Answered step by step

Verified Expert Solution

Question

1 Approved Answer

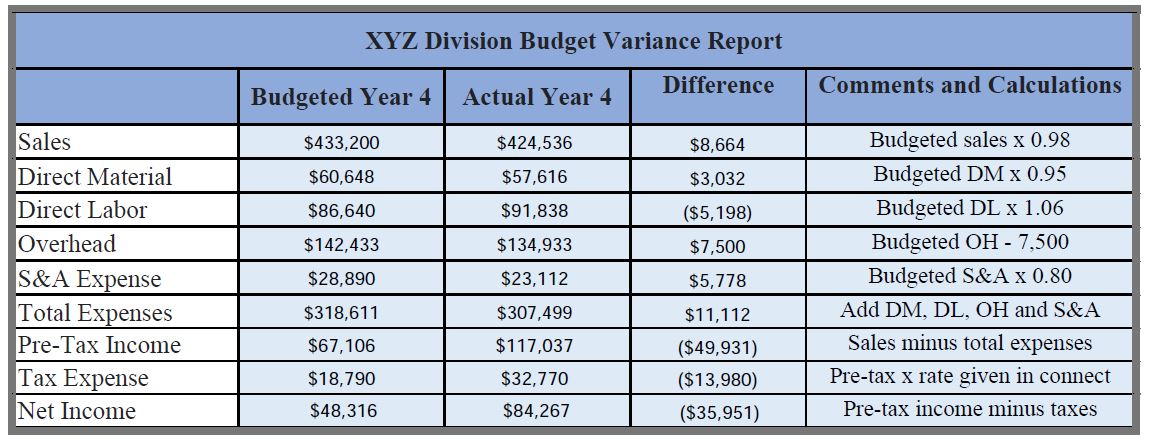

XYZ Division Budget Variance Report Budgeted Year 4 Actual Year 4 Sales Direct Material Direct Labor Overhead S&A Expense Total Expenses Pre-Tax Income Tax

XYZ Division Budget Variance Report Budgeted Year 4 Actual Year 4 Sales Direct Material Direct Labor Overhead S&A Expense Total Expenses Pre-Tax Income Tax Expense Net Income $433,200 $60,648 $86,640 $142,433 $28,890 $318,611 $67,106 $18,790 $48,316 $424,536 $57,616 $91 ,838 $134,933 $23,112 $307,499 $117,037 $32,770 $84,267 Difference $8,664 $3,032 ($5, 198) $7,500 S5,778 $11,112 ($49,931) ($13,980) ($35,951) Comments and Calculations Budgeted sales x 0.98 Budgeted DM x 0.95 Budgeted DLx 1.06 Budgeted OH - 7,500 Budgeted S&A x 0.80 Add DM, DL, OH and Sales minus total expenses Pre-tax x rate given in connect Pre-tax income minus taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started