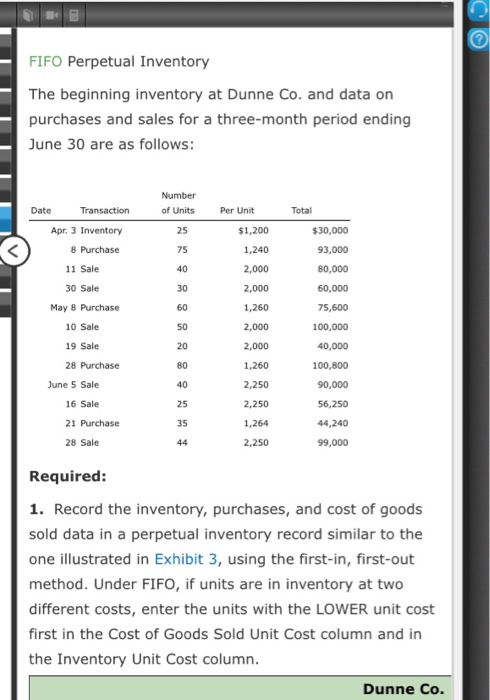

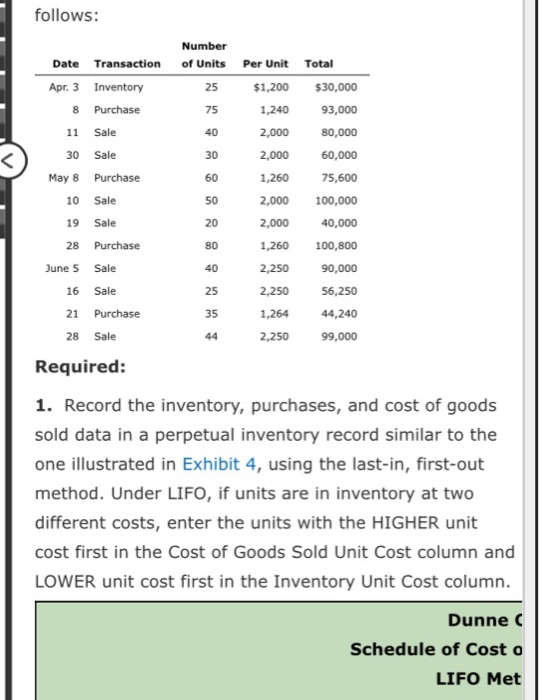

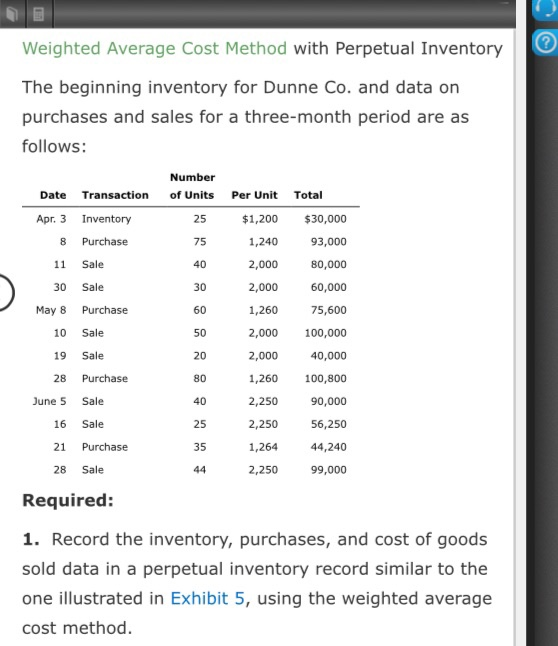

FIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Number of Units Date Transaction Per Unit Total Apr. 3 Inventory $1,200 8 Purchase 1,240 11 Sale 30 Sale May 8 Purchase 10 Sale $30,000 93,000 80,000 60,000 75,600 100,000 40,000 100,800 90,000 56,250 44,240 99,000 2,000 2,000 1,260 2,000 2,000 1,260 2,250 2,250 1,264 2,250 19 Sale 28 Purchase June 5 Sale 16 Sale 21 Purchase 28 Sale Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Dunne Co. follows: Number of Units Date Apr. 3 8 Transaction Inventory Purchase 11 Sale 30 May 8 10 19 Sale Purchase Sale Sale Per Unit $1,200 1,240 2,000 2,000 1,260 2,000 2,000 1,260 2,250 2,250 1,264 2,250 Total $30,000 93,000 80,000 60,000 75,600 100,000 40,000 100,800 90,000 28 Purchase June 5 Sale 16 Sale 21 28 Purchase Sale 56,250 44,240 99,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Dunne Schedule of Cost o LIFO Met Weighted Average Cost Method with Perpetual Inventory The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are as follows: Date Transaction Number of Units Total $30,000 Apr. 3 8 Inventory Purchase 93,000 Sale 80,000 Per Unit $1,200 1,240 2,000 2,000 1,260 2,000 2,000 11 30 May 8 10 19 Sale Purchase Sale Sale 60,000 75,600 100,000 40,000 100,800 90,000 28 Purchase 1,260 June 5 Sale 16 Sale 2,250 2,250 1,264 2,250 21 Purchase 28 Sale 56,250 44,240 99,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 5, using the weighted average cost method. FIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Number of Units Date Transaction Per Unit Total Apr. 3 Inventory $1,200 8 Purchase 1,240 11 Sale 30 Sale May 8 Purchase 10 Sale $30,000 93,000 80,000 60,000 75,600 100,000 40,000 100,800 90,000 56,250 44,240 99,000 2,000 2,000 1,260 2,000 2,000 1,260 2,250 2,250 1,264 2,250 19 Sale 28 Purchase June 5 Sale 16 Sale 21 Purchase 28 Sale Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Dunne Co. follows: Number of Units Date Apr. 3 8 Transaction Inventory Purchase 11 Sale 30 May 8 10 19 Sale Purchase Sale Sale Per Unit $1,200 1,240 2,000 2,000 1,260 2,000 2,000 1,260 2,250 2,250 1,264 2,250 Total $30,000 93,000 80,000 60,000 75,600 100,000 40,000 100,800 90,000 28 Purchase June 5 Sale 16 Sale 21 28 Purchase Sale 56,250 44,240 99,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Dunne Schedule of Cost o LIFO Met Weighted Average Cost Method with Perpetual Inventory The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are as follows: Date Transaction Number of Units Total $30,000 Apr. 3 8 Inventory Purchase 93,000 Sale 80,000 Per Unit $1,200 1,240 2,000 2,000 1,260 2,000 2,000 11 30 May 8 10 19 Sale Purchase Sale Sale 60,000 75,600 100,000 40,000 100,800 90,000 28 Purchase 1,260 June 5 Sale 16 Sale 2,250 2,250 1,264 2,250 21 Purchase 28 Sale 56,250 44,240 99,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 5, using the weighted average cost method