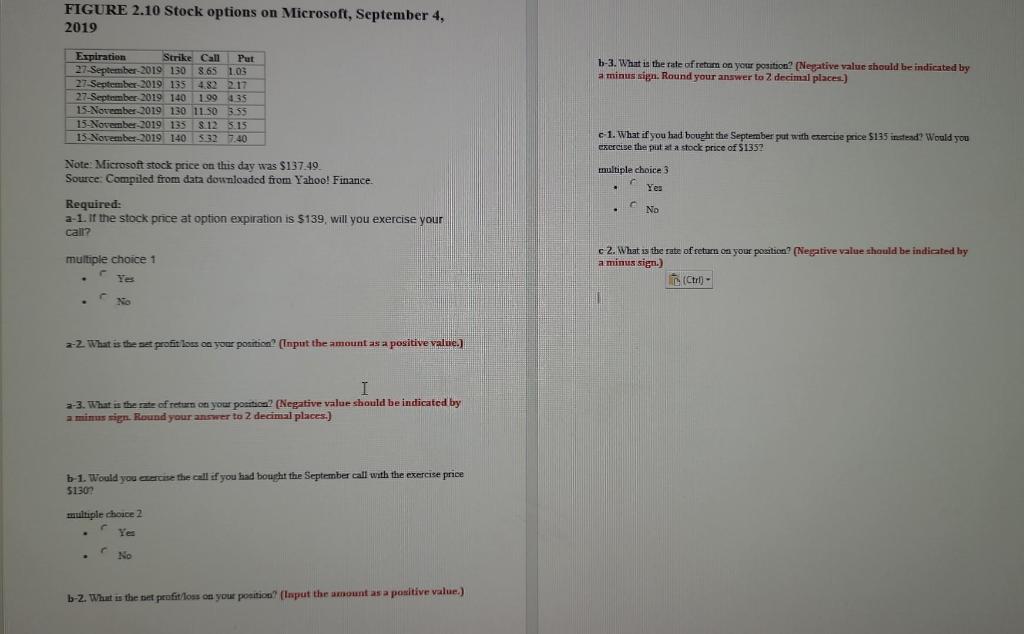

FIGURE 2.10 Stock options on Microsoft, September 4 , 2019 b-3. What is the tale of retum on your position? [Negative value should be indicated by a minus sign. Round your answer to Z decimil places.) C1. What if you had bought the September put with etercise price 5135 iretend? Would you excrcise the put at a stock price of 5135 ? Note: Microsoft stock price on this day was $137.49 tultiple choice 3 Source: Comptied from data dotsnloadcd from Yahool Finance. Required: a-1. if the stock price at option expiration is $139, will you exercise your call? c-2. What is the rate of retum oa your poaition? (Negative value shauld be indicated by multiple choice: 1 a minus sign.) - r Yes - riso a-2. What is the net profit loss con your position? (Input the amount as a positive valine.) 7-3. What is the rate of return on your poeition? [Negative value should be indicated by a minus sign. Round yaur answer to 2 decimal places.] b-1. Would you erercise the call if you had bought the September call with the exercise price 5130? multiple chosce 2 - r Yes - ris b-2. What is the oet profit/loss oa yous potition? (tipput the amount as a positive value.) FIGURE 2.10 Stock options on Microsoft, September 4 , 2019 b-3. What is the tale of retum on your position? [Negative value should be indicated by a minus sign. Round your answer to Z decimil places.) C1. What if you had bought the September put with etercise price 5135 iretend? Would you excrcise the put at a stock price of 5135 ? Note: Microsoft stock price on this day was $137.49 tultiple choice 3 Source: Comptied from data dotsnloadcd from Yahool Finance. Required: a-1. if the stock price at option expiration is $139, will you exercise your call? c-2. What is the rate of retum oa your poaition? (Negative value shauld be indicated by multiple choice: 1 a minus sign.) - r Yes - riso a-2. What is the net profit loss con your position? (Input the amount as a positive valine.) 7-3. What is the rate of return on your poeition? [Negative value should be indicated by a minus sign. Round yaur answer to 2 decimal places.] b-1. Would you erercise the call if you had bought the September call with the exercise price 5130? multiple chosce 2 - r Yes - ris b-2. What is the oet profit/loss oa yous potition? (tipput the amount as a positive value.)