Question

Figure 1 depicts the daily share prices of the A2 Milk Company Limited (A2M) between 01/03/2021 and 17/03/2021. Rob bought 1000 A2M shares on 02/03/2021

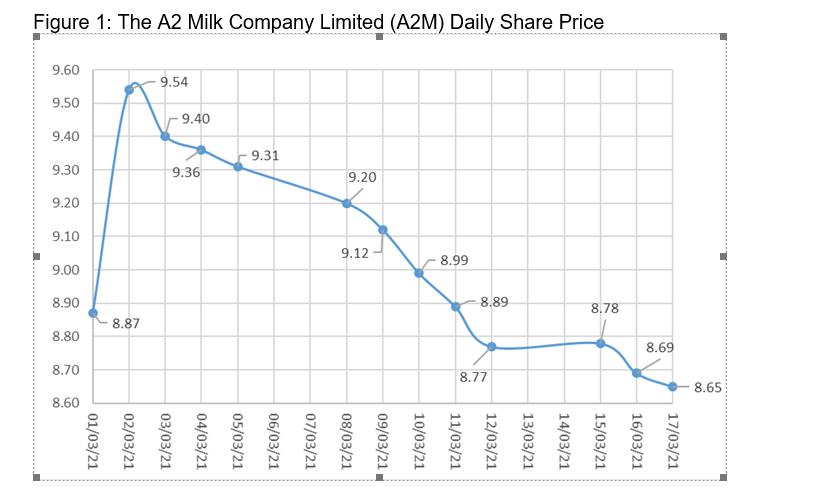

Figure 1 depicts the daily share prices of the A2 Milk Company Limited (A2M) between 01/03/2021 and 17/03/2021. Rob bought 1000 A2M shares on 02/03/2021 and Anna short sold 1000 A2M shares on the same day. They both used the margin trading facility, in which the initial margin is 50% and the maintenance margin is 30% for both the margin trading and the short selling. Subsequently, Rob closed his position on 11/03/2021 and Anna closed her position on 16/03/2021.

1) Ignore all the transaction costs, calculate the profit or loss from these two transactions.

2) Assume that Rob and Anna didn't close their positions as previously stated.

a. Will the price rise or fall for Rob to receive his margin call?

b. Work out that exact margin call price for Rob.

c. Will the price rise or fall for Anna to receive her margin call?

d. Work out that exact margin call price for Anna.

Figure 1:The A2 Milk Company Limited (A2M) Daily Share Price 1 9.60 9.50 9.40 9.30 9.20 9.10 9.00 8.90 8.80 8.70 8.60 -8.87 -9.54 9.40 9.36 - 9.31 T 9.20 9.12- 01/03/21 02/03/21 03/03/21 04/03/21 05/03/21 06/03/21 07/03/21 08/03/21 09/03/21 8.99 8.89 8.77 8.78 8.69 10/03/21 11/03/21 12/03/21 13/03/21 14/03/21 15/03/21 16/03/21 17/03/21 - 8.65

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To solve the questions provided we first need to refer to the chart provided to find the share prices for the A2 Milk Company on the specific dates me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started