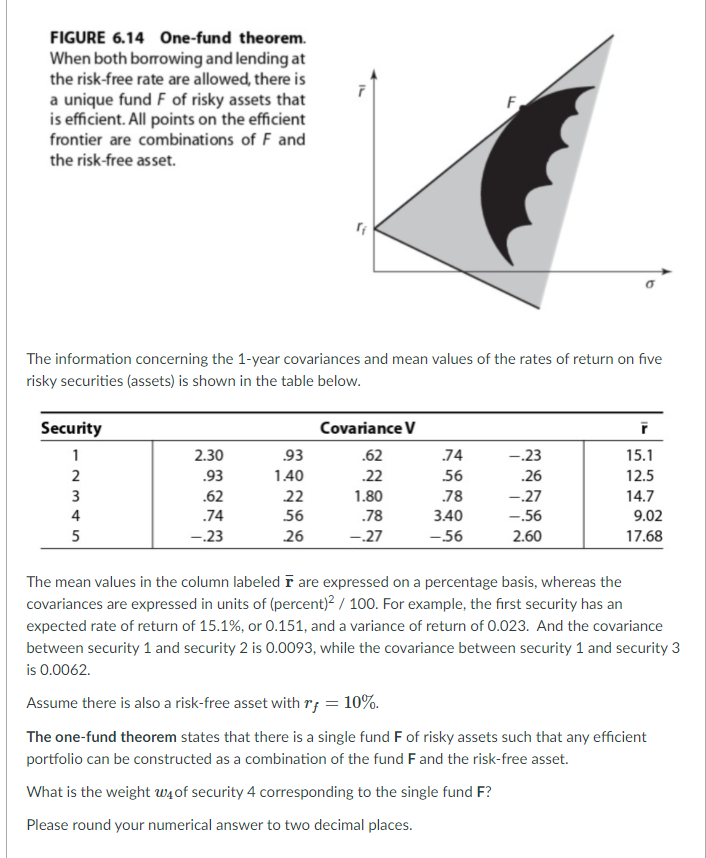

Question: FIGURE 6.14 One-fund theorem. When both borrowing and lending at the risk-free rate are allowed, there is a unique fund F of risky assets that

FIGURE 6.14 One-fund theorem. When both borrowing and lending at the risk-free rate are allowed, there is a unique fund F of risky assets that is efficient. All points on the efficient frontier are combinations of F and the risk-free asset. 7 F The information concerning the 1-year covariances and mean values of the rates of return on five risky securities (assets) is shown in the table below. r 2.30 Security 1 2 3 4 5 .93 93 1.40 .22 Covariance V .62 .22 1.80 .78 - 27 .62 .74 -.23 .74 56 .78 3.40 -56 -.23 .26 -.27 -.56 2.60 15.1 12.5 14.7 9.02 17.68 56 26 The mean values in the column labeled rare expressed on a percentage basis, whereas the covariances are expressed in units of (percent)2 / 100. For example, the first security has an expected rate of return of 15.1%, or 0.151, and a variance of return of 0.023. And the covariance between security 1 and security 2 is 0.0093, while the covariance between security 1 and security 3 is 0.0062. Assume there is also a risk-free asset with r; = 10%. The one-fund theorem states that there is a single fund F of risky assets such that any efficient portfolio can be constructed as a combination of the fund F and the risk-free asset. What is the weight W4 of security 4 corresponding to the single fund F? Please round your numerical answer to two decimal places. FIGURE 6.14 One-fund theorem. When both borrowing and lending at the risk-free rate are allowed, there is a unique fund F of risky assets that is efficient. All points on the efficient frontier are combinations of F and the risk-free asset. 7 F The information concerning the 1-year covariances and mean values of the rates of return on five risky securities (assets) is shown in the table below. r 2.30 Security 1 2 3 4 5 .93 93 1.40 .22 Covariance V .62 .22 1.80 .78 - 27 .62 .74 -.23 .74 56 .78 3.40 -56 -.23 .26 -.27 -.56 2.60 15.1 12.5 14.7 9.02 17.68 56 26 The mean values in the column labeled rare expressed on a percentage basis, whereas the covariances are expressed in units of (percent)2 / 100. For example, the first security has an expected rate of return of 15.1%, or 0.151, and a variance of return of 0.023. And the covariance between security 1 and security 2 is 0.0093, while the covariance between security 1 and security 3 is 0.0062. Assume there is also a risk-free asset with r; = 10%. The one-fund theorem states that there is a single fund F of risky assets such that any efficient portfolio can be constructed as a combination of the fund F and the risk-free asset. What is the weight W4 of security 4 corresponding to the single fund F? Please round your numerical answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts