FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical in every respect except that Company X uses

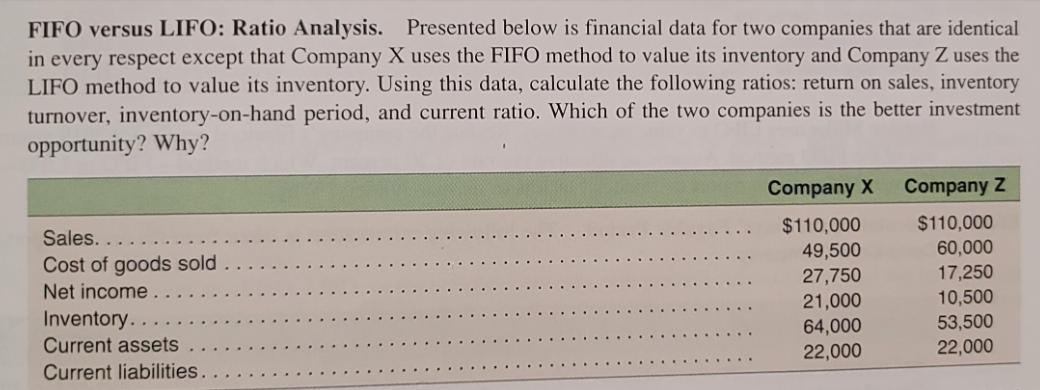

FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why? Sales. Cost of goods sold Net income Inventory.. Current assets Current liabilities. Company X Company Z $110,000 $110,000 49,500 60,000 27,750 17,250 21,000 10,500 64,000 53,500 22,000 22,000

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ratios and determine which company is the better investment opportunity we will use ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db08e80d68_963595.pdf

180 KBs PDF File

663db08e80d68_963595.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started