Answered step by step

Verified Expert Solution

Question

1 Approved Answer

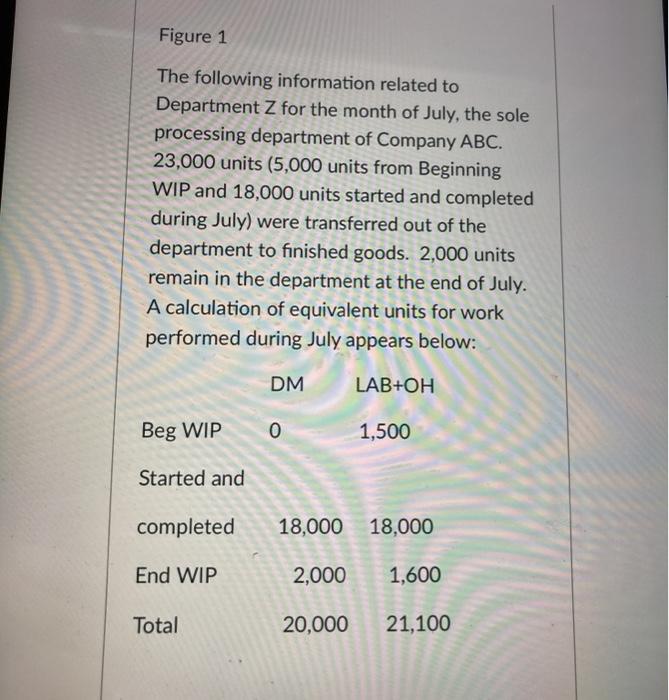

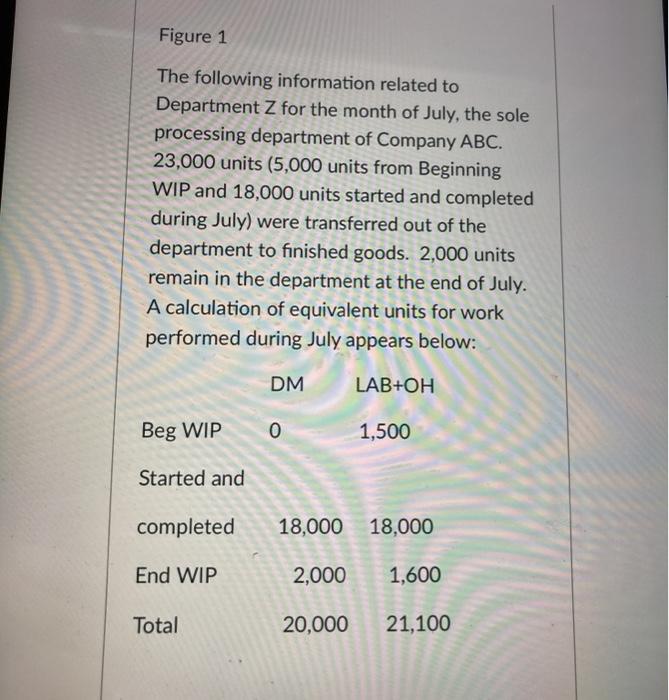

Figure 1 The following information related to Department Z for the month of July, the sole processing department of Company ABC. 23,000 units (5,000 units

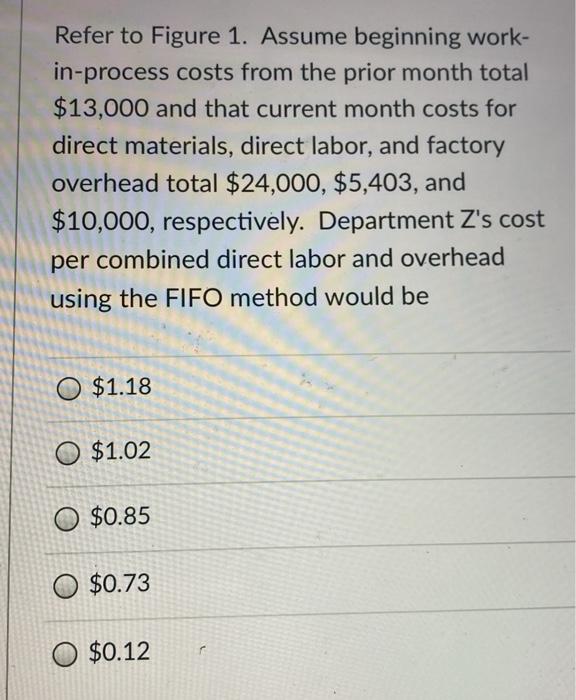

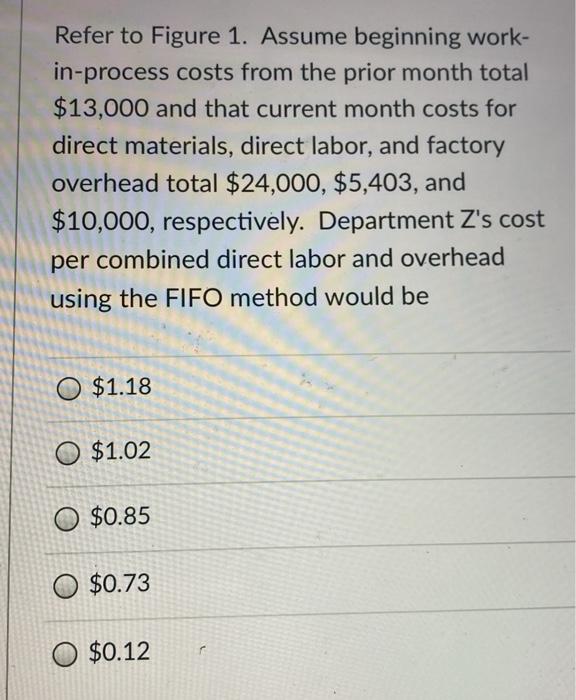

Figure 1 The following information related to Department Z for the month of July, the sole processing department of Company ABC. 23,000 units (5,000 units from Beginning WIP and 18,000 units started and completed during July) were transferred out of the department to finished goods. 2,000 units remain in the department at the end of July. A calculation of equivalent units for work performed during July appears below: DM LAB+OH Beg WIP 0 1,500 Started and completed 18,000 18,000 End WIP 2,000 1,600 Total 20,000 21,100 Refer to Figure 1. Assume beginning work- in-process costs from the prior month total $13,000 and that current month costs for direct materials, direct labor, and factory overhead total $24,000, $5,403, and $10,000, respectively. Department Z's cost per combined direct labor and overhead using the FIFO method would be O $1.18 O $1.02 $0.85 O $0.73 O $0.12

Figure 1 The following information related to Department Z for the month of July, the sole processing department of Company ABC. 23,000 units (5,000 units from Beginning WIP and 18,000 units started and completed during July) were transferred out of the department to finished goods. 2,000 units remain in the department at the end of July. A calculation of equivalent units for work performed during July appears below: DM LAB+OH Beg WIP 0 1,500 Started and completed 18,000 18,000 End WIP 2,000 1,600 Total 20,000 21,100 Refer to Figure 1. Assume beginning work- in-process costs from the prior month total $13,000 and that current month costs for direct materials, direct labor, and factory overhead total $24,000, $5,403, and $10,000, respectively. Department Z's cost per combined direct labor and overhead using the FIFO method would be O $1.18 O $1.02 $0.85 O $0.73 O $0.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started