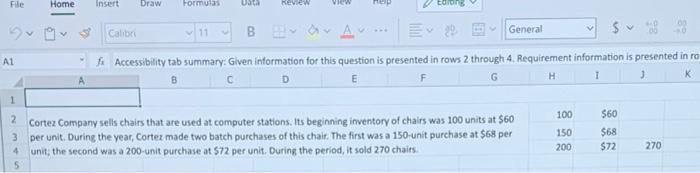

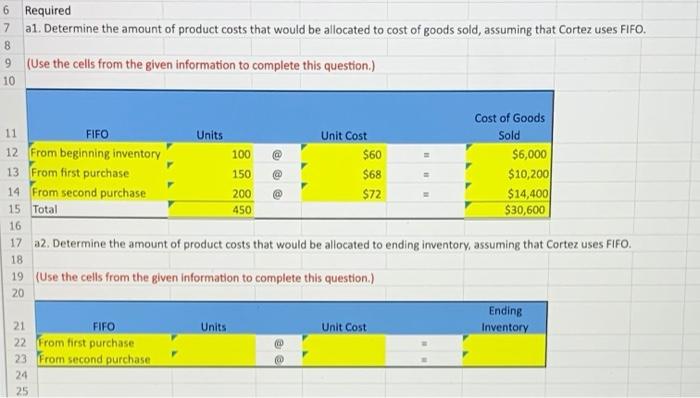

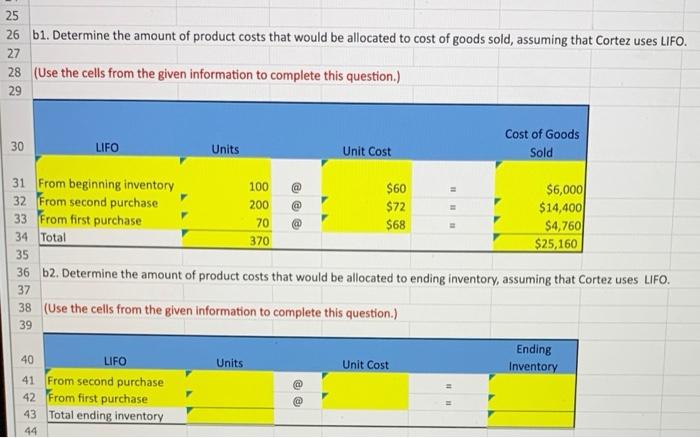

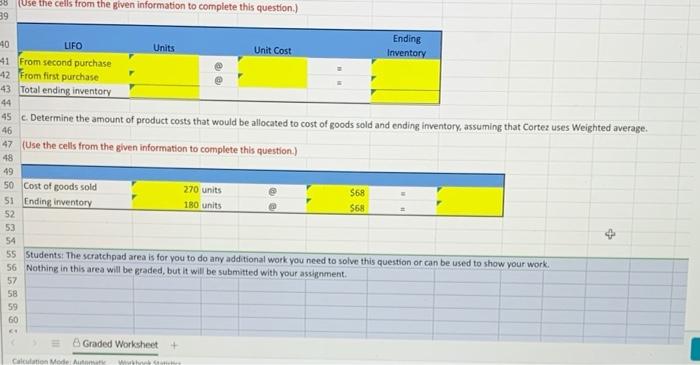

File Home Insert Draw Formulas Uta Review toons > sve Calibri My Bear A General sv Accessibility tab summary: Given information for this question is presented in rows 2 through 4. Requirement information is presented in ro D E H 1 3 K A1 1 100 2 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 100 units at $60 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 150-unit purchase at $68 per unit; the second was a 200-unit purchase at 572 per unit, During the period, it sold 270 chairs. 3 4 $60 $68 $72 150 200 270 6 Required 7 al. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses FIFO. 8 9 (Use the cells from the given information to complete this question.) 10 Cost of Goods 11 FIFO Units Unit Cost Sold 12 From beginning inventory 100 $60 $6,000 13 From first purchase 150 $68 $10,2001 14 From second purchase 200 $72 $14,400 15 Total 450 $30,600 16 17 a2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses FIFO. 18 19 (Use the cells from the given information to complete this question.) 20 Ending 21 FIFO Units Unit Cost Inventory 22 From first purchase 23 From second purchase 24 25 25 26 b1. Determine the amount of product costs that would be allocated to cost of goods sold, assuming that Cortez uses LIFO. 27 28 (Use the cells from the given information to complete this question.) 29 30 LIFO Units Cost of Goods Sold Unit Cost a $68 31 From beginning inventory 100 $60 $6,000 32 From second purchase 200 $72 $14,400 33 From first purchase 70 $4,7601 34 Total 370 $25,160 35 36 b2. Determine the amount of product costs that would be allocated to ending inventory, assuming that Cortez uses LIFO. 37 38 (Use the cells from the given information to complete this question.) 39 Units Unit Cost Ending Inventory 40 LIFO 41 From second purchase 42 From first purchase 43 Total ending inventory 44 @ @ - Use the cells from the given information to complete this question.) 39 Ending -40 LIFO Units Unit Cost Inventory 41 From second purchase 42 From first purchase 43 Total ending inventory 44 45 c. Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses Weighted average. 46 47 (Use the cells from the given information to complete this question.) 48 49 50 Cost of goods sold 270 units 51 Ending inventory 180 units $68 52 53 54 55 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work 56 Nothing in this area will be graded, but it will be submitted with your assignment 57 58 59 60 $68 Graded Worksheet Calculation Mode with