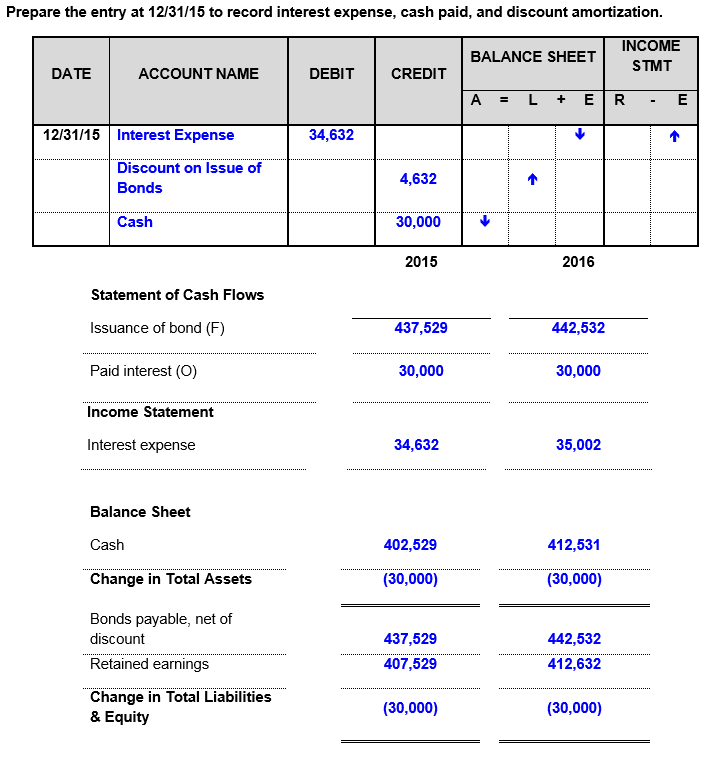

Accounting for Bonds Payable On January 1, 2015, & Co. issued 10-year bonds with a total face value of $500,000. The bond requires annual

Accounting for Bonds Payable On January 1, 2015, & Co. issued 10-year bonds with a total face value of $500,000. The bond requires annual interest payments on December 31 at a stated rate of Bonds with similar features ate,OJsgguntedin the market at 8%. at a discount or a premium? How much cash will Co. receive from issuing the bond? Discount How does this transaction affect & Co.'s balance sheet on the date of the issuance? Cash 432,897 Bonds Payable 500,000 Discount on Bonds Payable 67,103 BALANCE SHEET INCOME STMT DATE 01/01/15 ACCOUNT NAME Cash Discount on Issue of Bonds Bonds Payable DEBIT 432,897 67,103 CREDIT 500,000 R E What is the amount of cash interest paid by Co. in 2015? What is the amount of interest expense on the income statement in 2015? What is the carrying value of the bond on December 31, 2015? 30-000 437_579 Accounting for Bonds Payable On January 1, 2015, & Co. issued 10-year bonds with a total face value of $500,000. The bond requires annual interest payments on December 31 at a stated rate of Bonds with similar features ate,OJsgguntedin the market at 8%. at a discount or a premium? How much cash will Co. receive from issuing the bond? Discount How does this transaction affect & Co.'s balance sheet on the date of the issuance? Cash 432,897 Bonds Payable 500,000 Discount on Bonds Payable 67,103 BALANCE SHEET INCOME STMT DATE 01/01/15 ACCOUNT NAME Cash Discount on Issue of Bonds Bonds Payable DEBIT 432,897 67,103 CREDIT 500,000 R E What is the amount of cash interest paid by Co. in 2015? What is the amount of interest expense on the income statement in 2015? What is the carrying value of the bond on December 31, 2015? 30-000 437_579

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started