Answered step by step

Verified Expert Solution

Question

1 Approved Answer

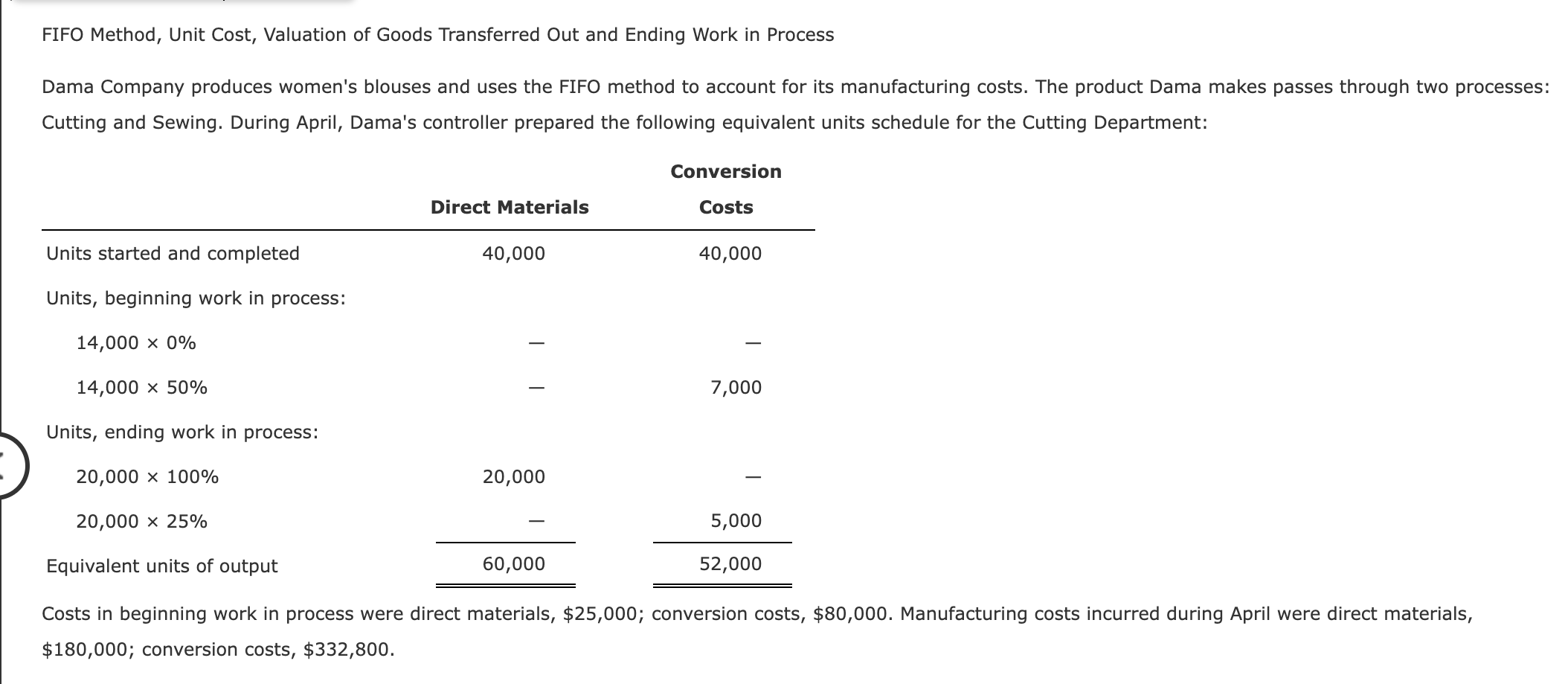

FIFO Method, Unit Cost, Valuation of Goods Transferred Out and Ending Work in Process Dama Company produces women's blouses and uses the FIFO method

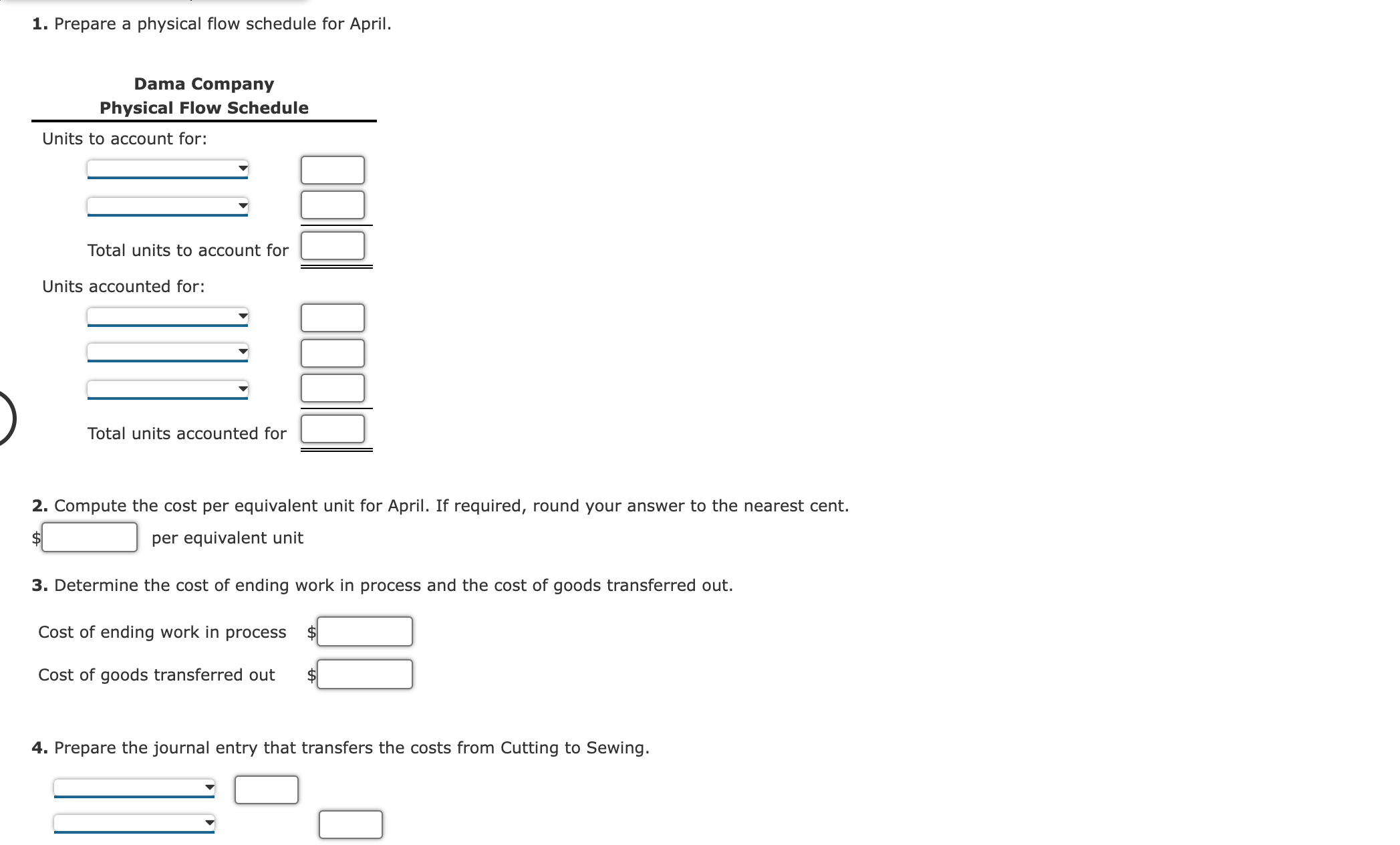

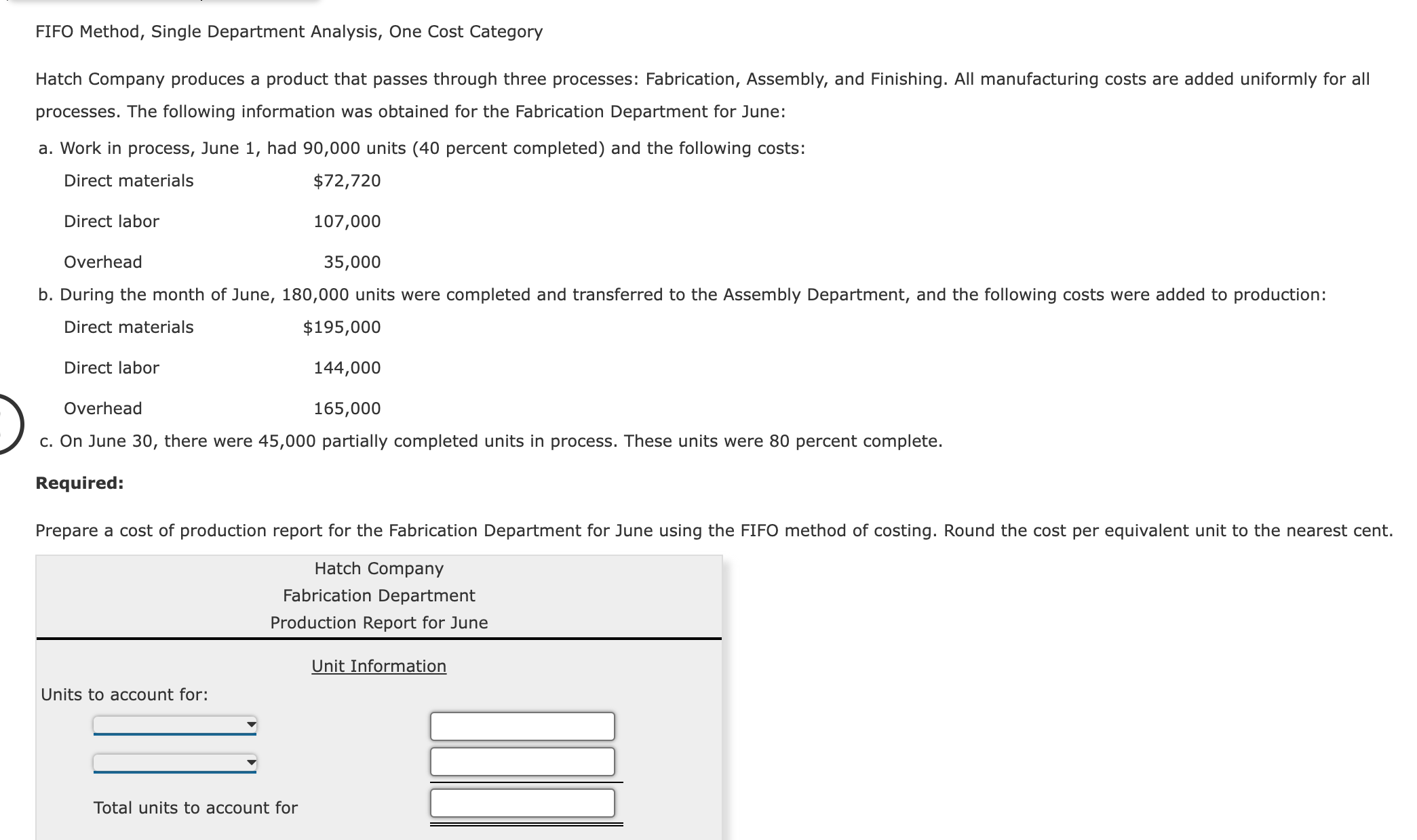

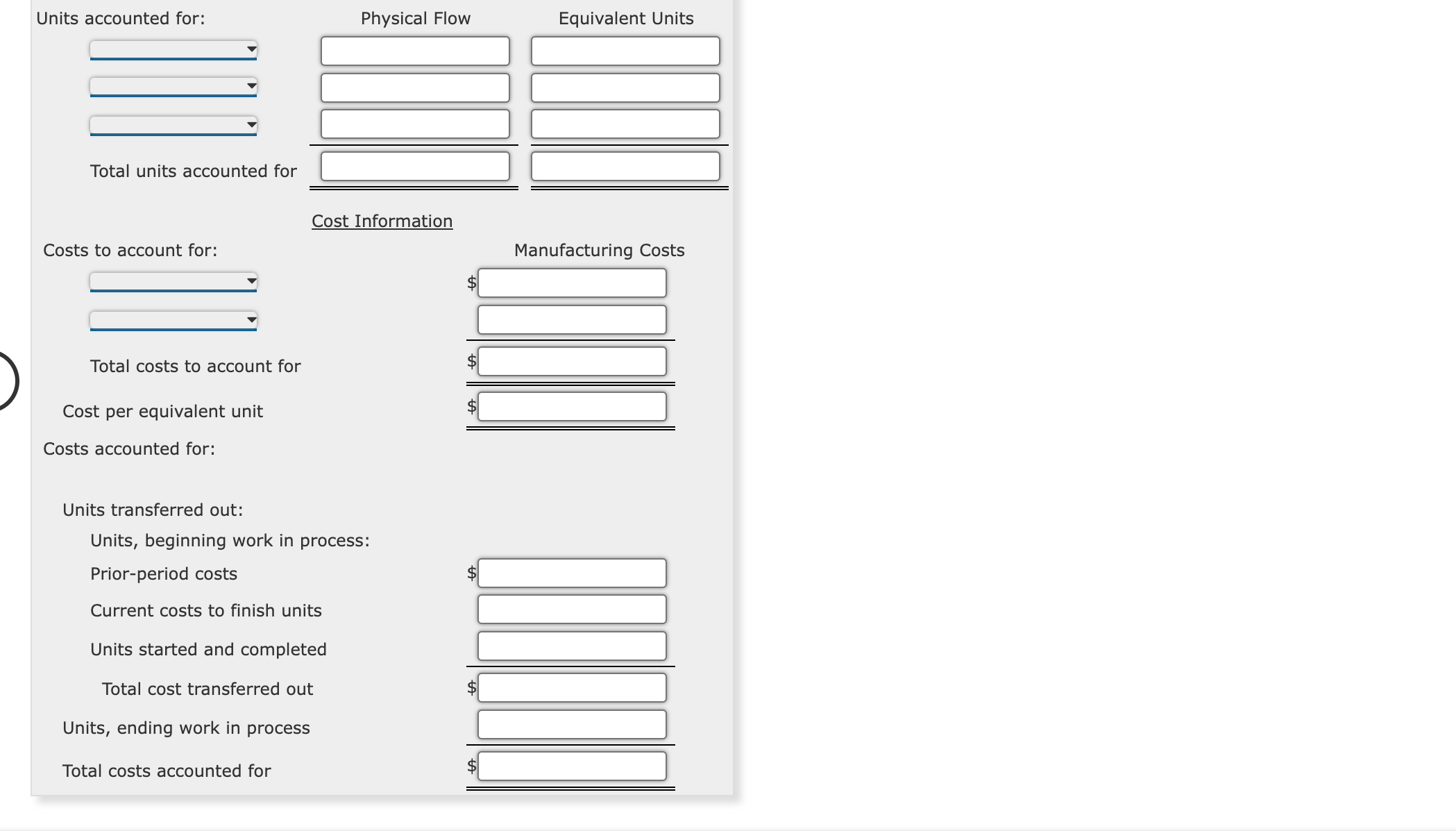

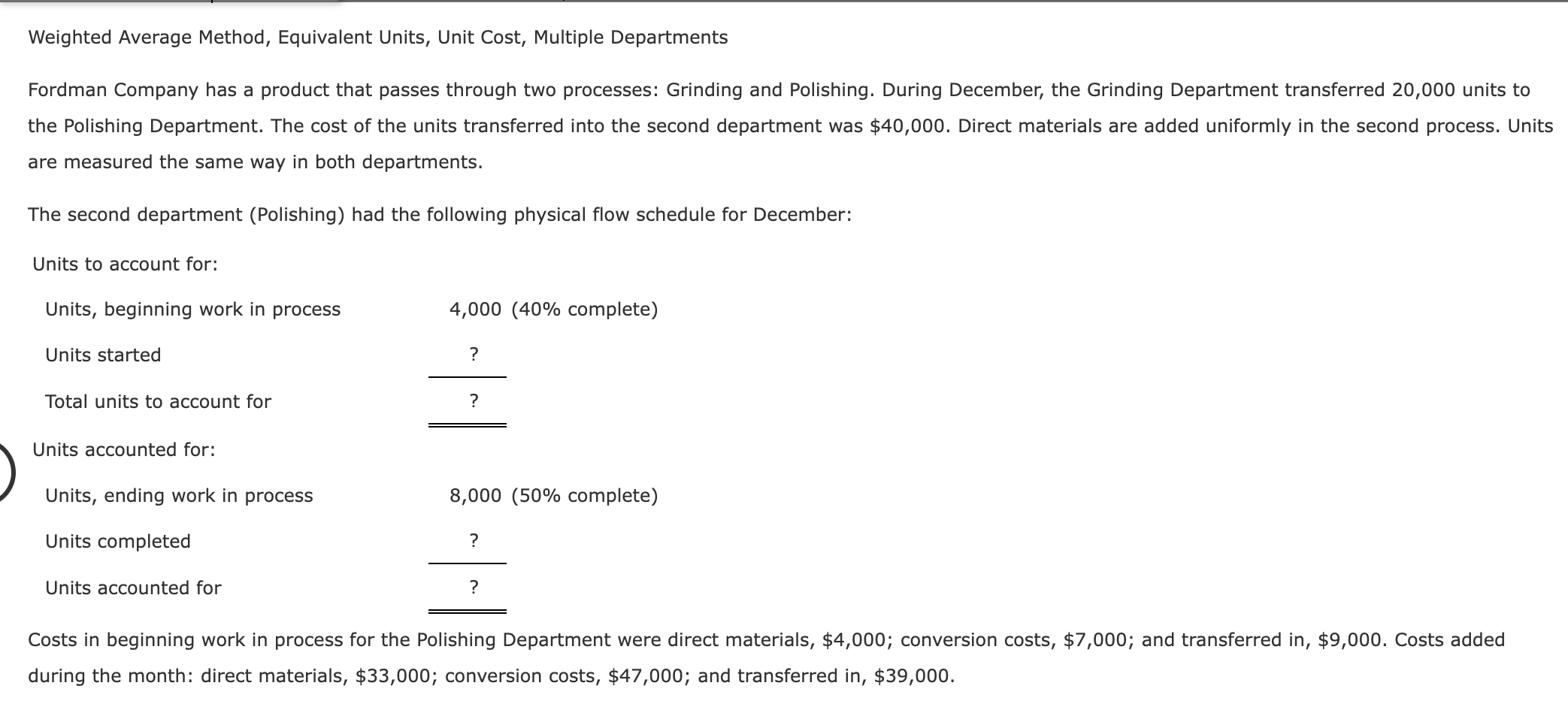

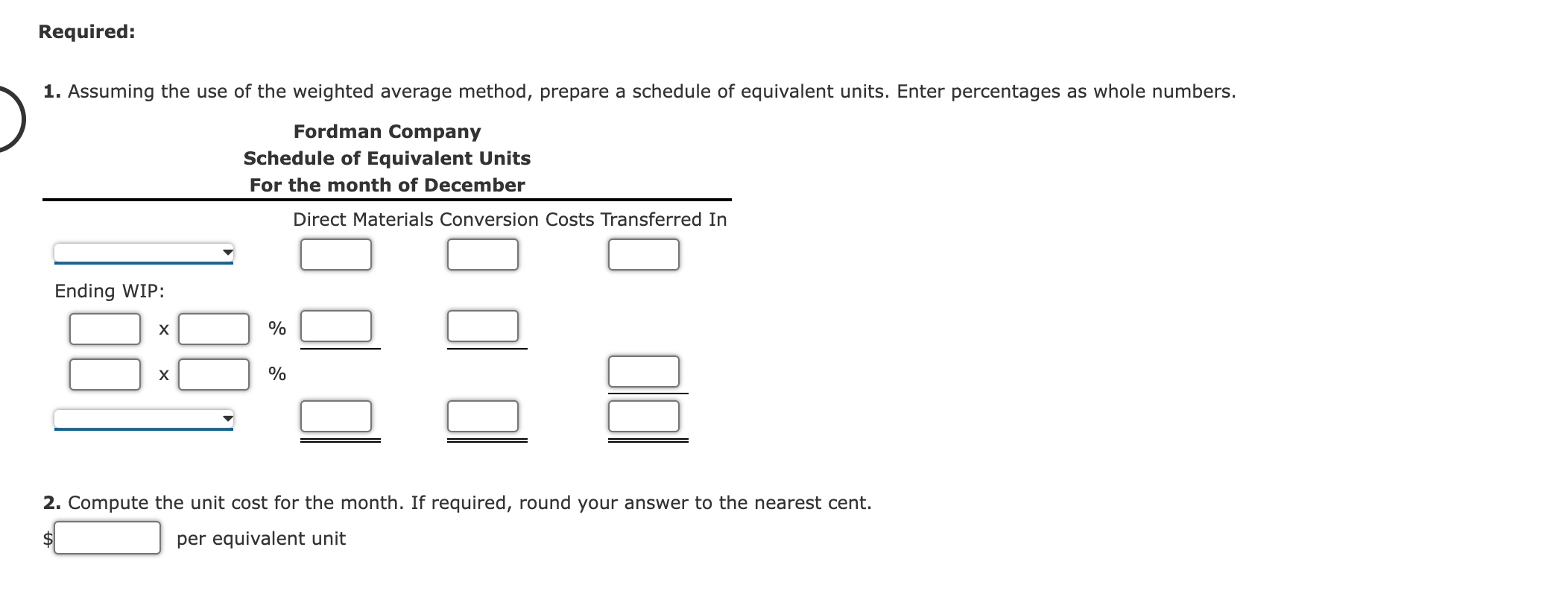

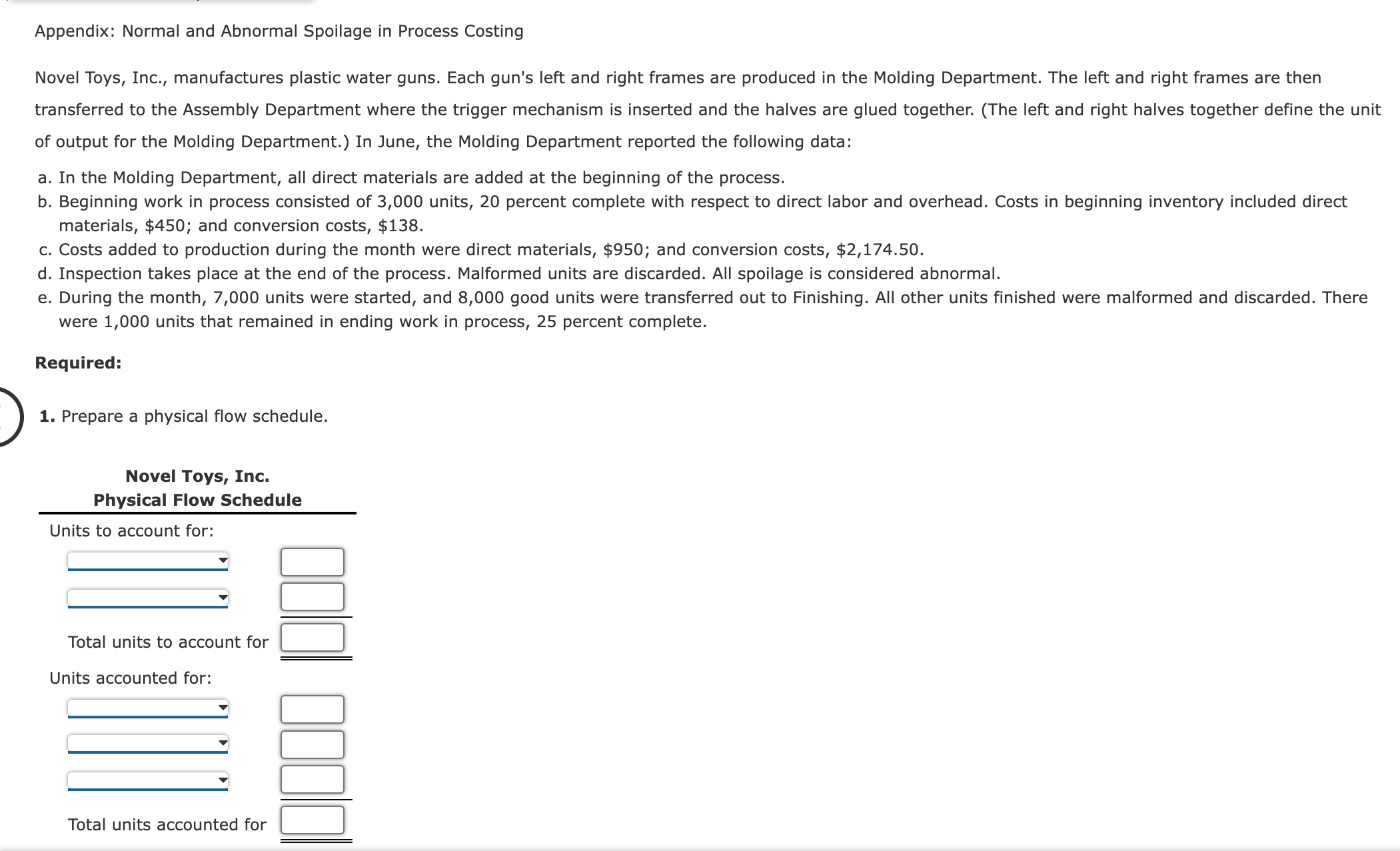

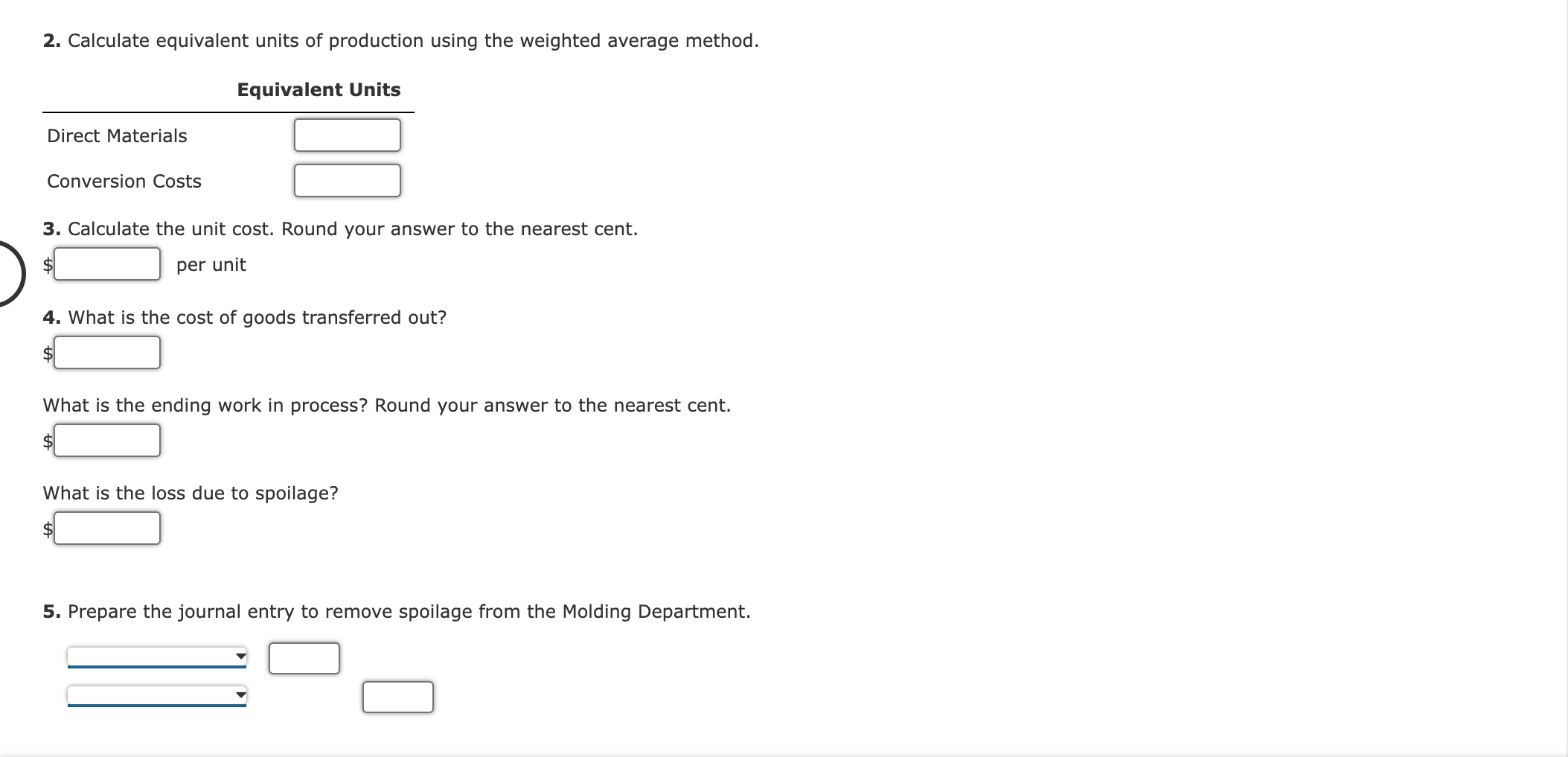

FIFO Method, Unit Cost, Valuation of Goods Transferred Out and Ending Work in Process Dama Company produces women's blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Dama's controller prepared the following equivalent units schedule for the Cutting Department: Units started and completed Units, beginning work in process: 14,000 0% 14,000 x 50% Units, ending work in process: 20,000 100% 20,000 x 25% Direct Materials 40,000 20,000 Conversion Costs 40,000 7,000 Equivalent units of output - 60,000 5,000 52,000 Costs in beginning work in process were direct materials, $25,000; conversion costs, $80,000. Manufacturing costs incurred during April were direct materials, $180,000; conversion costs, $332,800. 1. Prepare a physical flow schedule for April. Dama Company Physical Flow Schedule Units to account for: Total units to account for Units accounted for: Total units accounted for 2. Compute the cost per equivalent unit for April. If required, round your answer to the nearest cent. per equivalent unit 3. Determine the cost of ending work in process and the cost of goods transferred out. Cost of ending work in process $ Cost of goods transferred out 4. Prepare the journal entry that transfers the costs from Cutting to Sewing. FIFO Method, Single Department Analysis, One Cost Category Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June: a. Work in process, June 1, had 90,000 units (40 percent completed) and the following costs: Direct materials Direct labor Overhead $72,720 107,000 35,000 b. During the month of June, 180,000 units were completed and transferred to the Assembly Department, and the following costs were added to production: Direct materials $195,000 144,000 Direct labor Overhead 165,000 c. On June 30, there were 45,000 partially completed units in process. These units were 80 percent complete. Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Round the cost per equivalent unit to the nearest cent. Hatch Company Fabrication Department Production Report for June Unit Information Units to account for: Total units to account for Units accounted for: Physical Flow Equivalent Units Total units accounted for Cost Information Costs to account for: Manufacturing Costs Total costs to account for Cost per equivalent unit Costs accounted for: Units transferred out: Units, beginning work in process: Prior-period costs Current costs to finish units Units started and completed Total cost transferred out Units, ending work in process Total costs accounted for Weighted Average Method, Equivalent Units, Unit Cost, Multiple Departments Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was $40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Units to account for: Units, beginning work in process 4,000 (40% complete) Units started ? Total units to account for ? Units accounted for: Units, ending work in process 8,000 (50% complete) Units completed Units accounted for ? ? Costs in beginning work in process for the Polishing Department were direct materials, $4,000; conversion costs, $7,000; and transferred in, $9,000. Costs added during the month: direct materials, $33,000; conversion costs, $47,000; and transferred in, $39,000. Required: 1. Assuming the use of the weighted average method, prepare a schedule of equivalent units. Enter percentages as whole numbers. Fordman Company Schedule of Equivalent Units For the month of December Direct Materials Conversion Costs Transferred In Ending WIP: X % X % 2. Compute the unit cost for the month. If required, round your answer to the nearest cent. $ per equivalent unit Appendix: Normal and Abnormal Spoilage in Process Costing Novel Toys, Inc., manufactures plastic water guns. Each gun's left and right frames are produced in the Molding Department. The left and right frames are then transferred to the Assembly Department where the trigger mechanism is inserted and the halves are glued together. (The left and right halves together define the unit of output for the Molding Department.) In June, the Molding Department reported the following data: a. In the Molding Department, all direct materials are added at the beginning of the process. b. Beginning work in process consisted of 3,000 units, 20 percent complete with respect to direct labor and overhead. Costs in beginning inventory included direct materials, $450; and conversion costs, $138. c. Costs added to production during the month were direct materials, $950; and conversion costs, $2,174.50. d. Inspection takes place at the end of the process. Malformed units are discarded. All spoilage is considered abnormal. e. During the month, 7,000 units were started, and 8,000 good units were transferred out to Finishing. All other units finished were malformed and discarded. There were 1,000 units that remained in ending work in process, 25 percent complete. Required: 1. Prepare a physical flow schedule. Novel Toys, Inc. Physical Flow Schedule Units to account for: Total units to account for Units accounted for: Total units accounted for 2. Calculate equivalent units of production using the weighted average method. Equivalent Units Direct Materials Conversion Costs 3. Calculate the unit cost. Round your answer to the nearest cent. per unit 4. What is the cost of goods transferred out? What is the ending work in process? Round your answer to the nearest cent. What is the loss due to spoilage? 5. Prepare the journal entry to remove spoilage from the Molding Department.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started