Question

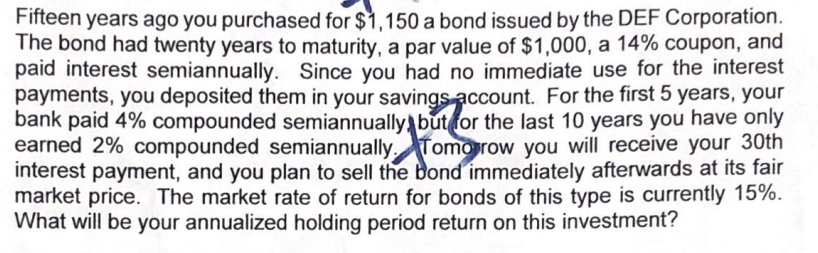

Fifteen years ago, you purchased for $1150 a bond issued by the DEF corporation. The bond had twenty years to maturity, a par value of

Fifteen years ago, you purchased for $1150 a bond issued by the DEF corporation. The bond had twenty years to maturity, a par value of $1000, a 14% coupon, and paid interest semiannually. Since you had no immediate use for the interest payments, you deposited them in your saving account. For the first 5 years, your bank paid 4% compounded semiannually, but for the last 10 years you have only earned 2% compounded semiannually, Tomorrow you will receive your 30th interest payment, and you plan to sell the bond immediately afterwards at its fair market price. The market rate of return for bonds of this type is currently 15%. What will be your annualized holding period return on this investment?

Please tell me how to draw the picture and the detailed steps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started