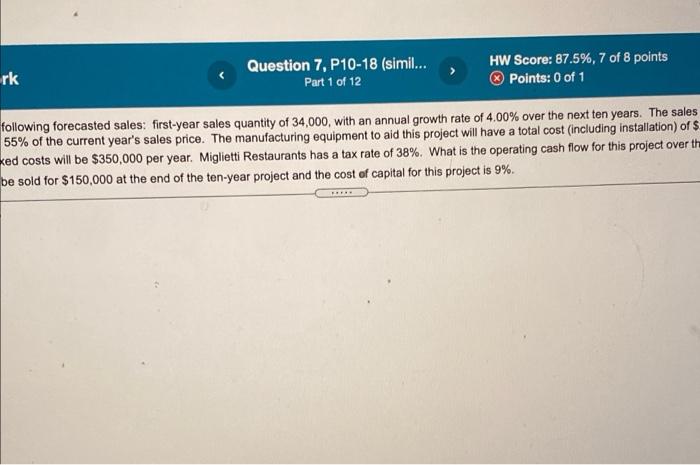

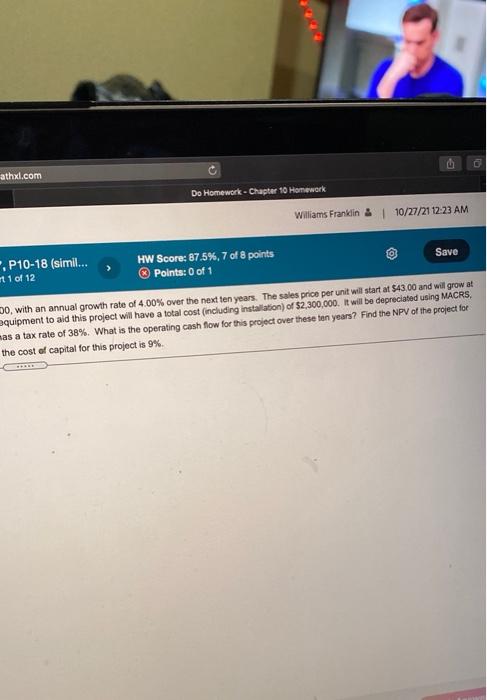

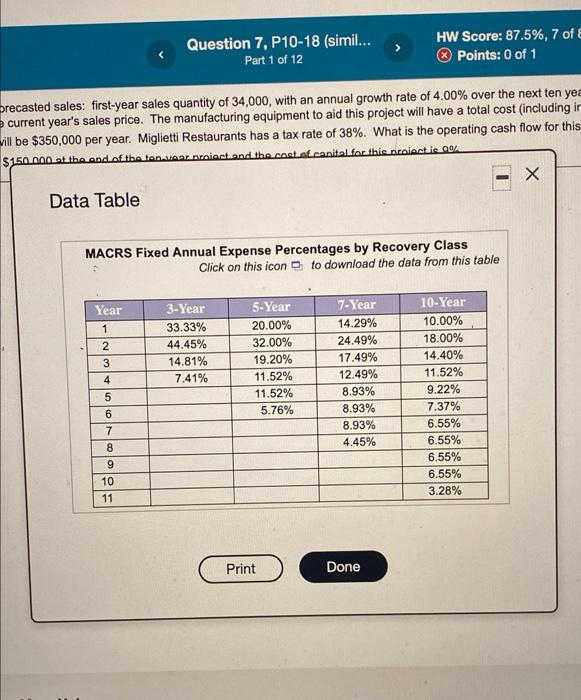

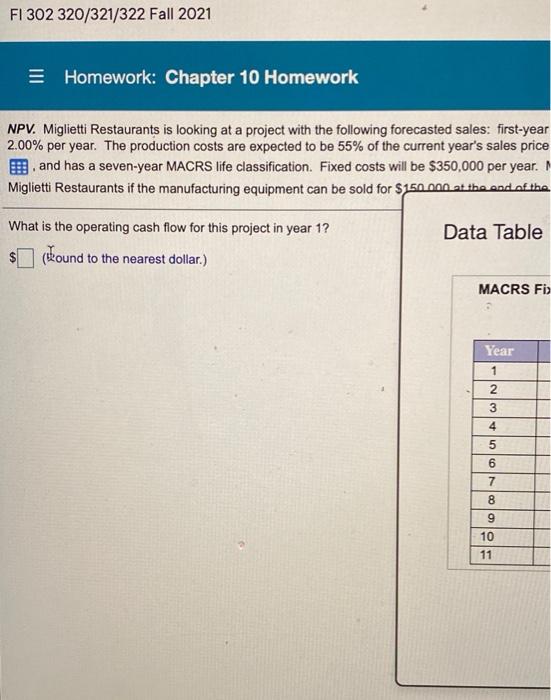

FI 302 320/321/322 Fall 2021 E Homework: Chapter 10 Homework Question 7, P10-18 (simi Part 1 of 12 NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 34,000, with an annual 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid thi and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 389 Miglietti Restaurants i the manufacturing equipment can be sold for $150,000 at the end of the ten-year project and the cost of capital fo What is the operating cash flow for this project in year 1? (Round to the nearest dollar.) rk Question 7, P10-18 (simil... Part 1 of 12 HW Score: 87.5%, 7 of 8 points Points: 0 of 1 following forecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next ten years. The sales 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $ Ked costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 38%. What is the operating cash flow for this project over the be sold for $150,000 at the end of the ten-year project and the cost of capital for this project is 9%. o athxl.com Do Homework - Chapter 10 Homework Williams Franklin & 10/27/21 12:23 AM P10-18 (simil... HW Score: 87.5%. 7 of 8 points Save 1 of 12 Points: 0 of 1 30, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $43,00 and will grow at equipment to aid this project will have a total cost (including installation) of $2,300,000. It will be depreciated using MACRS. mas a tax rate of 38%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for the cost of capital for this project is 9% Question 7, P10-18 (simil... Part 1 of 12 HW Score: 87.5%, 7 of E Points: 0 of 1 Drecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next ten yea current year's sales price. The manufacturing equipment to aid this project will have a total cost (including ir will be $350,000 per year. Miglietti Restaurants has a tax rate of 38%. What is the operating cash flow for this $150.000 at the end of the top wear project and the cost of canital for this project ie % Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 4 5 6 7 8 9 10 11 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done FI 302 320/321/322 Fall 2021 Homework: Chapter 10 Homework NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year 2.00% per year. The production costs are expected to be 55% of the current year's sales price and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants if the manufacturing equipment can be sold for $150.000 at the end of the What is the operating cash flow for this project in year 1? $1(Round to the nearest dollar.) Data Table MACRS FI Year 1 NI 2 3 4 Noon 5 6 7 8 9 10 11