Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inventories Most inventories owned by Deere & Company and its United States equipment subsidiaries are valued at cost, on the last-in, first-out (LIFO) basis.

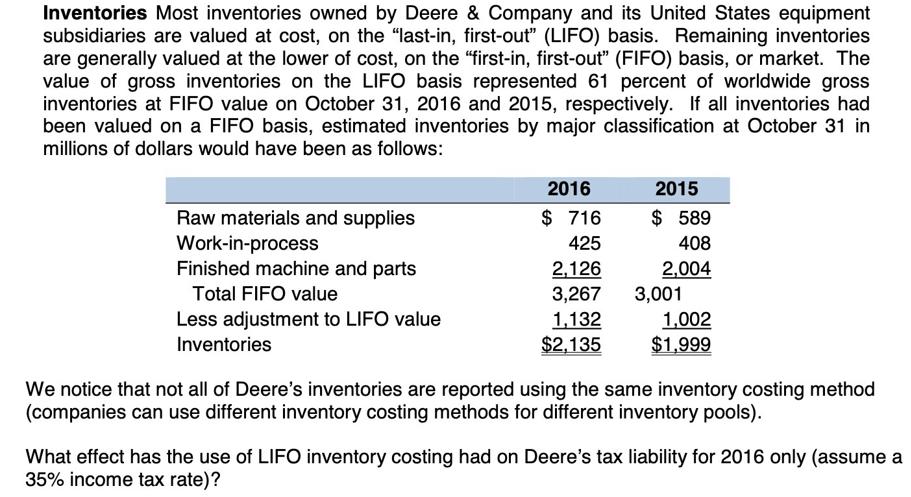

Inventories Most inventories owned by Deere & Company and its United States equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 61 percent of worldwide gross inventories at FIFO value on October 31, 2016 and 2015, respectively. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31 in millions of dollars would have been as follows: Raw materials and supplies Work-in-process Finished machine and parts Total FIFO value Less adjustment to LIFO value Inventories 2016 $716 425 2,126 3,267 1,132 $2,135 2015 $ 589 408 2,004 3,001 1,002 $1,999 We notice that not all of Deere's inventories are reported using the same inventory costing method (companies can use different inventory costing methods for different inventory pools). What effect has the use of LIFO inventory costing had on Deere's tax liability for 2016 only (assume a 35% income tax rate)?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided about Deeres inventories and costing methods we can analyze the ef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started