Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiery Ltd is a company that is operated through two divisions, namely Green Ltd and Dragon Ltd. These divisions were regarded as separate cash-generating

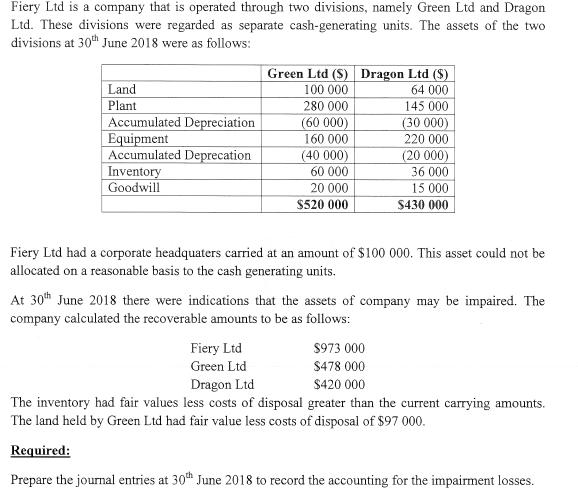

Fiery Ltd is a company that is operated through two divisions, namely Green Ltd and Dragon Ltd. These divisions were regarded as separate cash-generating units. The assets of the two divisions at 30th June 2018 were as follows: Land Plant Accumulated Depreciation Equipment Accumulated Deprecation Inventory Goodwill Green Ltd (S) Dragon Ltd (S) 100 000 64 000 145 000 280 000 (60 000) 160 000 Fiery Ltd Green Ltd (40 000) 60 000 20 000 $520 000 (30 000) 220 000 Fiery Ltd had a corporate headquaters carried at an amount of $100 000. This asset could not be allocated on a reasonable basis to the cash generating units. (20 000) 36 000 15 000 $430 000 At 30th June 2018 there were indications that the assets of company may be impaired. The company calculated the recoverable amounts to be as follows: $973 000 $478 000 $420 000 Dragon Ltd The inventory had fair values less costs of disposal greater than the current carrying amounts. The land held by Green Ltd had fair value less costs of disposal of $97 000. Required: Prepare the journal entries at 30th June 2018 to record the accounting for the impairment losses.

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Land Plant Equip Inventory Impairment Loss afPocated 100000 22000 4400 500 000 M 120000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started