Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fianancial Management ABC Co is considering whether or not to invest in a new Project A, which would have an expected market life of FOUR

Fianancial Management

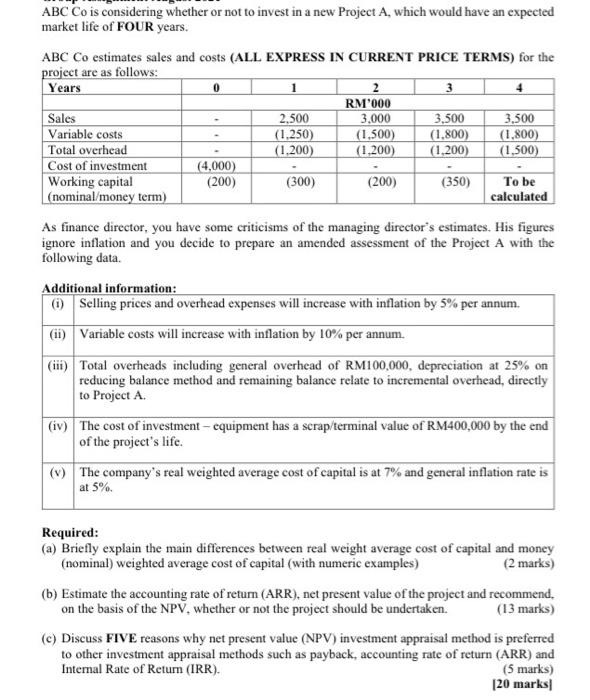

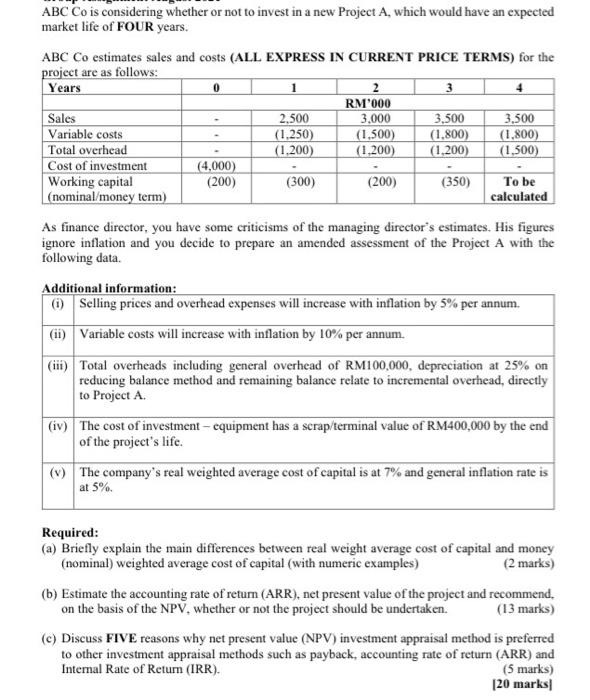

ABC Co is considering whether or not to invest in a new Project A, which would have an expected market life of FOUR years. ABC Co estimates sales and costs (ALL EXPRESS IN CURRENT PRICE TERMS) for the project are as follows: Years 0 1 3 4 RM'000 Sales 2.500 3.000 3,500 3,500 Variable costs (1,250) (1.500) (1.800) (1.800) Total overhead (1.200) (1,200) (1,200) (1,500) Cost of investment (4,000) Working capital (200) (300) (200) (350) To be (nominal/money term) calculated As finance director, you have some criticisms of the managing director's estimates. His figures ignore inflation and you decide to prepare an amended assessment of the Project A with the following data. Additional information: () Selling prices and overhead expenses will increase with inflation by 5% per annum. (ii) Variable costs will increase with inflation by 10% per annum. (iii) Total overheads including general overhead of RM100,000, depreciation at 25% on reducing balance method and remaining balance relate to incremental overhead, directly to Project A. (iv) The cost of investment - equipment has a scrap/terminal value of RM400,000 by the end of the project's life. (1) The company's real weighted average cost of capital is at 7% and general inflation rate is at 5%. Required: (a) Briefly explain the main differences between real weight average cost of capital and money (nominal) weighted average cost of capital (with numeric examples) (2 marks) (b) Estimate the accounting rate of retum (ARR), net present value of the project and recommend on the basis of the NPV, whether or not the project should be undertaken. (13 marks) (c) Discuss FIVE reasons why net present value (NPV) investment appraisal method is preferred to other investment appraisal methods such as payback, accounting rate of return (ARR) and Internal Rate of Retum (IRR). (5 marks) [20 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started