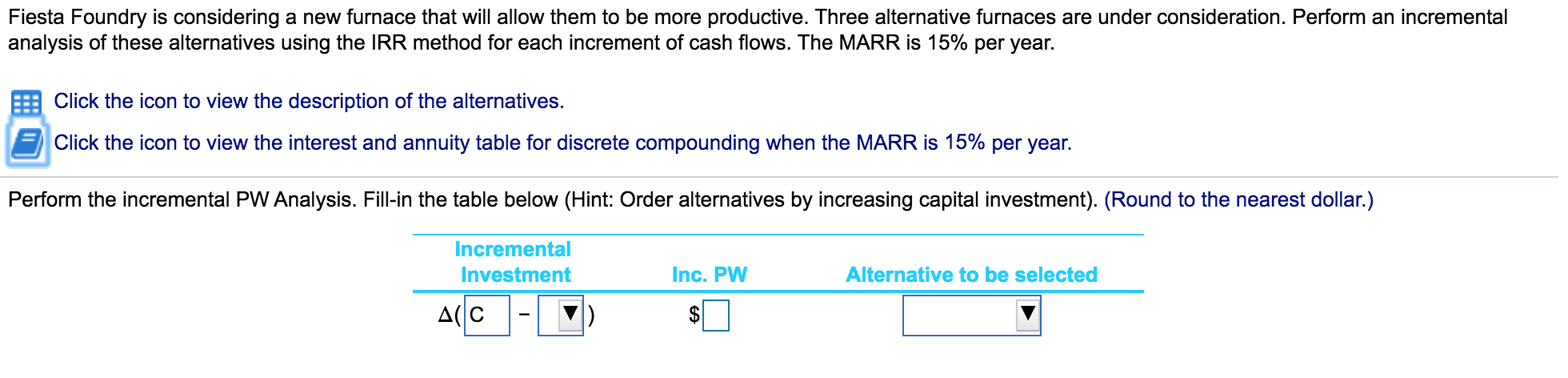

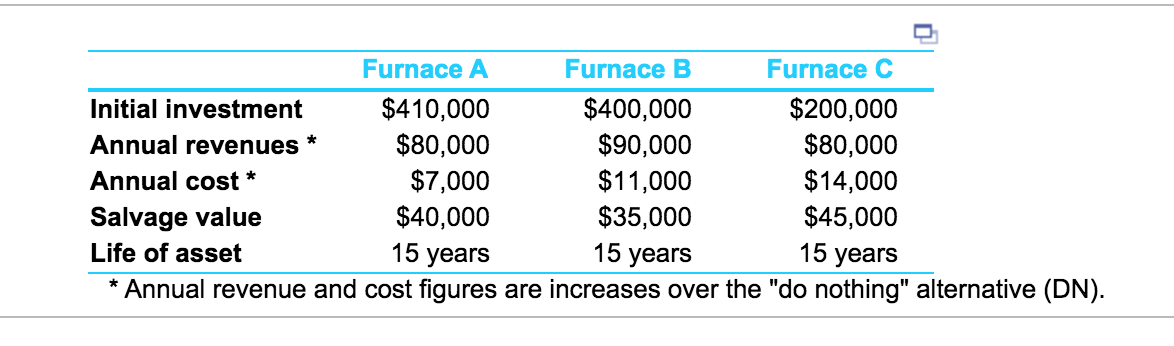

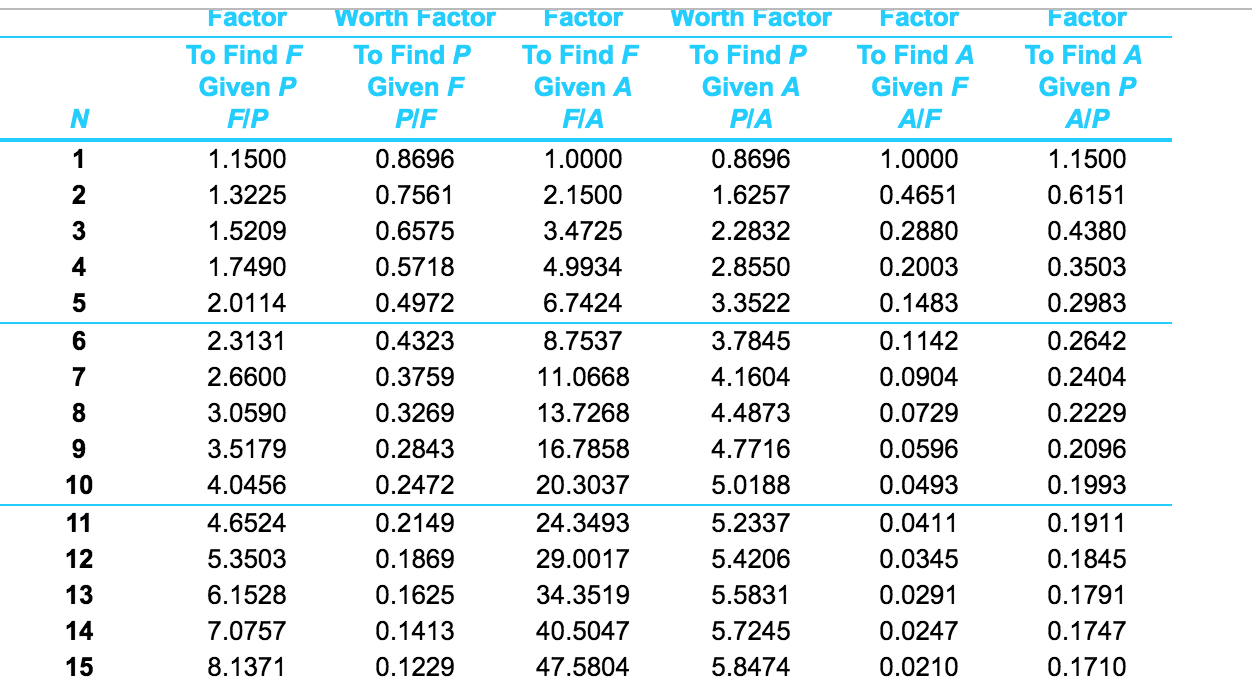

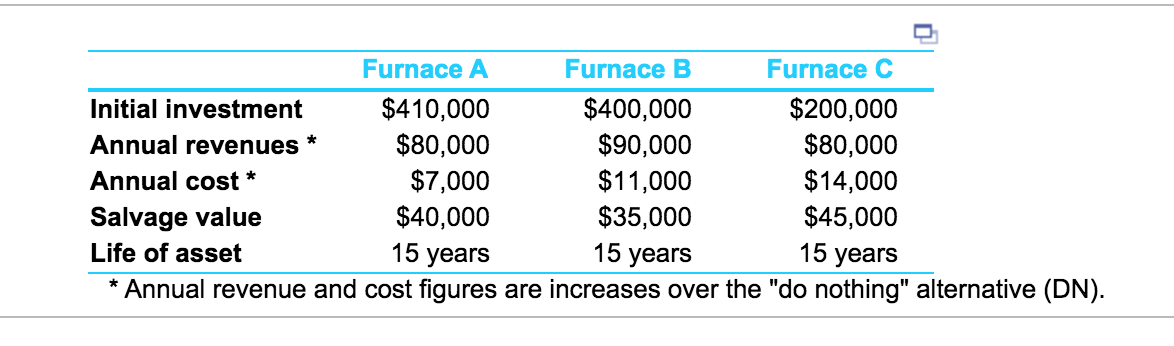

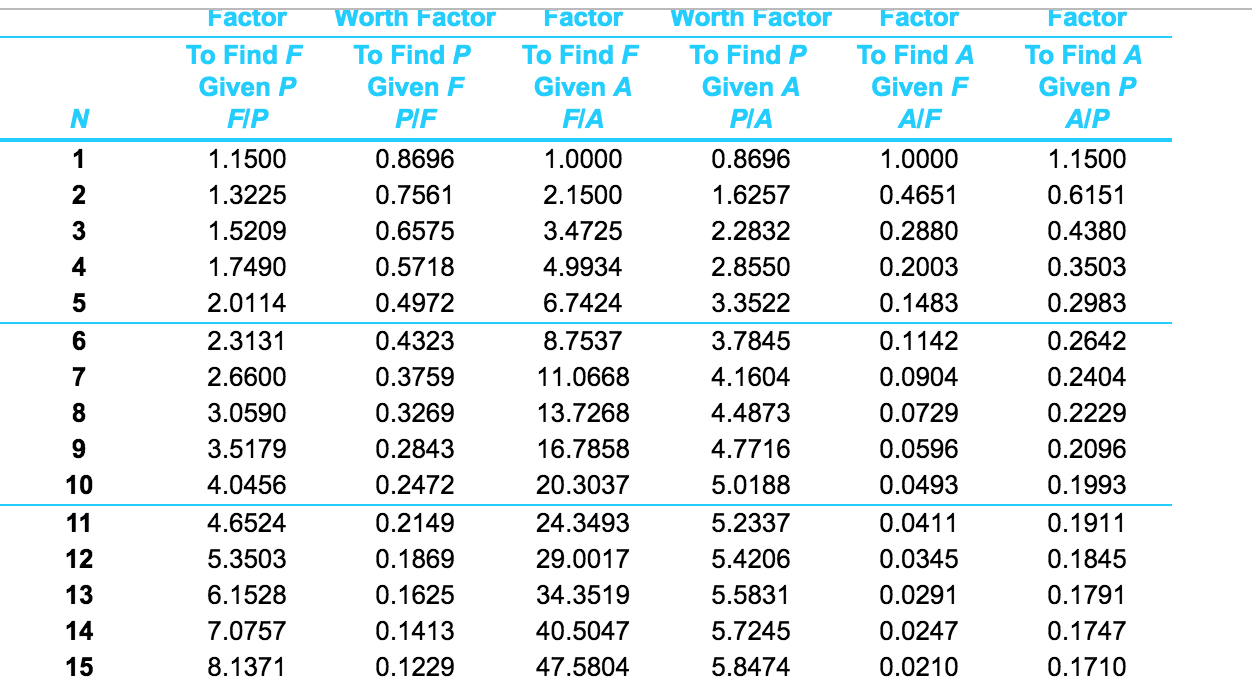

Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 15% per year. Click the icon to view the description of the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. Perform the incremental PW Analysis. Fill-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest dollar.) Incremental Investment Inc. PW Alternative to be selected AC Furnace A Furnace B Furnace C Initial investment $410,000 $400,000 $200,000 Annual revenues * $80,000 $90,000 $80,000 Annual cost * $7,000 $11,000 $14,000 Salvage value $40,000 $35,000 $45,000 Life of asset 15 years 15 years 15 years * Annual revenue and cost figures are increases over the "do nothing" alternative (DN). Factor To Find F Given P FIP Worth Factor To Find P Given F PIF 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 4.6524 5.3503 6.1528 7.0757 8.1371 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 Factor To Find F Given A FIA 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 24.3493 29.0017 34.3519 40.5047 47.5804 Worth Factor To Find P Given A PIA 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 Factor To Find A Given F AIF 1.0000 0.4651 0.2880 0.2003 0.1483 0.1142 0.0904 0.0729 0.0596 0.0493 0.0411 0.0345 0.0291 0.0247 0.0210 Factor To Find A Given P AIP 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710 Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 15% per year. Click the icon to view the description of the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. Perform the incremental PW Analysis. Fill-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest dollar.) Incremental Investment Inc. PW Alternative to be selected AC Furnace A Furnace B Furnace C Initial investment $410,000 $400,000 $200,000 Annual revenues * $80,000 $90,000 $80,000 Annual cost * $7,000 $11,000 $14,000 Salvage value $40,000 $35,000 $45,000 Life of asset 15 years 15 years 15 years * Annual revenue and cost figures are increases over the "do nothing" alternative (DN). Factor To Find F Given P FIP Worth Factor To Find P Given F PIF 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 4.6524 5.3503 6.1528 7.0757 8.1371 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 Factor To Find F Given A FIA 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 24.3493 29.0017 34.3519 40.5047 47.5804 Worth Factor To Find P Given A PIA 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 Factor To Find A Given F AIF 1.0000 0.4651 0.2880 0.2003 0.1483 0.1142 0.0904 0.0729 0.0596 0.0493 0.0411 0.0345 0.0291 0.0247 0.0210 Factor To Find A Given P AIP 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710