Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis

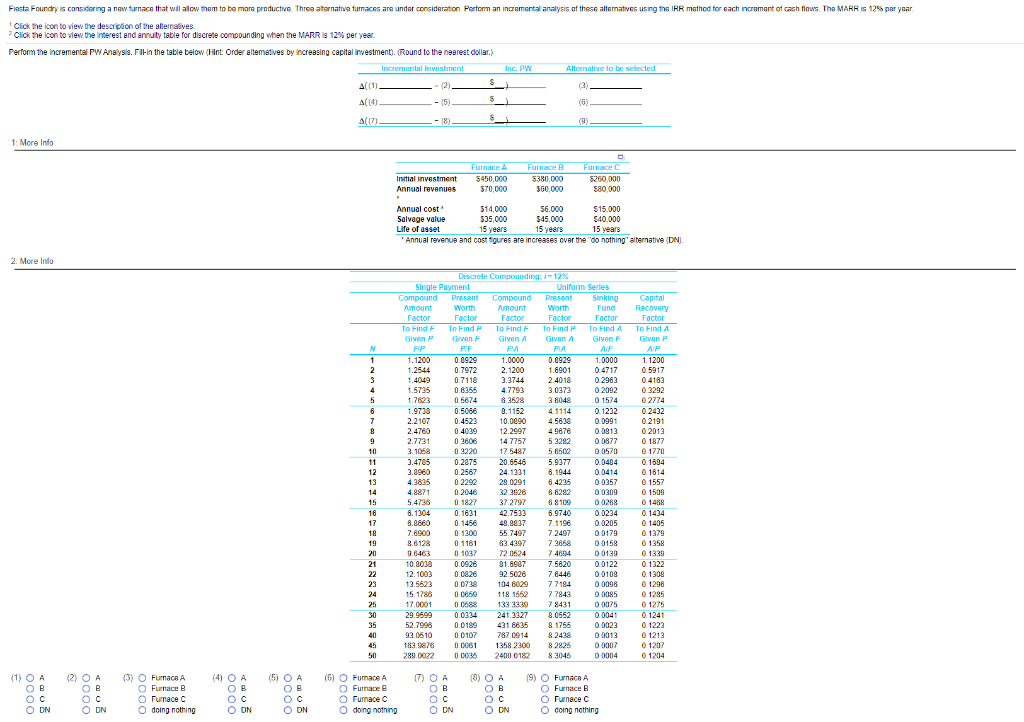

Fiesta Foundry is considering a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 12 per year.

Fiesta Foundry is considering a new furnace that will allow them to be more productive Three alternative fumaces are under consideration Perform an incremental analysis of these alternatives using the IRR mathod for each increment of cash flows The MARR is 125 per year Click the icon to view the description of the alternatives 2 Click the icon to view the interest and annuity table for discrede compounding when the MARR S 129 perveer Perform the incremental PW Analysis. Fil-in the table below (Hint Order alteratives by increasing capital investment). (Round to the nearest dollar.) re ntal investment Inc. PW Alternative to be selected ALCO AMT 1: More Info Fumace A Fumac Furnace Initial investment 5450.000 $380.000 $250 000 Annual revenues 570,000 $60,000 $80.000 Annual cost 514.000 56 000 $15.000 Salvage value 335.000 545 000 $40 000 Life of asset 15 years 15 years 15 years Annual revenue and cost figures are increases over the "do nothing alternative (DN). 2. More info Discrete Compounding: 1 -12% Single Payment Uniform Series Compound Present Compound Present Sinking Amount Worth Amount Worth Fund Factor Factor Factor To Find To Find To Find To Find To Find A Given Given F Give A Give A Given F Capital Recovery To Find A Given P AP 00929 1.1200 1.2544 0.4717 1.5735 0.7972 0.7118 0.8255 05874 0.5066 0.4522 04029 0.2806 02220 0 2075 0.2567 1.9729 2.2 107 2.4760 27731 3.1058 3.4705 3.8960 ****** 1.0000 10000 1.8901 3.3744 2.4018 0.2963 4.7793 02092 8.3528 3.8048 0.1574 9.1152 4 1114 0.1222 10.0090 4 5838 0.0991 12.2997 4.9676 00913 14.7757532820 0877 17 5497 58502 0 0570 20 8546 5.9377 0.0494 24 1231 6.1944 0.0414 29.0291 00257 32.3926 6.8282 0.0309 37 2797 681090 0288 42.7523 6.9740 0.0234 49.9937 7. 1196 0.0205 55.7497 72497 0 0179 82.4297 7 3858 00158 72 0624 74810400139 31.8987 75820 0.0122 92.5028 7.8446 0 0109 104 8029 77184 0 0098 118. 1552 7.7843 00085 133 3339784310 0075 241.23273 ,0552 0 0041 431.8635 8.1756 0 .0023 787 0914 82439 0 0013 1358 2300828250 0007 2400 0108304500004 48971 0 2046 5.4723 0.1827 8.1304 0.1631 0.1458 7.8000 0.13.00 9.8128 0 1181 98463 01037 00926 12.1003 0.0826 0.0738 15. 1788 0.009 17 0001 00588 29.9599 0.0224 52.7998 0.0199 92.0610 0.0107 183 9878 00061 299 02200036 1.1200 0.5917 0.4183 3292 02774 0.2432 0.2191 0 2013 01877 01770 1894 0.1614 1557 0.1509 1488 0.1434 0.1405 0.1379 01358 1 339 0.1322 0.1309 01298 01295 01275 0.1241 0.1223 0 1213 01207 01204 10.8039 12 5523 (1) OA (2) OA (3) Furnace A OB Furnace OCO Furnace C O ON doing nothing (4) OA (5) OA (6) O Furace A OBOBO Furnace B OCOCO Furnace ODNO ON O doing nothing (7) OA () OA 9 ) Furnace A OB O Furnace B OCOCO Furnace C ODN O doing nothing OON Fiesta Foundry is considering a new furnace that will allow them to be more productive Three alternative fumaces are under consideration Perform an incremental analysis of these alternatives using the IRR mathod for each increment of cash flows The MARR is 125 per year Click the icon to view the description of the alternatives 2 Click the icon to view the interest and annuity table for discrede compounding when the MARR S 129 perveer Perform the incremental PW Analysis. Fil-in the table below (Hint Order alteratives by increasing capital investment). (Round to the nearest dollar.) re ntal investment Inc. PW Alternative to be selected ALCO AMT 1: More Info Fumace A Fumac Furnace Initial investment 5450.000 $380.000 $250 000 Annual revenues 570,000 $60,000 $80.000 Annual cost 514.000 56 000 $15.000 Salvage value 335.000 545 000 $40 000 Life of asset 15 years 15 years 15 years Annual revenue and cost figures are increases over the "do nothing alternative (DN). 2. More info Discrete Compounding: 1 -12% Single Payment Uniform Series Compound Present Compound Present Sinking Amount Worth Amount Worth Fund Factor Factor Factor To Find To Find To Find To Find To Find A Given Given F Give A Give A Given F Capital Recovery To Find A Given P AP 00929 1.1200 1.2544 0.4717 1.5735 0.7972 0.7118 0.8255 05874 0.5066 0.4522 04029 0.2806 02220 0 2075 0.2567 1.9729 2.2 107 2.4760 27731 3.1058 3.4705 3.8960 ****** 1.0000 10000 1.8901 3.3744 2.4018 0.2963 4.7793 02092 8.3528 3.8048 0.1574 9.1152 4 1114 0.1222 10.0090 4 5838 0.0991 12.2997 4.9676 00913 14.7757532820 0877 17 5497 58502 0 0570 20 8546 5.9377 0.0494 24 1231 6.1944 0.0414 29.0291 00257 32.3926 6.8282 0.0309 37 2797 681090 0288 42.7523 6.9740 0.0234 49.9937 7. 1196 0.0205 55.7497 72497 0 0179 82.4297 7 3858 00158 72 0624 74810400139 31.8987 75820 0.0122 92.5028 7.8446 0 0109 104 8029 77184 0 0098 118. 1552 7.7843 00085 133 3339784310 0075 241.23273 ,0552 0 0041 431.8635 8.1756 0 .0023 787 0914 82439 0 0013 1358 2300828250 0007 2400 0108304500004 48971 0 2046 5.4723 0.1827 8.1304 0.1631 0.1458 7.8000 0.13.00 9.8128 0 1181 98463 01037 00926 12.1003 0.0826 0.0738 15. 1788 0.009 17 0001 00588 29.9599 0.0224 52.7998 0.0199 92.0610 0.0107 183 9878 00061 299 02200036 1.1200 0.5917 0.4183 3292 02774 0.2432 0.2191 0 2013 01877 01770 1894 0.1614 1557 0.1509 1488 0.1434 0.1405 0.1379 01358 1 339 0.1322 0.1309 01298 01295 01275 0.1241 0.1223 0 1213 01207 01204 10.8039 12 5523 (1) OA (2) OA (3) Furnace A OB Furnace OCO Furnace C O ON doing nothing (4) OA (5) OA (6) O Furace A OBOBO Furnace B OCOCO Furnace ODNO ON O doing nothing (7) OA () OA 9 ) Furnace A OB O Furnace B OCOCO Furnace C ODN O doing nothing OONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started