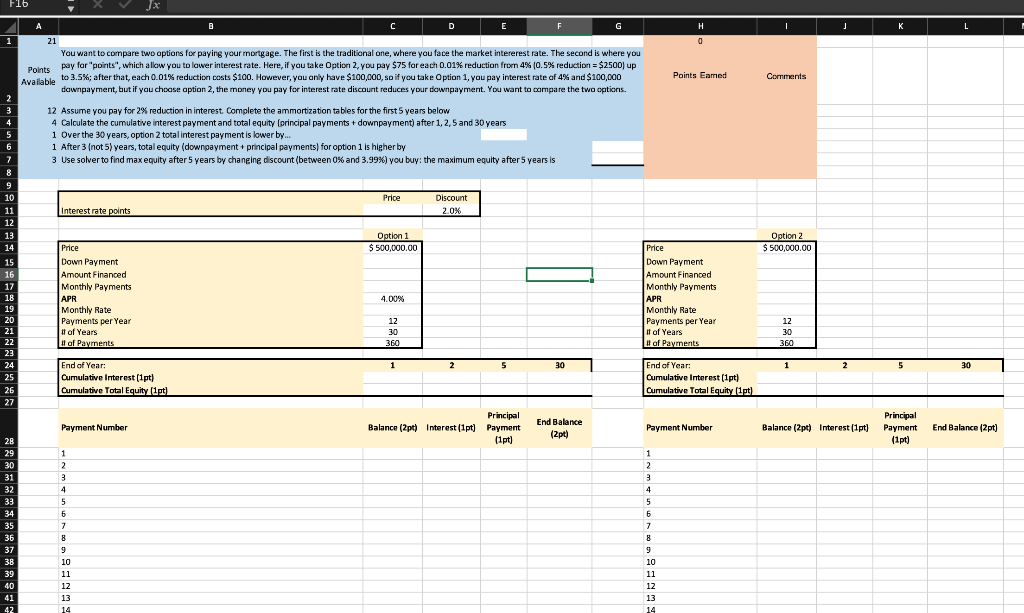

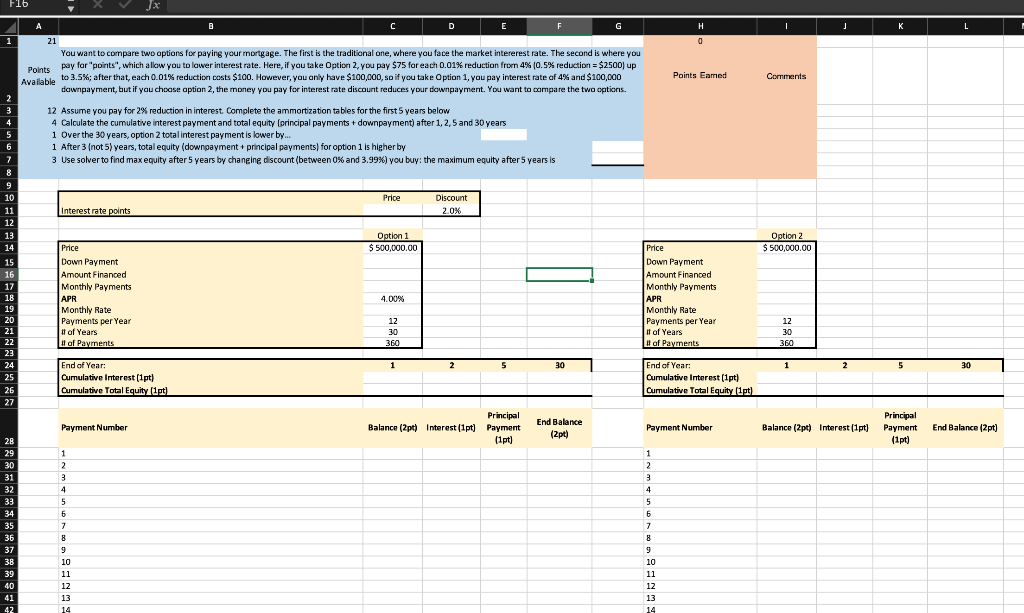

Fib A B G T J L H . 0 1 Points Points Eamed Cornments 2 3 C D E F 21 You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market intererest rate. The second is where you pay for "points", which allow you to lower interest rate. Here, if you take Option 2you pay $75 for each 0.01% reduction from 4% (0.5% reduction = $2500) up Available to 3.5%; after that, each 0.01% reduction costs $100. However, you only have $100,000, so if you take Option 1, you pay interest rate of 4% and $100,000 downpayment, but if you choose aption 2, the money you pay for interest rate discount reduces your downpayment. You want to compare the two options. 12 Assume you pay for 2% reduction in interest. Complete the ammortization tables for the first 5 years below 4 Calculate the cumulative interest payment and total equity (principal payments + downpayment) after 1, 2,5 and 30 years 1 Over the 30 years, option 2 total interest payment is lower by... 1 After 3 (not 5) years, total equity (downpayment principal payments) for option 1 is higher by 3 Use solver to find max equity after 5 years by changing discount (between 0% and 3.99%) you buy: the maximum equity after 5 years is 6 8 Price Discount 2.0% Interest rate points Option 1 $ 500,000.00 Option 2 $ 500,000.00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Price Down Payment Amount Financed Monthly Payments APR Monthly Rate Payments per Year ut of Years of Payments 4.00% Price Down Payment Amount Financed Monthly Payments APR Monthly Rate Payments per Year ut of Years # af Payments 12 30 360 12 30 360 1 2 2 5 30 1 2 5 30 End of Year: Cumulative Interest (1 pt) Cumulative Total Equity (ipt) End of Year: Cumulative Interest (1 pt) Cumulative Total Equity (1) Payment Number Principal Balance (2pt) Interest (1pt) Payment (1 pt) End Balance (2pt) Payment Number Balance (2pt) Interest (1 pt) Principal Payment (1pt) End Balance (2pt] 28 29 30 31 32 33 34 35 36 37 1 2 3 4 5 5 7 7 1 2 3 4 5 5 6 7 8 8 9 9 10 38 39 40 41 42 11 12 13 14 10 11 12 13 14 Fib A B G T J L H . 0 1 Points Points Eamed Cornments 2 3 C D E F 21 You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market intererest rate. The second is where you pay for "points", which allow you to lower interest rate. Here, if you take Option 2you pay $75 for each 0.01% reduction from 4% (0.5% reduction = $2500) up Available to 3.5%; after that, each 0.01% reduction costs $100. However, you only have $100,000, so if you take Option 1, you pay interest rate of 4% and $100,000 downpayment, but if you choose aption 2, the money you pay for interest rate discount reduces your downpayment. You want to compare the two options. 12 Assume you pay for 2% reduction in interest. Complete the ammortization tables for the first 5 years below 4 Calculate the cumulative interest payment and total equity (principal payments + downpayment) after 1, 2,5 and 30 years 1 Over the 30 years, option 2 total interest payment is lower by... 1 After 3 (not 5) years, total equity (downpayment principal payments) for option 1 is higher by 3 Use solver to find max equity after 5 years by changing discount (between 0% and 3.99%) you buy: the maximum equity after 5 years is 6 8 Price Discount 2.0% Interest rate points Option 1 $ 500,000.00 Option 2 $ 500,000.00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Price Down Payment Amount Financed Monthly Payments APR Monthly Rate Payments per Year ut of Years of Payments 4.00% Price Down Payment Amount Financed Monthly Payments APR Monthly Rate Payments per Year ut of Years # af Payments 12 30 360 12 30 360 1 2 2 5 30 1 2 5 30 End of Year: Cumulative Interest (1 pt) Cumulative Total Equity (ipt) End of Year: Cumulative Interest (1 pt) Cumulative Total Equity (1) Payment Number Principal Balance (2pt) Interest (1pt) Payment (1 pt) End Balance (2pt) Payment Number Balance (2pt) Interest (1 pt) Principal Payment (1pt) End Balance (2pt] 28 29 30 31 32 33 34 35 36 37 1 2 3 4 5 5 7 7 1 2 3 4 5 5 6 7 8 8 9 9 10 38 39 40 41 42 11 12 13 14 10 11 12 13 14