Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiftycent Inc., has hired you to advise the firm on a capital budgeting issue involving two unequal-lived, mutually exclusive projects, S and T. The

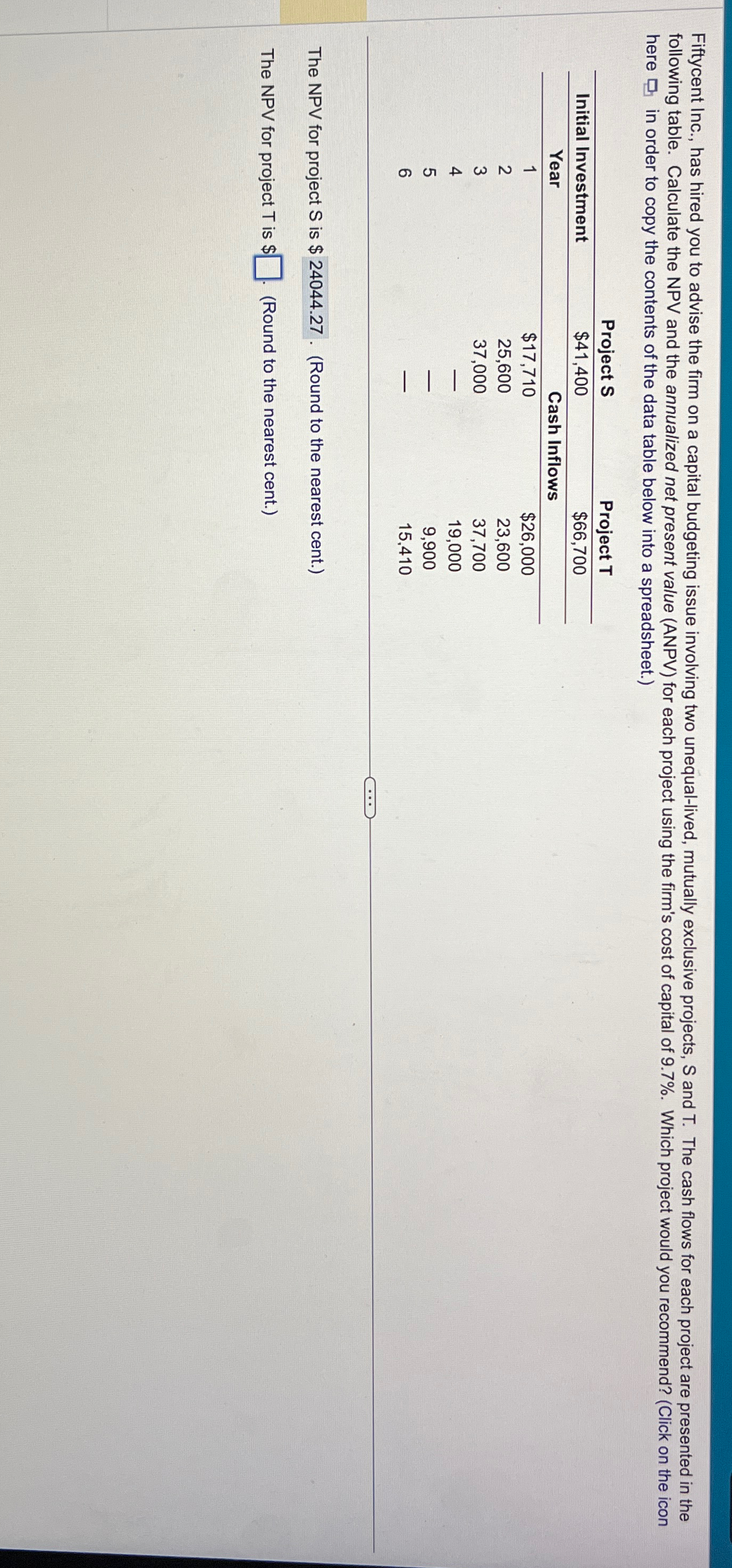

Fiftycent Inc., has hired you to advise the firm on a capital budgeting issue involving two unequal-lived, mutually exclusive projects, S and T. The cash flows for each project are presented in the following table. Calculate the NPV and the annualized net present value (ANPV) for each project using the firm's cost of capital of 9.7%. Which project would you recommend? (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial Investment Year 1 23456 Project S $41,400 Project T $66,700 Cash Inflows $17,710 $26,000 25,600 37,000 23,600 37,700 19,000 9,900 15,410 The NPV for project S is $ 24044.27. (Round to the nearest cent.) The NPV for project T is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started