Answered step by step

Verified Expert Solution

Question

1 Approved Answer

File Home Insert Page Layout Formulas Data Review View Help Design Tell me what you want to do C11 fo Cash pool service revenue for

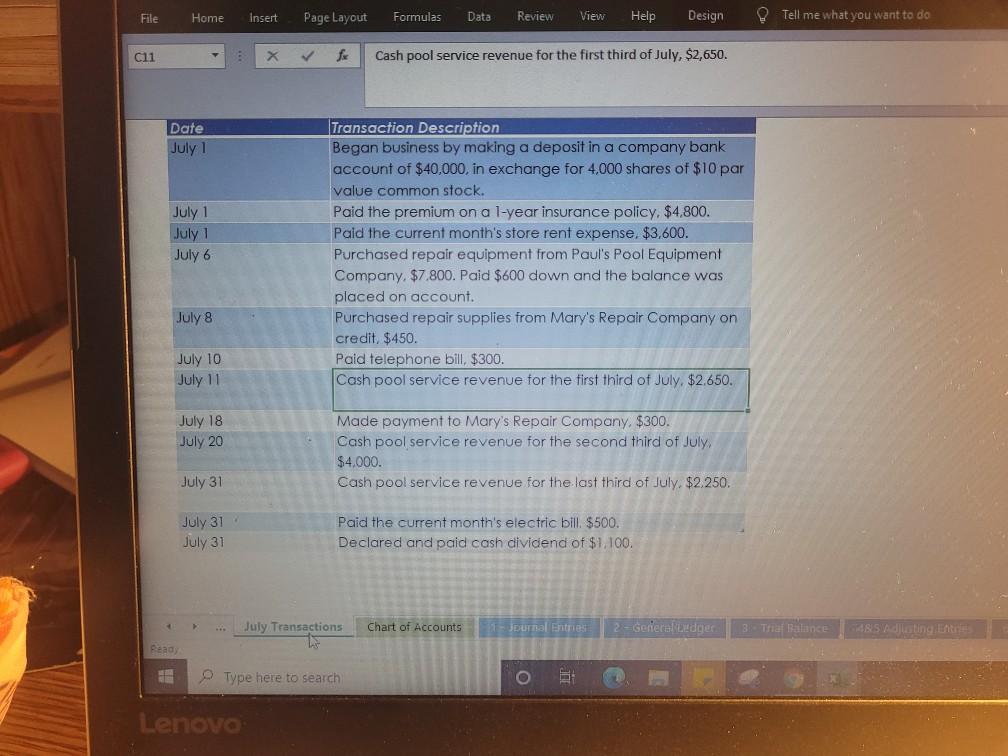

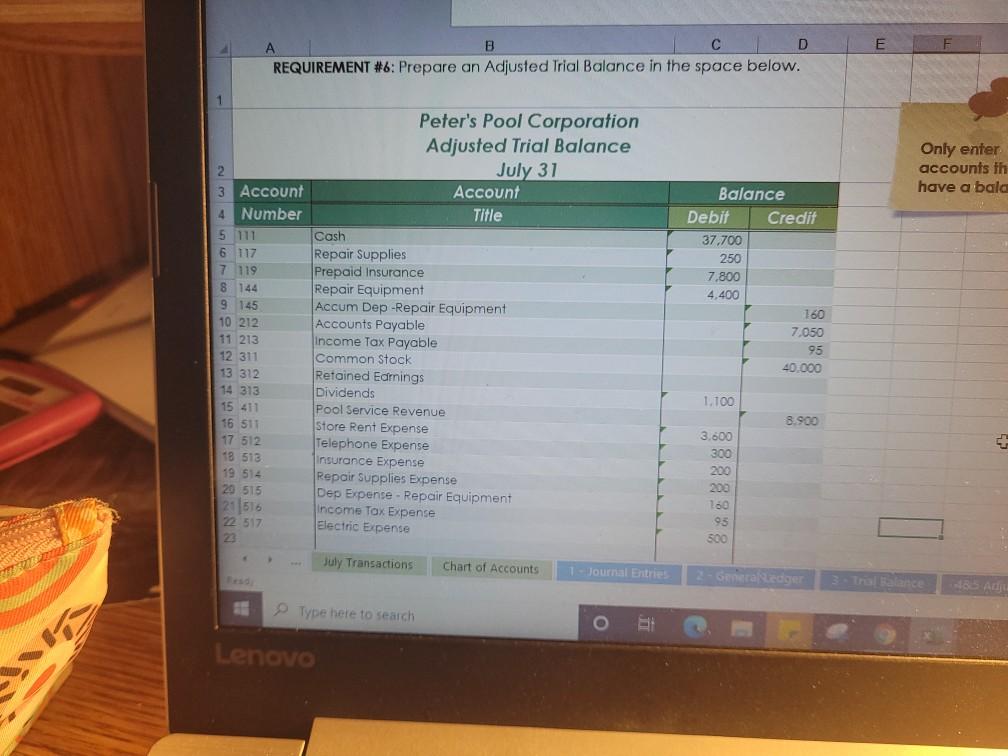

File Home Insert Page Layout Formulas Data Review View Help Design Tell me what you want to do C11 fo Cash pool service revenue for the first third of July, $2,650. Date July 1 July 1 July 1 July 6 Transaction Description Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. Paid the premium on a 1-year insurance policy. $4,800. Paid the current month's store rent expense. $3,600. Purchased repair equipment from Paul's Pool Equipment Company, $7.800. Paid $600 down and the balance was placed on account. Purchased repair supplies from Mary's Repair Company on credit. $450. Paid telephone bill, $300. Cash pool service revenue for the first third of July, $2.650. July 8 July 10 July 11 July 18 July 20 Made payment to Mary's Repair Company. $300. Cash pool service revenue for the second third of July, $4,000. Cash pool service revenue for the last third of July. $2.250. July 31 July 31 July 31 Paid the current month's electric bill. $500. Declared and paid cash dividend of $1,100. July Transactions Chart of Accounts 19 - Jurnal Entries 2 - Generaliteder Tra Balince Dead Type here to search O Lenovo B D REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Only enter accounts th have a bala Peter's Pool Corporation Adjusted Trial Balance 2 July 31 3 Account Account 4 Number Title 5 111 Cash 6 117 Repair Supplies 7 119 Prepaid Insurance 8 144 Repair Equipment 9 145 Accum Dep-Repair Equipment 10 212 Accounts Payable 11 213 Income Tax Payable 12 311 Common Stock 13 312 Retained Edmings 14 313 Dividends 15 411 Pool Service Revenue 16 511 Store Rent Expense 17 512 Telephone Expense 18 513 Insurance Expense 19 514 Repair Supplies Expense 20 515 Dep Expense - Repair Equipment 211616 Income Tax Expense 72 517 Electric Expense 2 July Transactions Chart of Accounts 1 Journal Entries Balance Debit Credit 37.700 250 7.800 4.400 160 7.050 95 40.000 1.100 8.900 3.600 300 200 200 16 95 500 Generaler 33 A Type here to search O Lenovo File Home Insert Page Layout Formulas Data Review View Help Design Tell me what you want to do C11 fo Cash pool service revenue for the first third of July, $2,650. Date July 1 July 1 July 1 July 6 Transaction Description Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. Paid the premium on a 1-year insurance policy. $4,800. Paid the current month's store rent expense. $3,600. Purchased repair equipment from Paul's Pool Equipment Company, $7.800. Paid $600 down and the balance was placed on account. Purchased repair supplies from Mary's Repair Company on credit. $450. Paid telephone bill, $300. Cash pool service revenue for the first third of July, $2.650. July 8 July 10 July 11 July 18 July 20 Made payment to Mary's Repair Company. $300. Cash pool service revenue for the second third of July, $4,000. Cash pool service revenue for the last third of July. $2.250. July 31 July 31 July 31 Paid the current month's electric bill. $500. Declared and paid cash dividend of $1,100. July Transactions Chart of Accounts 19 - Jurnal Entries 2 - Generaliteder Tra Balince Dead Type here to search O Lenovo B D REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Only enter accounts th have a bala Peter's Pool Corporation Adjusted Trial Balance 2 July 31 3 Account Account 4 Number Title 5 111 Cash 6 117 Repair Supplies 7 119 Prepaid Insurance 8 144 Repair Equipment 9 145 Accum Dep-Repair Equipment 10 212 Accounts Payable 11 213 Income Tax Payable 12 311 Common Stock 13 312 Retained Edmings 14 313 Dividends 15 411 Pool Service Revenue 16 511 Store Rent Expense 17 512 Telephone Expense 18 513 Insurance Expense 19 514 Repair Supplies Expense 20 515 Dep Expense - Repair Equipment 211616 Income Tax Expense 72 517 Electric Expense 2 July Transactions Chart of Accounts 1 Journal Entries Balance Debit Credit 37.700 250 7.800 4.400 160 7.050 95 40.000 1.100 8.900 3.600 300 200 200 16 95 500 Generaler 33 A Type here to search O Lenovo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started