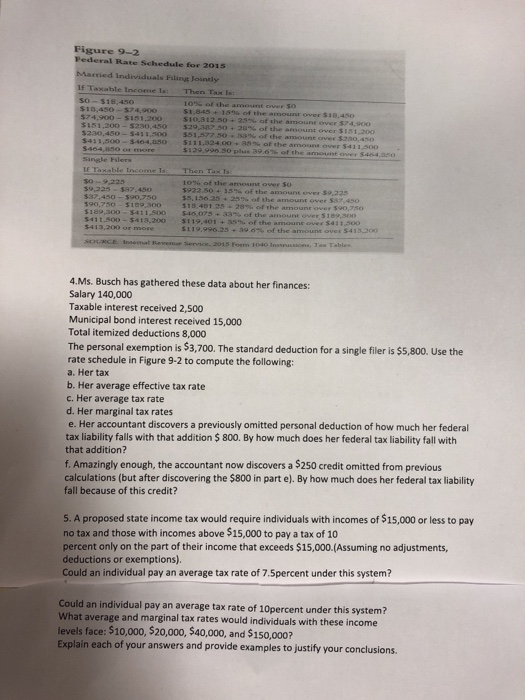

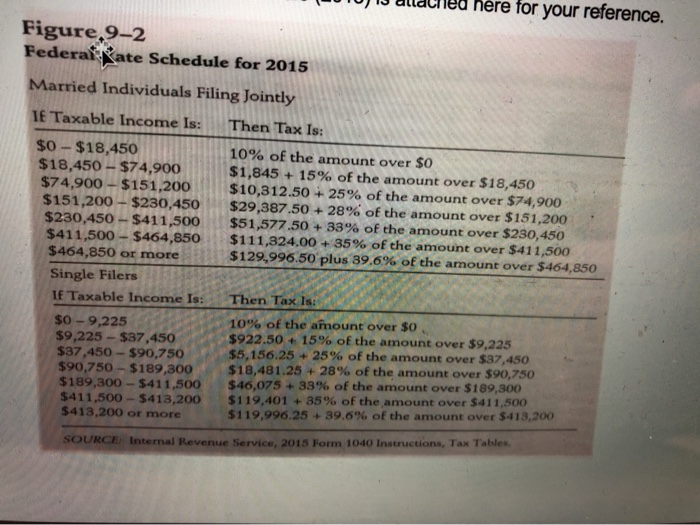

Figure 9-2 Federal Rate Schedule for 2015 Married individuals in Jointly If Taxable income to Then Tax SO-316,450 10% of the amount over $10,450 $74,900 $1,845 + 15% of the amount $74,900 - 5151 200 510.31250 +25 of the amount over 54.00 5151,200-5230.450529137 10 20 of the amount over SI $230,450-$411 300 $411,50 1164.50 5111.324.00.35% of the amount over $411.500 5464,650 Or more $129,990.50 plus 39.63 of the amountar 39,225 597.450 $37.450 - 590,750 $90,750 5169,00 $1 ,3005411.500 5411.50D - 5413,200) 5413,200 or more Then Taxis: 10% of the amount over 50 $922.50 13 of the amount over 59,325 35,156.25. 25% of the amount over 5. 450 $11528he amount 5.16.07833 of the amount over 51,300 5119,401 +3 of the amount over $11,500 $119.990. - 19 4 1 Service, 2015 Form 1040 Incion, Tax Tables 4.Ms. Busch has gathered these data about her finances: Salary 140,000 Taxable interest received 2,500 Municipal bond interest received 15,000 Total itemized deductions 8,000 The personal exemption is 53,700. The standard deduction for a single filer is $5,800. Use the rate schedule in Figure 9-2 to compute the following: a. Her tax b. Her average effective tax rate c. Her average tax rate d. Her marginal tax rates e. Her accountant discovers a previously omitted personal deduction of how much her federal tax liability falls with that addition $ 800. By how much does her federal tax liability fall with that addition? f. Amazingly enough, the accountant now discovers a $250 credit omitted from previous calculations (but after discovering the $800 in parte). By how much does her federal tax liability fall because of this credit? 5. A proposed state income tax would require individuals with incomes of $15,000 or less to pay no tax and those with incomes above $15,000 to pay a tax of 10 percent only on the part of their income that exceeds $15,000.(Assuming no adjustments, deductions or exemptions). Could an individual pay an average tax rate of 7.5 percent under this system? Could an individual pay an average tax rate of 10percent under this system? What average and marginal tax rates would individuals with these income levels face: $10,000, $20,000, $40,000, and $150,000? Explain each of your answers and provide examples to justify your conclusions. ---.0) ulu NcIU yuui leiererce. Figure.9-2 Federal Kate Schedule for 2015 Married Individuals Filing Jointly TE Taxable income is: Then Tax Is: $0-$18,450 10% of the amount over $0 $18,450 - $74,900 $1,845 + 15% of the amount over $18,450 $74,900 - $151,200 $10,312.50 +25% of the amount over $74,900 $151,200 - $230,450 $29,387.50 +28% of the amount over $151,200 $230,450-$411,500 $51,577.50 + 33% of the amount over $230,450 $411,500 - $464,850 $111,324.00 + 85% of the amount over $411,500 $464,850 or more $129,996.50 plus 39.6% of the amount over $464,850 Single Filers If Taxable Income Is: Then Tax Is: $0 - 9,225 10% of the amount over $0 $9.225 - $37.450 $922.50 15% of the amount over $9,225 $37.450 - $90.750 5 5.156.25 -25% of the amount over $37,450 $90,750 - $189,800 $18,481.25 4 28% of the amount over $90,750 $189,300 - 5411,500 $46,075 -33% of the amount over $189,300 $411,500 - 5413,200 $119,401 +85% of the amount over $411,500 $413,200 or more $119.996.25 +39.6% of the amount over $413,200 SOURCE Internal Revenue Service, 2015 Form 1040 Instructions, Tax Tables Figure 9-2 Federal Rate Schedule for 2015 Married individuals in Jointly If Taxable income to Then Tax SO-316,450 10% of the amount over $10,450 $74,900 $1,845 + 15% of the amount $74,900 - 5151 200 510.31250 +25 of the amount over 54.00 5151,200-5230.450529137 10 20 of the amount over SI $230,450-$411 300 $411,50 1164.50 5111.324.00.35% of the amount over $411.500 5464,650 Or more $129,990.50 plus 39.63 of the amountar 39,225 597.450 $37.450 - 590,750 $90,750 5169,00 $1 ,3005411.500 5411.50D - 5413,200) 5413,200 or more Then Taxis: 10% of the amount over 50 $922.50 13 of the amount over 59,325 35,156.25. 25% of the amount over 5. 450 $11528he amount 5.16.07833 of the amount over 51,300 5119,401 +3 of the amount over $11,500 $119.990. - 19 4 1 Service, 2015 Form 1040 Incion, Tax Tables 4.Ms. Busch has gathered these data about her finances: Salary 140,000 Taxable interest received 2,500 Municipal bond interest received 15,000 Total itemized deductions 8,000 The personal exemption is 53,700. The standard deduction for a single filer is $5,800. Use the rate schedule in Figure 9-2 to compute the following: a. Her tax b. Her average effective tax rate c. Her average tax rate d. Her marginal tax rates e. Her accountant discovers a previously omitted personal deduction of how much her federal tax liability falls with that addition $ 800. By how much does her federal tax liability fall with that addition? f. Amazingly enough, the accountant now discovers a $250 credit omitted from previous calculations (but after discovering the $800 in parte). By how much does her federal tax liability fall because of this credit? 5. A proposed state income tax would require individuals with incomes of $15,000 or less to pay no tax and those with incomes above $15,000 to pay a tax of 10 percent only on the part of their income that exceeds $15,000.(Assuming no adjustments, deductions or exemptions). Could an individual pay an average tax rate of 7.5 percent under this system? Could an individual pay an average tax rate of 10percent under this system? What average and marginal tax rates would individuals with these income levels face: $10,000, $20,000, $40,000, and $150,000? Explain each of your answers and provide examples to justify your conclusions. ---.0) ulu NcIU yuui leiererce. Figure.9-2 Federal Kate Schedule for 2015 Married Individuals Filing Jointly TE Taxable income is: Then Tax Is: $0-$18,450 10% of the amount over $0 $18,450 - $74,900 $1,845 + 15% of the amount over $18,450 $74,900 - $151,200 $10,312.50 +25% of the amount over $74,900 $151,200 - $230,450 $29,387.50 +28% of the amount over $151,200 $230,450-$411,500 $51,577.50 + 33% of the amount over $230,450 $411,500 - $464,850 $111,324.00 + 85% of the amount over $411,500 $464,850 or more $129,996.50 plus 39.6% of the amount over $464,850 Single Filers If Taxable Income Is: Then Tax Is: $0 - 9,225 10% of the amount over $0 $9.225 - $37.450 $922.50 15% of the amount over $9,225 $37.450 - $90.750 5 5.156.25 -25% of the amount over $37,450 $90,750 - $189,800 $18,481.25 4 28% of the amount over $90,750 $189,300 - 5411,500 $46,075 -33% of the amount over $189,300 $411,500 - 5413,200 $119,401 +85% of the amount over $411,500 $413,200 or more $119.996.25 +39.6% of the amount over $413,200 SOURCE Internal Revenue Service, 2015 Form 1040 Instructions, Tax Tables