Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Figure 22.2 shows the possible cash flows and end-of-year values for the malted herring project. If you commit and invest $180 million, you have

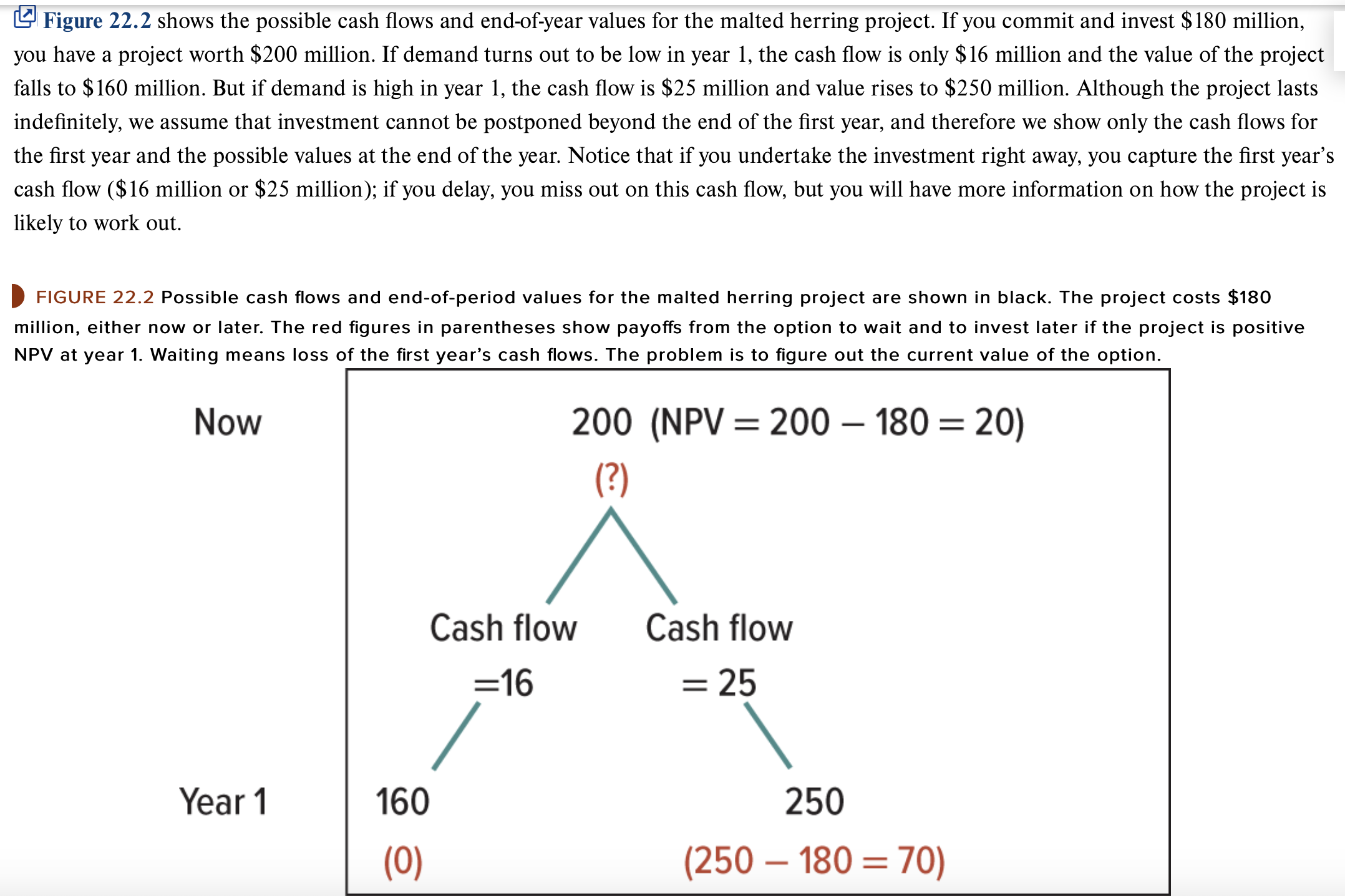

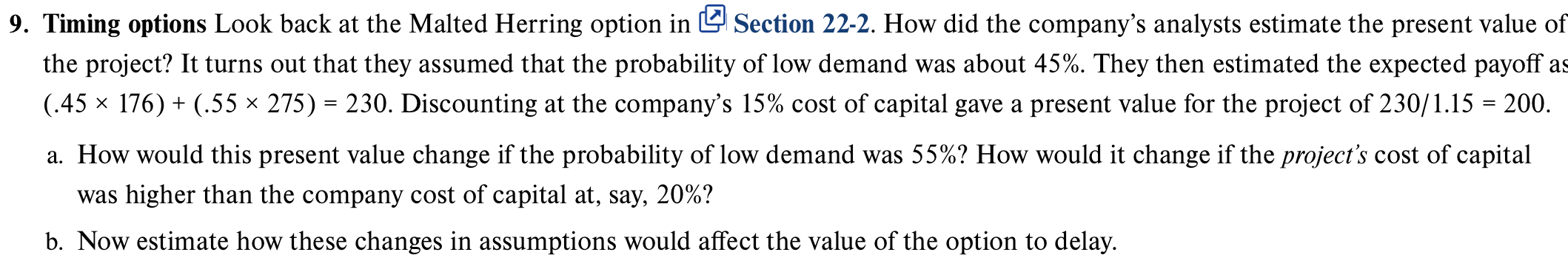

Figure 22.2 shows the possible cash flows and end-of-year values for the malted herring project. If you commit and invest $180 million, you have a project worth $200 million. If demand turns out to be low in year 1, the cash flow is only $16 million and the value of the project falls to $160 million. But if demand is high in year 1, the cash flow is $25 million and value rises to $250 million. Although the project lasts indefinitely, we assume that investment cannot be postponed beyond the end of the first year, and therefore we show only the cash flows for the first year and the possible values at the end of the year. Notice that if you undertake the investment right away, you capture the first year's cash flow ($16 million or $25 million); if you delay, you miss out on this cash flow, but you will have more information on how the project is likely to work out. FIGURE 22.2 Possible cash flows and end-of-period values for the malted herring project are shown in black. The project costs $180 million, either now or later. The red figures in parentheses show payoffs from the option to wait and to invest later if the project is positive NPV at year 1. Waiting means loss of the first year's cash flows. The problem is to figure out the current value of the option. Now 200 (NPV = 200 - 180 = 20) (?) Year 1 160 (0) Cash flow =16 Cash flow = 25 250 (250-180 = 70) 9. Timing options Look back at the Malted Herring option in Section 22-2. How did the company's analysts estimate the present value of the project? It turns out that they assumed that the probability of low demand was about 45%. They then estimated the expected payoff as (.45 176) + (.55 275) = 230. Discounting at the company's 15% cost of capital gave a present value for the project of 230/1.15 = 200. a. How would this present value change if the probability of low demand was 55%? How would it change if the project's cost of capital was higher than the company cost of capital at, say, 20%? b. Now estimate how these changes in assumptions would affect the value of the option to delay.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started