Question: FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Financing Early Operations Musk's first entrepreneurial venture was to join up with his brother, Kimbal, and

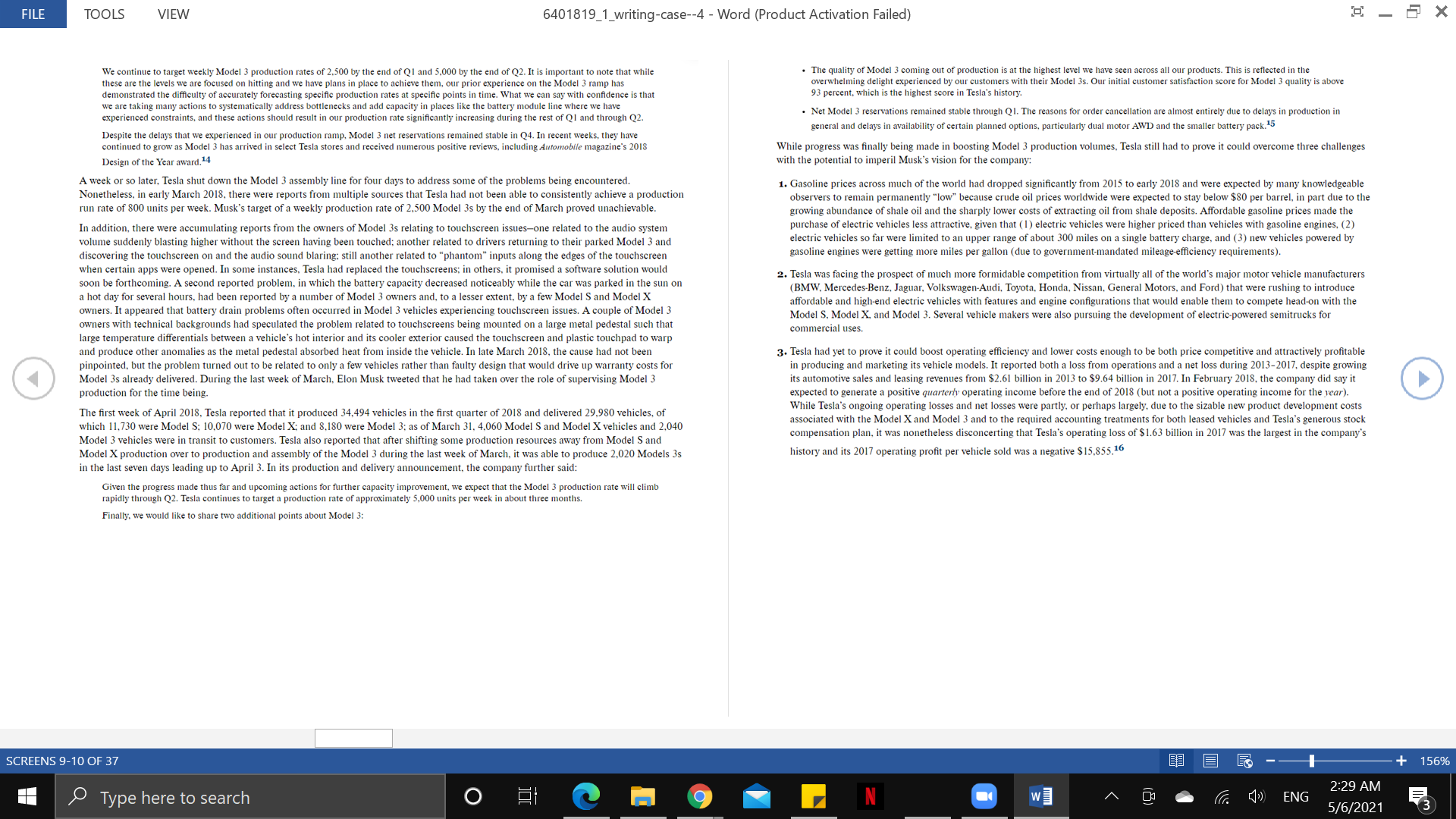

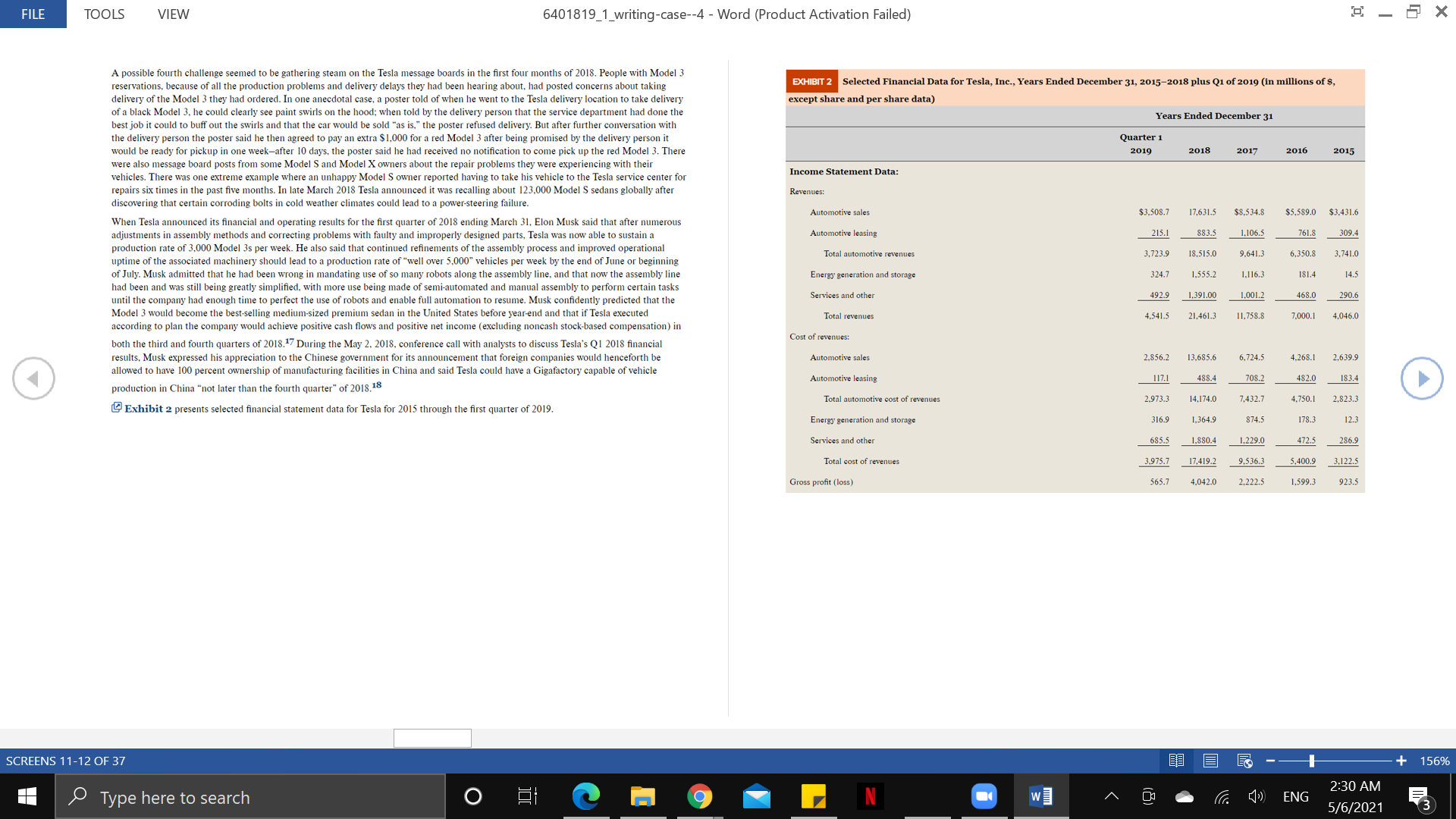

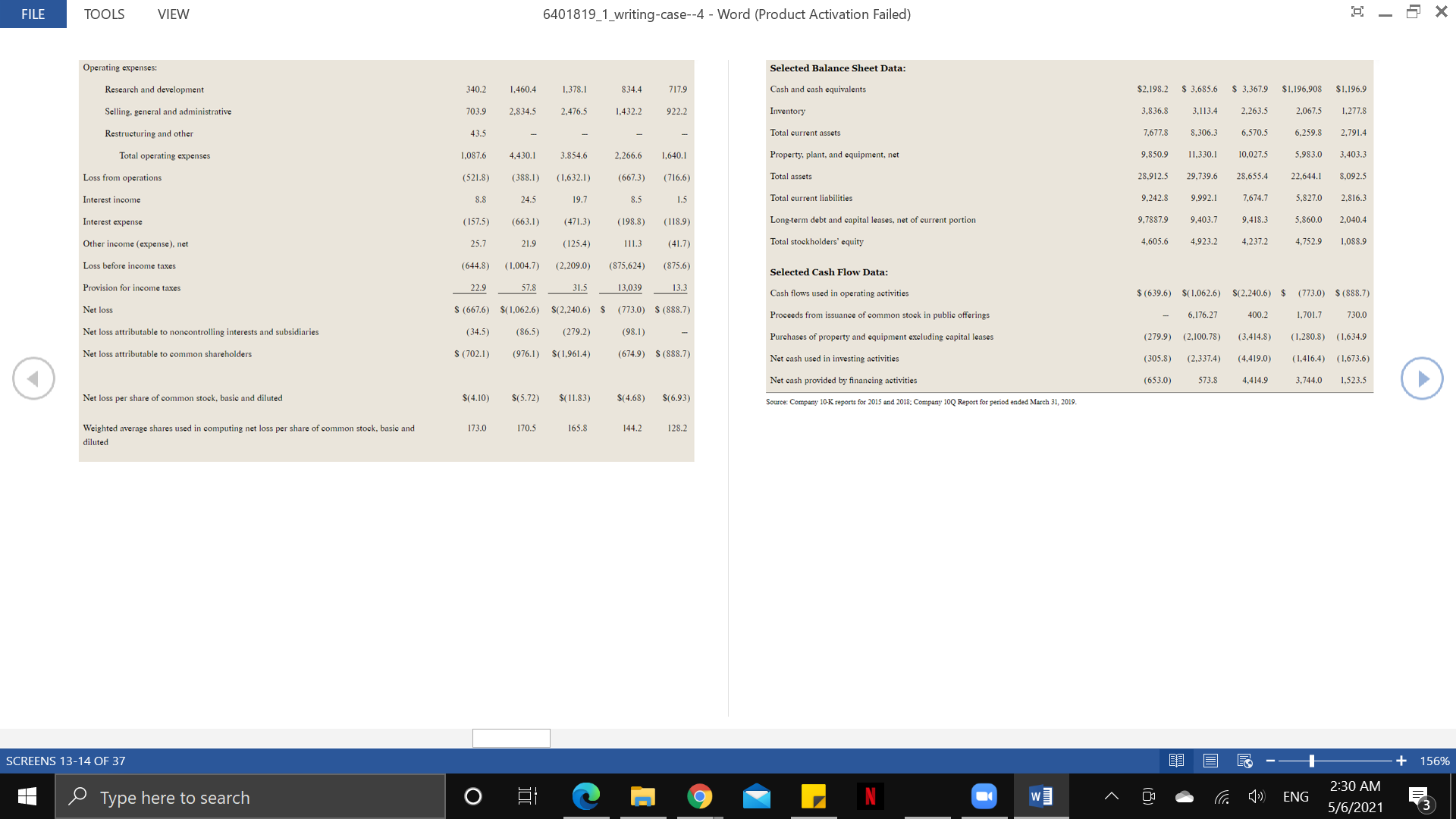

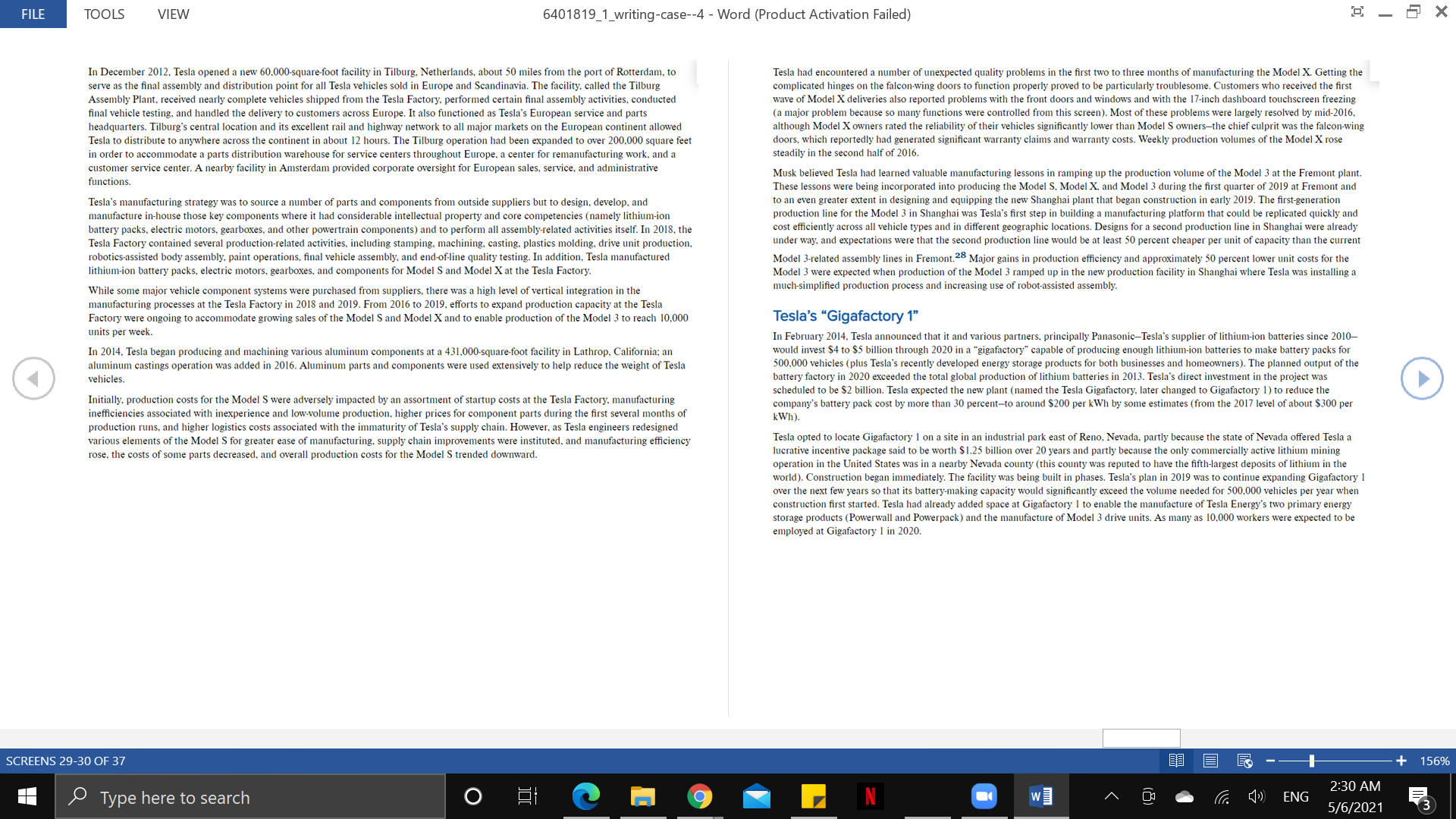

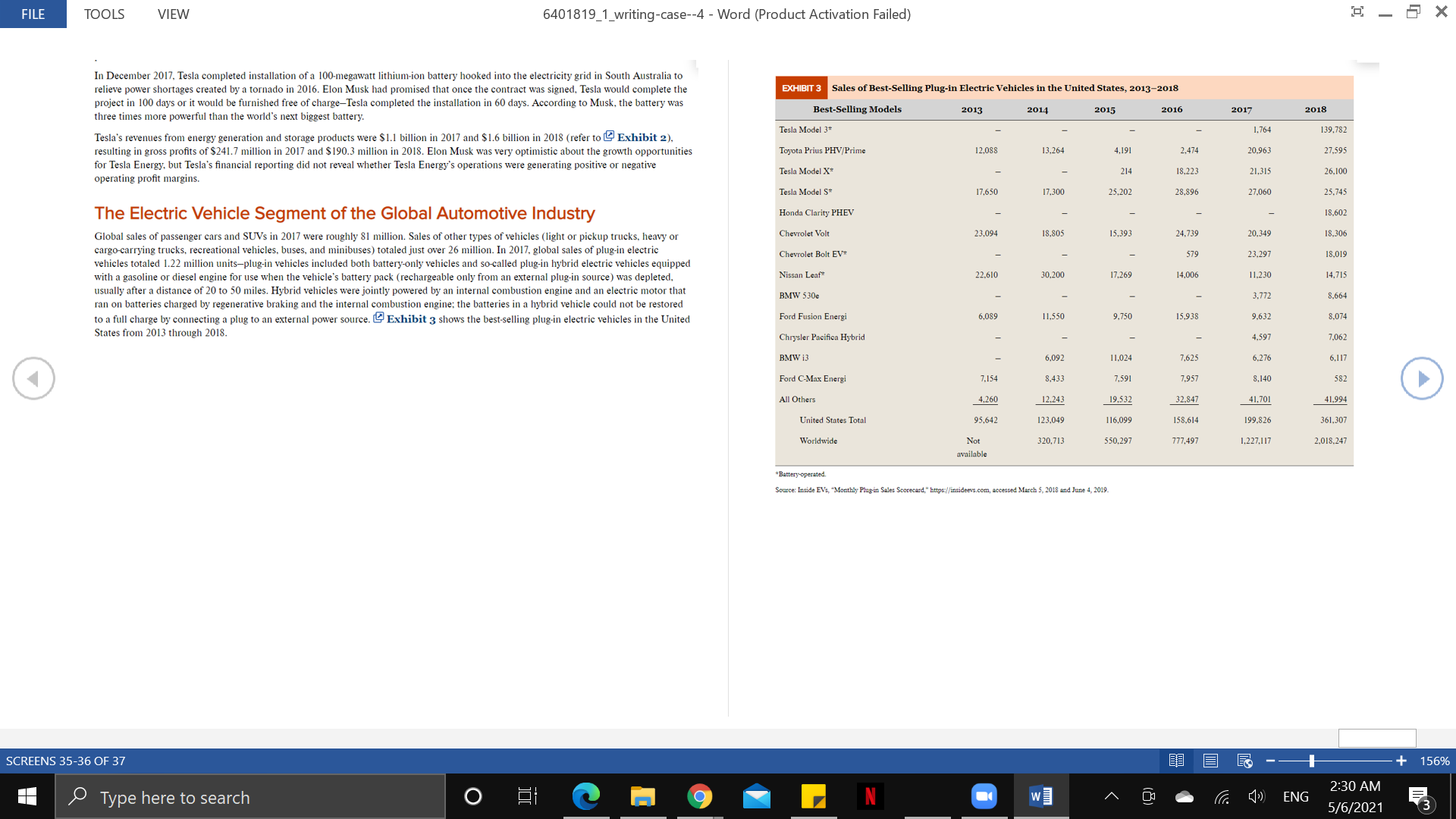

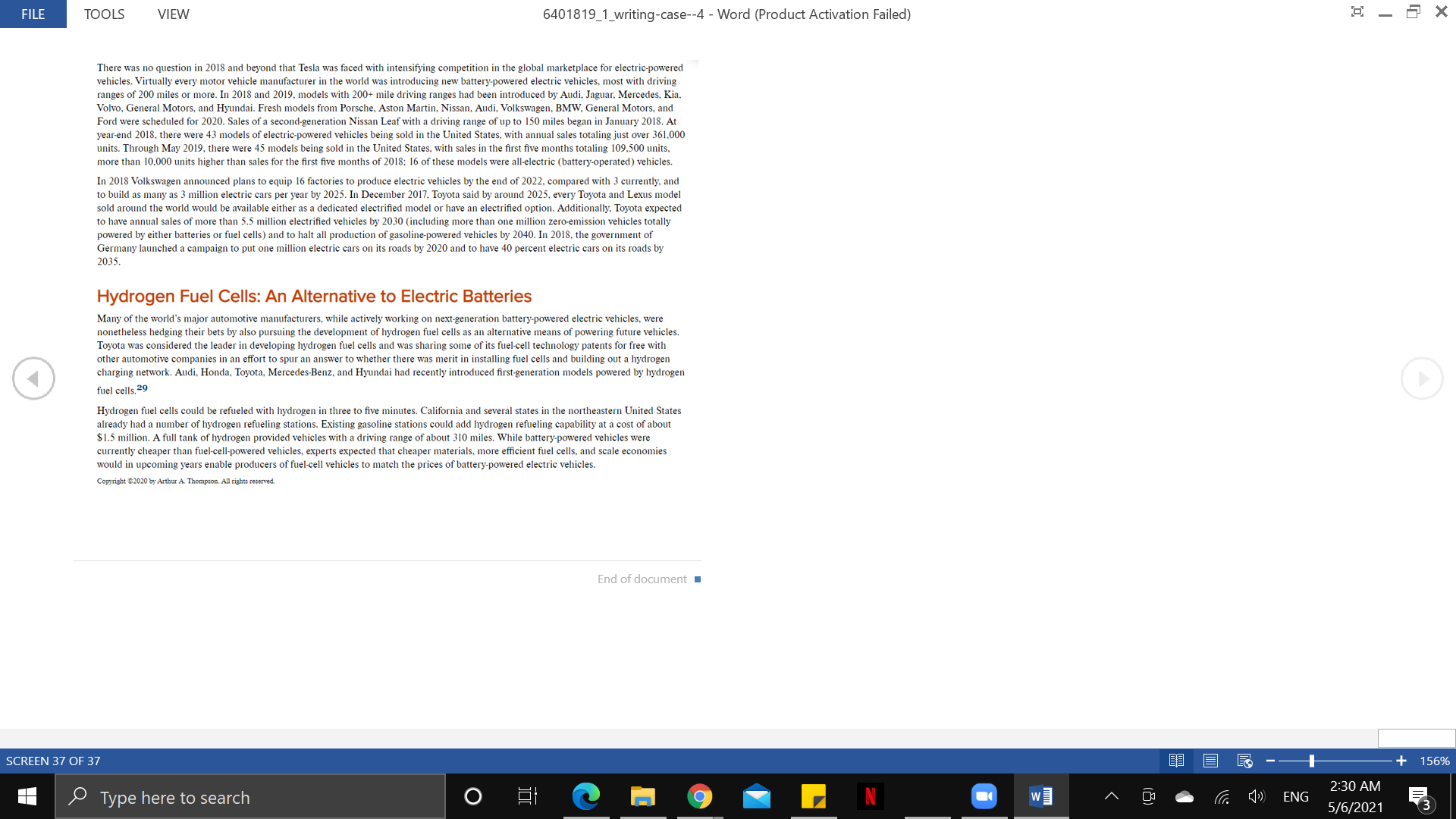

FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Financing Early Operations Musk's first entrepreneurial venture was to join up with his brother, Kimbal, and establish Zip2, an Internet software company that developed, hosted, and maintained some 200 websites involving "city guides" for media companies. In 1999 Zip2 was sold to a wholly owned Eberhard and Tarpenning financed the company until Tesla's first round of investor funding in February 2004. Elon Musk contributed $6.35 subsidiary of Compaq Computer for $307 million in cash and $34 million in stock options-Musk received a reported $22 million from the million of the $6.5 million in initial funding and, as the company's majority investor, assumed the position of Chairman of the company's sale.5 board of directors. Martin Eberhard put up $75,000 of the initial $6.5 million, with two private equity investment groups and a number of private investors contributing the remainder. Several rounds of investor funding ensued, with Elon Musk emerging as the company's biggest In March 1999, Musk co-founded X.com, a Silicon Valley online financial services and e-mail payment company. One year later, X.com shareholder. Other notable investors included Google co-founders Sergey Brin and Larry Page, former eBay President Jeff Skoll, and Hyatt acquired Confinity, which operated a subsidiary called PayPal. Musk was instrumental in the development of the person-to-person payment heir Nick Pritzker. In 2009, Germany's Daimler AG, the maker of Mercedes vehicles, acquired an equity stake of almost 10 percent in Tesla platform and, seeing big market opportunity for such an online payment platform, decided to rename X.com as PayPal. Musk pocketed about $150 million in eBay shares when PayPal was acquired by eBay for $1.5 billion in eBay stock in October 2002. for a reported $50 million.2 Daimler's investment was motivated by a desire to partner with Tesla to accelerate the development of Tesla's lithium-ion battery technology and electric drive train technology and to collaborate on electric cars being developed at Mercedes. Later in In June 2002, Elon Musk with an investment of $100 million of his own money founded his third company, Space Exploration Technologies 2009, Tesla was awarded a $465 million low-interest loan by the U.S. Department of Energy to accelerate the production of affordable, fuel- (SpaceX), to develop and manufacture space launch vehicles, with a goal of revolutionizing the state of rocket technology and ultimately efficient electric vehicles: Tesla used $365 million for production engineering and assembly of its forthcoming Model S and $100 million for enabling people to live on other planets. Upon hearing of Musk's new venture into the space flight business, David Sacks, one of Musk's a powertrain manufacturing plant employing about 650 people that would supply all-electric powertrain solutions to other automakers and former colleagues at PayPal, said, "Elon thinks bigger than just about anyone else I've ever met. He sets lofty goals and sets out to achieve help accelerate the availability of relatively low-cost, mass-market electric vehicles. them with great speed." In 2011, Musk vowed to put a man on Mars in 10 years. In May 2012, a SpaceX Dragon cargo capsule powered by In June 2010, Tesla Motors became a public company, raising $226 million with an initial public offering of common stock. It was the first aSpaceX Falcon Rocket completed a near flawless test flight to and from the International Space Station: since then, under contracts with American car company to go public since Ford Motor Company in 1956. NASA, the SpaceX Dragon had delivered cargo to and from the Space Station multiple times. Going into 2018, SpaceX secured contracts of over $12 billion to conduct over 100 missions. Currently, SpaceX was working toward developing fully and rapidly reusable rockets and test Management Changes at Tesla launching its new Falcon Heavy rocket, said to be the world's most powerful rocket. The company was said to be both profitable and cash- flow positive in 2013 to 2017. Headquartered in Hawthorne, California, SpaceX had 5,000 employees and was owned by management, In August 2007, with the company plagued by delays in getting its first model-the Tesla Roadster-into production, co-founder Martin employees, and private equity firms: Elon Musk was the company's CEO and largest stockholder. Eberhard was ousted as Tesla's chief executive officer (CEO). While his successor managed to get the Tesla Roadster into production in March 2008 and begin delivering Roadsters to customers in October 2008, internal turmoil in the executive ranks prompted Elon Musk to decide it made more sense for him to take on the role as Tesla's chief executive officer-while continuing to serve as chairman of the board- because he was making all the major decisions anyway. Elon Musk Elon Musk was born in South Africa, taught himself computer programming and, at age 12. made $500 by selling the computer code for a video game he invented.3 In 1992, after spending two years at Queen's University in Ontario, Canada, Musk transferred to the University of Pennsylvania where he earned an undergraduate degree in business and a second degree in physics. During his college days, Musk spent some time thinking about two important matters that he thought merited his time and attention later in his career: one was that the world needed an environmentally clean method of transportation; the other was that it would be good if humans could colonize another planet.4 After graduating from the University of Pennsylvania, he decided to move to California and pursue a PhD in applied physics at Stanford: however, he left the program after two days to pursue his entrepreneurial aspirations instead. SCREENS 3-4 OF 37 + 156% Type here to search O 2:29 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Another of Elon Musk's business ventures was SolarCity Inc., a full-service provider of solar system design, financing, solar panel In 2019, Elon Musk's base salary as Tesla's CEO was $62,400, an amount required by California's minimum wage law; however, he was installation, and ongoing system monitoring for homeowners, municipalities, businesses (including Intel. Walmart, Walgreens, and eBay). accepting only $1 in salary. The company's Board of Directors in 2017 established an executive compensation plan for Musk tied to Tesla's universities, nonprofit organizations, and military bases. Initially. investors were generally bullish on SolarCity's future prospects, and the performance on various metrics; compensation was in the form of stock option awards subject to various vesting conditions. As of April 30. company's stock price rose from about $10.50 in late December 2012 to an all-time high of $85 in March 2013. But when the company's 2019. Musk controlled 38.6 million shares of Tesla common stock (worth some $9.2 billion): his shareholdings gave him 21.7 percent of losses continued to grow, investor sentiment cooled and SolarCity's stock price dropped to the $16 to $20 range in February 2016. While total shareholder voting power in Tesla. Solar City had installed many solar energy systems and managed more solar systems for homes than any other solar company in the United Musk's Vision and Strategy for Tesla Elon Musk's strategic vision for the automotive segment of Tesla's operations featured three States, its business model of recovering the capital and operating costs of the installed systems through leasing fees and power purchase major elements: agreements had resulted in negative cash flows and ever-larger net losses. In November 2016, to rescue SolarCity from probable bankruptcy. Tesla acquired the company for $2.6 billion (the deal was approved by an 85 percent shareholder vote): SolarCity's operations were folded 1. Bring a full-range of affordable electric-powered vehicles to market and become the world's foremost manufacturer of premium quality. into a new division named Tesla Energy. However, the business model was changed to one where customers financed their new solar power high-performance electric vehicles. installations with cash and loans, thus producing a healthier mix of upfront and recurring revenue; moreover, the costs of installing solar- powered installations were expected to decline, partly because of improvements in solar technology, greater efficiencies in manufacturing 2. Convince motor vehicle owners worldwide that electric-powered motor vehicles were an appealing alternative to gasoline-powered solar-generation systems, and cost savings achieved by operating Tesla's automotive and energy divisions as sister companies. vehicles. From 2008 to 2015, many business articles had been written about Musk's brilliant entrepreneurship in creating companies with 3. Accelerate the world's transition from carbon-producing, gasoline-powered motor vehicles to zero emission electric vehicles. revolutionary products that either spawned new industries or disruptively transformed existing industries. In a 2012 Success magazine article. In 2016, Musk's stated near-term strategic objective was for Tesla to achieve sales of about 500,000 electric vehicles annually by year-end Musk indicated that his commitments to his spacecraft, electric car, and solar panel businesses were long term and deeply felt. The author 2018, but this sales target soon was pushed out to the end of 2019 at the earliest and more probably the end of 2020, assuming sales of the quoted Musk as saying, "I never expect to sort of sell them off and do something else. I expect to be with those companies as far into the Model 3 took off as expected. In 2018. Musk envisioned that Tesla would introduce an SUV version of the Model 3 sedan (called Model Y) future as I can imagine." Musk indicated he was involved in both Tesla's motor vehicle and energy businesses "because I'm concerned about in 2019, also perhaps begin deliveries of the Tesla Semi in late 2019 to spur the switch to electric-powered vehicles in the freight the environment," while "Spacex is about trying to help us work toward extending life beyond Earth on a permanent basis and becoming a transportation industry, and then a new version of the Tesla Roadster in 2020 to 2021. His strategic intent was for Tesla to be the world's multiplanetary species." The same writer described Musk's approach to a business as one of rallying employees and investors without biggest and most highly regarded producer of electric-powered motor vehicles, dramatically increasing the share of electric vehicles on roads creating false hope." The article quoted Musk as saying: across the world and causing global use of gasoline-powered motor vehicles to fall into permanent long-term decline. You've got to communicate, particularly within the company. the true state of the company. When people really understand it's do or die but if At its core, therefore, Tesla's strategy was aimed squarely at utilizing the company's battery and electric drivetrain technology to disrupt the we work hard and pull through, there's going to be a great outcome. people will give it everything they've got. world automotive industry in ways that were sweeping and transformative. If Tesla's strategy proved to be as successful as Elon Musk Asked if he relied more on information or instinct in making key decisions, Musk said he made no bright-line distinction between the two. believed it would be, industry observers expected that Tesla's competitive position and market standing vis-a-vis the world's best-known automotive manufacturers would be vastly stronger in 2025 than it was in 2018 and 2019. Data informs the instinct. Generally, I wait until the data and my instincts are in alignment. And if either the data or my instincts are out of alignment, then I sort of keep working the issue until they are in alignment, either positive or negative. 10 Musk was widely regarded as being an inspiring and visionary entrepreneur with astronomical ambition and willingness to invest his own money in risky and highly problematic business ventures. He set stretch performance targets and high product quality standards, and he pushed hard for their achievement. He exhibited perseverance, dedication, and an exceptionally strong work ethic. He typically worked 85 to 90 hours a week. Most weeks. Musk split his time between SpaceX and Tesla. SCREENS 5-6 OF 37 + 156% Type here to search O 2:29 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Tesla's Early Sales Successes with the Model S and Model X, 2012 to 2018 Tesla's Excruciating Struggle to Boost Production Volumes of the Model 3 In 2017 and 2018 production and sales of the company's trailblazing Model S sedan (introduced in 2012) and Model X sports utility vehicle Tesla Motors began assembling the first models of its new "affordably-priced" entry-level Model 3 electric car in May 2017 and delivered the (introduced in late 2015) were proceeding largely on plan. Combined sales of these two models were almost 101,500 units in 2017 and just first units the last week of July, with a goal of gradually ramping up production to a total of 1.500 units by the end of September. The first under 100,000 units in 2018 (see ( Exhibit 1). The Model S was a fully electric, four-door, five-passenger luxury sedan with an all-glass production vehicles, delivered to employees who had placed preproduction reservations over a year earlier, were preconfigured with rear- panoramic roof, high definition backup camera, a 17-inch touchscreen that controlled most of the car's functions, keyless entry, xenon wheel drive and a long-range battery; had a range of 310 miles and 0 to 60 mph acceleration time of 5.1 seconds; and a sticker price starting headlights, dual USB ports, tire pressure monitoring, and numerous other features that were standard in most luxury vehicles. The cheapest at $44.000 with premium upgrades available for an additional $5,000. Deliveries of the standard Model 3. with a base price of $35,000, 220 Model S had a base price of $75,700 in 2018 and, when equipped with options frequently selected by customers, carried a retail sticker price miles of range, and a 0 to 60 mph acceleration time of 5.6 seconds, were expected to begin in the United States in November 2017. Dual ranging from $95,000 to $136,000. The Model X was the longest range all-electric production sport utility vehicle in the world; it could seat motor all-wheel drive configurations were scheduled to be available in early 2018. Plans called for international deliveries of the Model 3 to up to seven adults and incorporated a unique falcon wing door system for easy access to the second and third seating rows. The Model X had begin in late 2018, contingent upon regulatory approvals, starting with left-hand drive markets and followed by right-hand drive markets in 2019. an all-wheel drive dual motor system and autopilot capabilities, along with a full assortment of standard and optional features. Retail sticker prices in 2018 ranged from a base price of $80.700 to $97,000 for a well-equipped Model X to $ 140,000 for a fully loaded model. Both the Tesla unveiled six drivable prototypes of the Model 3 for public viewing and a limited number of test drives on the evening of March 31, Model S and Model X were being sold in North America, Europe, and Asia in 2017 and 2018. 2016. Buyer reaction was overwhelmingly positive. Over the next two weeks, some 350,000 individuals paid a $1,000 deposit to reserve a The Model S was the most-awarded car of 2013, including Motor Trend's 2013 Car of the Year award and Automobile magazine's 2013 Car of place in line to obtain a Model 3: reportedly, the number of reservations grew to nearly 400,000 units over the next several months. Because the Year award. The National Highway Traffic Safety Administration (NTSHA) in 2013, 2014, and 2015 awarded the Tesla Model S a 5-star of the tremendous amount of interest in the Model 3. Elon Musk announced in May 2016 that Tesla was advancing its schedule to begin producing the Model 3 from late 2017 to mid-2017 and further that it was going to accelerate its efforts to expand production capacity of the safety rating. both overall and in every subcategory (a score achieved by approximately 1 percent of all cars tested by the NHTSA). Model 3, with a goal of getting to a production run rate of 500,000 units annually by year-end 2018 instead of year-end 2020. Consumer Reports gave the Model S a score of 99 out of 100 points in 2013, 2014, and 2015, saying it was "better than anything we've ever tested." However, the Tesla Model S did not make the Consumer Reports list of the " 10 Top Picks" in 2016, 2017, and 2018, but the Model S In early August 2017, in a letter updating shareholders on the company's second-quarter 2017 results, Musk said: did earn a perfect 100 score on the 2018 road test drive. Based on our preparedness at this time, we are confident we can produce just over 1,500 [Model 3] vehicles in Q3 and achieve a run rate of 5,000 rehicles per week by the end of 2017. We also continue to plan on increasing Model 3 production to 10,000 vehicles per week at some point in The sleek styling and politically correct power source of Tesla's Model S and Model X were thought to explain why thousands of wealthy 2018.12 individuals in countries where the two models were being sold-anxious to be a part of the migration from gasoline-powered vehicles to electric-powered vehicles and to publicly display support for a cleaner environment-had become early purchasers and advocates for Tesla's But in his third-quarter 2017 update on November 1. 2017, Musk related a host of production bottlenecks and challenges that were blocking vehicles. Indeed, word-of-mouth praise among current owners and glowing articles in the media were so pervasive that Tesla had not yet the ramp-up of Model 3 production and delaying deliveries, saying, "this makes it difficult to predict exactly how long it will take for all spent any money on advertising to boost customer traffic in its showrooms. In a presentation to investors, a Tesla officer said, "Tesla owners bottlenecks to be cleared or when new ones will appear. Based on what we know now, we currently expect to achieve a production rate of are our best salespeople."11 5.000 Model 3 vehicles per week by late Q1 2018."13 However, Tesla's "production hell" with the Model 3 continued to haunt the company in early 2018. Many analysts believed Tesla's problems stemmed from having taken huge shortcuts in the parts approval process, production line validation, and full beta testing of the Model 3 in order to begin early assembly and production ramp-up. There were other reasons, including ongoing parts bottlenecks and inconsistent manufacturing quality. Production line employees interviewed by reporters indicated significant numbers of units coming off the assembly line had quality problems involving malfunctioning parts/components and/or faulty installation issues that required reworking. A big parking lot just outside the assembly plant in Fremont. California, was said to be full of Model 3s awaiting corrective attention: a few were even being junked because of the high cost of restoring them to a condition that would pass final predelivery inspection. On February 7, 2018, Musk reported: SCREENS 7-8 OF 37 + 156% Type here to search O 2:29 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) We continue to target weekly Model 3 production rates of 2.500 by the end of Q1 and 5.000 by the end of Q2. It is important to note that while . The quality of Model 3 coming out of production is at the highest level we have seen across all our products. This is reflected in the these are the levels we are focused on hitting and we have plans in place to achieve them, our prior experience on the Model 3 ramp has overwhelming delight experienced by our customers with their Model 3s. Our initial customer satisfaction score for Model 3 quality is above demonstrated the difficulty of accurately forecasting specific production rates at specific points in time. What we can say with confidence is that 93 percent, which is the highest score in Tesla's history. we are taking many actions to systematically address bottlenecks and add capacity in places like the battery module line where we have experienced constraints, and these actions should result in our production rate significantly increasing during the rest of Q1 and through Q2. . Net Model 3 reservations remained stable through Q1. The reasons for order cancellation are almost entirely due to delays in production in general and delays in availability of certain planned options, particularly dual motor AWD and the smaller battery pack. 15 Despite the delays that we experienced in our production ramp, Model 3 net reservations remained stable in Q4. In recent weeks, they have continued to grow as Model 3 has arrived in select Tesla stores and received numerous positive reviews, including Automobile magazine's 2018 While progress was finally being made in boosting Model 3 production volumes. Tesla still had to prove it could overcome three challenges Design of the Year award. 14 with the potential to imperil Musk's vision for the company: A week or so later, Tesla shut down the Model 3 assembly line for four days to address some of the problems being encountered. 1. Gasoline prices across much of the world had dropped significantly from 2015 to early 2018 and were expected by many knowledgeable Nonetheless. in early March 2018, there were reports from multiple sources that Tesla had not been able to consistently achieve a production observers to remain permanently "low" because crude oil prices worldwide were expected to stay below $80 per barrel, in part due to the run rate of 800 units per week. Musk's target of a weekly production rate of 2,500 Model 3s by the end of March proved unachievable. growing abundance of shale oil and the sharply lower costs of extracting oil from shale deposits. Affordable gasoline prices made the In addition, there were accumulating reports from the owners of Model 3s relating to touchscreen issues-one related to the audio system purchase of electric vehicles less attractive, given that (1 ) electric vehicles were higher priced than vehicles with gasoline engines, (2) volume suddenly blasting higher without the screen having been touched; another related to drivers returning to their parked Model 3 and electric vehicles so far were limited to an upper range of about 300 miles on a single battery charge, and (3) new vehicles powered by discovering the touchscreen on and the audio sound blaring; still another related to "phantom" inputs along the edges of the touchscreen gasoline engines were getting more miles per gallon (due to government-mandated mileage-efficiency requirements). when certain apps were opened. In some instances, Tesla had replaced the touchscreens; in others, it promised a software solution would 2. Tesla was facing the prospect of much more formidable competition from virtually all of the world's major motor vehicle manufacturers soon be forthcoming. A second reported problem. in which the battery capacity decreased noticeably while the car was parked in the sun on (BMW, Mercedes-Benz, Jaguar, Volkswagen-Audi, Toyota, Honda, Nissan, General Motors, and Ford) that were rushing to introduce a hot day for several hours, had been reported by a number of Model 3 owners and, to a lesser extent, by a few Model S and Model X affordable and high-end electric vehicles with features and engine configurations that would enable them to compete head-on with the owners. It appeared that battery drain problems often occurred in Model 3 vehicles experiencing touchscreen issues. A couple of Model 3 Model S, Model X, and Model 3. Several vehicle makers were also pursuing the development of electric-powered semitrucks for owners with technical backgrounds had speculated the problem related to touchscreens being mounted on a large metal pedestal such that commercial uses. large temperature differentials between a vehicle's hot interior and its cooler exterior caused the touchscreen and plastic touchpad to warp and produce other anomalies as the metal pedestal absorbed heat from inside the vehicle. In late March 2018, the cause had not been 3. Tesla had yet to prove it could boost operating efficiency and lower costs enough to be both price competitive and attractively profitable pinpointed, but the problem turned out to be related to only a few vehicles rather than faulty design that would drive up warranty costs for in producing and marketing its vehicle models. It reported both a loss from operations and a net loss during 2013-2017, despite growing Model 3s already delivered. During the last week of March, Elon Musk tweeted that he had taken over the role of supervising Model 3 its automotive sales and leasing revenues from $2.61 billion in 2013 to $9.64 billion in 2017. In February 2018, the company did say it production for the time being. expected to generate a positive quarterly operating income before the end of 2018 (but not a positive operating income for the year). The first week of April 2018. Tesla reported that it produced 34,494 vehicles in the first quarter of 2018 and delivered 29,980 vehicles, of While Tesla's ongoing operating losses and net losses were partly, or perhaps largely, due to the sizable new product development costs which 11.730 were Model S; 10,070 were Model X: and 8,180 were Model 3; as of March 31, 4,060 Model S and Model X vehicles and 2,040 associated with the Model X and Model 3 and to the required accounting treatments for both leased vehicles and Tesla's generous stock Model 3 vehicles were in transit to customers. Tesla also reported that after shifting some production resources away from Model S and compensation plan, it was nonetheless disconcerting that Tesla's operating loss of $1.63 billion in 2017 was the largest in the company's Model X production over to production and assembly of the Model 3 during the last week of March, it was able to produce 2,020 Models 3s history and its 2017 operating profit per vehicle sold was a negative $15.855.16 in the last seven days leading up to April 3. In its production and delivery announcement, the company further said: Given the progress made thus far and upcoming actions for further capacity improvement, we expect that the Model 3 production rate will climb rapidly through Q2. Tesla continues to target a production rate of approximately 5,000 units per week in about three months. Finally, we would like to share two additional points about Model 3: SCREENS 9-10 OF 37 + 156% Type here to search O 2:29 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) A possible fourth challenge seemed to be gathering steam on the Tesla message boards in the first four months of 2018. People with Model 3 reservations, because of all the production problems and delivery delays they had been hearing about, had posted concerns about taking EXHIBIT 2 Selected Financial Data for Tesla, Inc., Years Ended December 31, 2015-2018 plus Q1 of 2019 (in millions of $, delivery of the Model 3 they had ordered. In one anecdotal case, a poster told of when he went to the Tesla delivery location to take delivery except share and per share data) of a black Model 3. he could clearly see paint swirls on the hood; when told by the delivery person that the service department had done the Years Ended December 31 best job it could to buff out the swirls and that the car would be sold "as is," the poster refused delivery. But after further conversation with the delivery person the poster said he then agreed to pay an extra $1,000 for a red Model 3 after being promised by the delivery person it Quarter 1 would be ready for pickup in one week-after 10 days, the poster said he had received no notification to come pick up the red Model 3. There 2019 2018 2017 2016 2015 were also message board posts from some Model S and Model X owners about the repair problems they were experiencing with their vehicles. There was one extreme example where an unhappy Model S owner reported having to take his vehicle to the Tesla service center for Income Statement Data: repairs six times in the past five months. In late March 2018 Tesla announced it was recalling about 123,000 Model S sedans globally after Revenues: discovering that certain corroding bolts in cold weather climates could lead to a power-steering failure. Automotive sales $3.508.7 17,631.5 $8,534.8 $5,589.0 $3,431.6 When Tesla announced its financial and operating results for the first quarter of 2018 ending March 31, Elon Musk said that after numerous adjustments in assembly methods and correcting problems with faulty and improperly designed parts, Tesla was now able to sustain a Automotive leasing 215.1 883.5 1.106.5 761.8 309.4 production rate of 3,000 Model 3s per week. He also said that continued refinements of the assembly process and improved operational Total automotive revenues 3,723.9 18,515.0 9.641.3 6,350.8 3,741.0 uptime of the associated machinery should lead to a production rate of "well over 5.000" vehicles per week by the end of June or beginning of July. Musk admitted that he had been wrong in mandating use of so many robots along the assembly line, and that now the assembly line Energy generation and storage 324.7 1.555.2 1.116.3 181.4 14.5 had been and was still being greatly simplified, with more use being made of semi-automated and manual assembly to perform certain tasks Services and other 492.9 1.391.00 468.0 until the company had enough time to perfect the use of robots and enable full automation to resume. Musk confidently predicted that the 1.001.2 290.6 Model 3 would become the best-selling medium-sized premium sedan in the United States before year-end and that if Tesla executed Total revenues 4.541.5 21,461.3 11,758.8 7.000.1 4.046.0 according to plan the company would achieve positive cash flows and positive net income (excluding noncash stock-based compensation) in Cost of revenues both the third and fourth quarters of 2018.17 During the May 2. 2018, conference call with analysts to discuss Tesla's Q1 2018 financial results. Musk expressed his appreciation to the Chinese government for its announcement that foreign companies would henceforth be Automotive sales 2,856.2 13,685.6 5,724.5 4.268.1 2.639.9 allowed to have 100 percent ownership of manufacturing facilities in China and said Tesla could have a Gigafactory capable of vehicle Automotive leasing 117.1 488.4 708.2 482.0 183.4 production in China "not later than the fourth quarter" of 2018.18 Total automotive cost of revenues 2,973.3 14,174.0 7.432.7 4.750.1 2.823.3 Exhibit 2 presents selected financial statement data for Tesla for 2015 through the first quarter of 2019. Energy generation and storage 316.9 1.364.9 874.5 178.3 12.3 Services and other 685.5 1.880.4 1.229.0 472.5 286.9 Total cost of revenues 3.975.7 17.419.2 9.536.3 5.400.9 3.122.5 Gross profit (loss) 565.7 4,042.0 2,222. 1,599.3 923.5 SCREENS 11-12 OF 37 + 156% Type here to search O 2:30 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) B - X Operating expenses: Selected Balance Sheet Data: Research and development 340.2 1.460.4 1,378.1 834.4 717.9 Cash and cash equivalents $2,198.2 $ 3,685.6 $ 3,367.9 $1,196,908 $1 Selling, general and administrative 703.9 2.834.5 2.476.5 1.432.2 922.2 Inventory 3,836.8 3.113.4 2.263.5 2.067.5 1.277.8 Restructuring and other 43.5 Total current assets 7.677. 8.306.3 6.570.5 6.259.8 2.791.4 Total operating expenses 1,087.6 4,430.1 3.854.6 2.266.6 1,640.1 Property, plant, and equipment, net 9.850.9 11,330.1 10,027.5 5.983.0 3.403.3 Loss from operations (521.8) (388.1) (1,632.1) (667.3) (716.6) Total assets 28,912.5 29,739.6 28,655.4 22,644.1 8,092. Interest income 8.8 24.5 19.7 1.5 Total current liabilities 9.242.8 9.992.1 7.674.7 5.827.0 2.816.3 Interest expense (157.5) (663.1) 471.3) (198.8) (118.9) Long-term debt and capital leases, net of current portion 9,7887.9 9.403.7 9.418.3 5,860.0 2.040.4 Other income (expense), net 25.7 21.9 (125.4) 111.3 (41.7 Total stockholders' equity 4,605.6 4,923.2 4,237.2 4,752.9 1,088.9 Loss before income taxes (644.8) (1,004.7) (2,209.0) (875,624) (875.6) Selected Cash Flow Data: Provision for income taxes 22.9 57.8 31.5 13.039 13.3 Cash flows used in operating activities $ (639.6) $(1,062.6) $(2,240.6) $ (773.0) $ (888.7) Net loss $ (667.6) $(1,062.6) $(2,240.6) $ (773.0) $ (888.7) Proceeds from issuance of common stock in public offerings 6.176.27 400.2 1,701.7 730.0 Net loss attributable to noncontrolling interests and subsidiaries (34.5) (86.5) (279.2) (98.1) Purchases of property and equipment excluding capital leases (279.9) (2,100.78) (3.414.8) (1.280.8) (1.634.9 Net loss attributable to common shareholders $ (702.1) (976.1) $(1,961.4) (674.9) $ (888.7) Net cash used in investing activities (305.8) (2,337.4) (4,419.0) (1,416.4) (1,673.6) Net cash provided by financing activities (653.0) 573.8 4.414.9 3,744.0 1,523.5 Net loss per share of common stock, basic and diluted $(4.10) $(5.72) $(11.83) $(4.68) $(6.93) Source: Company 10-K reports for 2015 and 2018: Company 10Q Report for period ended March 31, 2019. Weighted average shares used in computing net loss per share of common stock, basic and 173.0 170.5 165.8 144.2 128.2 diluted SCREENS 13-14 OF 37 + 156% 2:30 AM Type here to search O ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Tesla in 2018-2019 Tesla ended Q1 2019 with $2.2 billion in cash and cash equivalents. down from $3.7 billion on December 31. 2018: this was due to a $920 million bond repayment and increases in the number of vehicles in transit. Executive management expected that the company's capital Following the acquisition of Solar City in late 2016, Tesla described its business in the following way: expenditures in 2019 would be about $2.0 to $2.5 billion. The new Gigafactory in Shanghai. China, was being almost fully funded with local We design, develop, manufacture and sell high-performance fully electric vehicles, and energy generation and storage systems, and also install and debt: as of March 31. 2019, a $522 million credit line had been secured with local banks. In May 2019. Tesla announced offerings of $650 maintain such systems and sell solar electricity. We are the world's only vertically integrated sustainable energy company, offering end-to-end million of common stock and $1.350 million in convertible senior notes due in 2024: underwriters were granted a 30-day option to purchase clean energy products, including generation, storage and consumption. We have established and continue to grow a global network of stores. up to an additional 15 percent of each offering. Elon Musk participated by purchasing $10 million of common stock. Aggregate gross vehicle service centers and Supercharger stations to accelerate the widespread adoption of our products, and we continue to develop self- driving capability in order to improve vehicle safety. Our sustainable energy products, engineering expertise, intense focus to accelerate the proceeds of the offering. given exercise of the 30-day option, were approximately $2.3 billion before discounts and expenses. world's transition to sustainable energy, and b We currently produce and sell three fully electric vehicles, the Model S sedan, the Model X sport utility vehicle ("SUV") and the Model 3 sedan. . Tesla's Strategy to Become the World's Biggest and Most Highly Regarded . We also intend to bring additional vehicles to market in the future, including trucks and an all-new sports car. . . . We sell our vehicles through our own sales and service network which we are continuing to grow globally. The benefits we receive from distribution ownership enable us to Producer of Electric Vehicles improve the overall customer experience, the speed of product development, and the capital efficiency of our business. We are also continuing to build our network of Superchargers and Destination Chargers in North America. Europe. and Asia to provide fast charging that enables In 2019, Tesla's strategy was focused on continuing to gear up production of the Model 3, continuing the development of the new Model Y convenient long distance travel. SUV and the Tesla Semi, continuing to add production capabilities at Gigafactory 1 near Reno, Nevada, getting the new Gigafactory in . . . In addition, we are leveraging our technological expertise in batteries, power electronics, and integrated systems to manufacture and sell China ready to produce Model 3 vehicles in late 2019, and adding service centers and Supercharger stations in the United States, much of energy storage products. In late 2016, we began production and deliveries of our latest generation energy storage products, Powerwall 2 and Europe, China, and Australia. At the Tesla Energy division, efforts were under way to (1) standardize the product offering, (2) simplify the Powerpack 2. Powerwall 2 is a home battery.... Powerpack 2 is an energy storage system for commercial, industrial, and utility applications. customer buying experience, (3) concentrate sales and marketing efforts on the markets with the strongest economics, and (4) implement a Finally, we sell and lease solar systems (with or without accompanying energy storage systems) to residential and commercial customers and sell new pricing and product deployment strategy aimed at combatting mounting competition from established companies with a similar renewable energy to residential and commercial customers at prices that are typically below utility rates. Since 2006, we have installed solar portfolio of energy storage products and more competitively priced solar products. Tesla fell far short of its goal of tripling sales of energy energy systems for hundreds of thousands of customers. Our long-term lease and power purchase agreements with our customers generate storage products in 2018. recurring payments and create a portfolio of high-quality receivables that we leverage to further reduce the cost of making the switch to solar energy. The electricity produced by our solar installations represents a very small fraction of total U.S. electricity generation. With tens of millions of single-family homes and businesses in our primary service territories, and many more in other locations, we have a large opportunity to expand and grow this business. [ Revenues and cost of goods sold from the energy generation and storage activities of SolarCity/Tesla Energy Product Line Strategy are shown in C Exhibit 2.] A key element of Tesla's long-term strategy was to offer vehicle buyers a full line of electric vehicle options. So far Tesla had introduced four We manufacture our vehicle products primarily at our facilities in Fremont, California, Lathrop, California, Tilburg, Netherlands, and at our models-the Tesla Roadster, Model S. Model X. and Model 3. Aggressive efforts were under way to get the Model Y into the marketplace in Gigafactory I near Reno, Nevada. We manufacture our energy storage products at Gigafactory I and our solar products at our factories in late 2019-2020 along with the Tesla Semi truck. These were scheduled to be followed by a new Roadster 2 model and a pickup truck. Fremont, California, and Buffalo, New York (Gigafactory 2).20 During 2014-2017. Tesla raised billions of dollars via the sale of senior notes convertible into common stock, other types of long-term debt, and issues of new common stock to provide funding for research and development (R&D), the development of new models, expanded production capabilities, an ever-growing network of recharging stations, and opening retail showrooms and Tesla service centers. Tesla's long- term debt and contractual capital lease obligations grew from $600 million at year-end 2013 to $9.8 billion as of March 31, 2019; and the number of shares of common stock outstanding rose from 119 million to nearly 173 million during the same period. In recent years, Tesla had burned through cash at a torrid pace because of the heavy expenses it was incurring for design and engineering, gearing up to produce certain parts and component systems internally, constructing new facilities, equipping vehicle assembly lines with robotics technology, tools, and other machinery, and boosting its employee count from almost 6,000 employees at year-end 2013 to over 48,800 at year-end 2018. SCREENS 15-16 OF 37 + 156% Type here to search O 2:30 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) Tesla's First Vehicle-The Tesla Roadster Popular options included enhanced autopilot software ($5,000); full self-driving capability-subject to further software validation and regulatory approval ($3,000); and third-row, rear-facing seating ($4,000). From time to time, Tesla sent software updates to all Model S Following Tesla's initial funding in 2004, Musk took an active role within the company. Although he was not involved in day-to-day business vehicles previously delivered to customers that included new and updated features. In 2018-2019, all Model S vehicles had a standard operations, he nonetheless exerted strong influence in the design of the Tesla Roadster, a two-seat convertible that could accelerate from 0 to software feature called "Range Assurance," an always-running application within the car's navigation system that kept tabs on the vehicle's 60 miles per hour in as little as 3.7 seconds, had a maximum speed of about 120 miles per hour, could travel about 245 miles on a single battery charge-level and the locations of Tesla Supercharging stations and parking-spot chargers in the vicinity. When the vehicle's battery charge, and had a base price of $ 109,000. Musk insisted from the beginning that the Roadster have a lightweight, high-strength carbon fiber began running low, an alert appeared on the navigation screen, along with a list of nearby Tesla Supercharger stations and public charging body, and he influenced the design of components of the Roadster ranging from the power electronics module to the headlamps and other facilities: a second warning appeared when the vehicle was about to go beyond the radius of nearby chargers without enough juice to get to styling features. 21 Prototypes of the Roadster were introduced to the public in July 2006. The first "Signature One Hundred" set of fully the next facility, at which point drivers were directed to the nearest charge point. There was also a Trip Planner feature that enabled drivers equipped Roadsters sold out in less than three weeks; the second hundred sold out by October 2007. General production began in March to plan long-distance trips based on the best locations for recharging both en route and at the destination: during travel, the software was 2008. New models of the Roadster were introduced in July 2009 (including the Roadster Sport with a base price of $128,500) and in July programmed to pull in new data about every 30 seconds, updating to show which charging facilities had vacancies or were full. Autopilot 2010. Sales of Roadster models to countries in Europe and Asia began in 2010. From 2008 through 2012, Tesla sold more than 2.450 software features were updated and upgraded as fast as they were developed and tested. Roadsters in 31 countries. 22 Sales of Roadster models ended in December 2012 so that the company could concentrate exclusively on In the United States, customers who purchased a Model S (or any other Tesla model) before 2019 were eligible for a federal tax credit of up producing and marketing the Model S. However, Tesla announced in early 2015 that Roadster owners would be able to obtain a Roadster 3.0 to $7,500. A number of states also offered rebates on electric vehicle purchases, with states like California and New York offering rebates as package that enabled a 40 to 50 percent improvement in driving range to as much as 400 miles on a single charge; management indicated high as $7,500. Customers who leased a Model S were not entitled to rebates. Legislation authorizing the federal tax credit called for the tax additional updates for Roadsters would be forthcoming. In 2017, Tesla announced it would reintroduce a new version of the Roadster in credits on a manufacturer's electric vehicles to expire once the manufacturer's cumulative sales of electric vehicles reached 200,000 units. 2020 (after it began deliveries of the Tesla Semi truck and Model Y). Bills had been introduced in Congress to extend the credits past a cumulative sales volume of 200,000 units, but none of these had passed as of June 3, 2019. Tesla's Second Vehicle-The Model S Customer deliveries of Tesla's second vehicle-the sleek, eye-catching Model S sedan-began in July 2012. Tesla introduced several new Tesla's Third Vehicle-The Model X Crossover SUV options for the Model S in 2013, including a subzero weather package, parking sensors, upgraded leather interior, several new wheel options, To reduce the development costs of the Model X. Tesla had designed the Model X so that it could share about 60 percent of the Model S and a yacht-style center console. Xenon headlights and a high-definition backup camera were made standard equipment on all Model S cars. platform. The Model X had seating for seven adults, dual electric motors that powered an all-wheel drive system, and a driving range of In 2014 an all-wheel drive powertrain was introduced to provide buyers with four powertrain options. The Model S powertrain options were about 260 miles per charge. The Model X's distinctive "falcon-wing doors" provided easy access to the second and third seating rows, further modified several times. In May 2019, the Model S was being offered with two powertrain options: resulting in a profile that resembled a sedan more than an SUV. The three drive train options for the Model X in 2018 were the same as for . 100D-all-wheel drive, 100-kWh battery pack, 335-mile driving range, 0 to 60 mph in 4.1 seconds, with a standard price of $94,000 the Model S, but the driving ranges and acceleration times for the Model X were different from those of the Model S. In 2018, the standard (which included Smart Air Suspension) price for the Model X with a 75D drive train was $79,500; the standard price for a 100D Model X was $96,000 (which included Smart Air Suspension); and the standard price for a P100D Model X was $140,000 (which included the best interior and other premium upgrades). PIOOD -maximum performance all-wheel drive with dual front and rear motors (mounted on the front and rear axles), 100-kWh battery The Model X was the first SUV ever to achieve a 5-star safety rating in every category and subcategory; it had both the lowest probability of pack, 315-mile driving range, 0 to 60 mph in 2.5 seconds, with a standard price of $135,000 (which included the best interior and other occupant injury and a rollover risk half that of any SUV on the road. Over-the-Internet software updates were standard. premium upgrades) SCREENS 17-18 OF 37 + 156% Type here to search O 2:30 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) B - X Tesla's Fourth Vehicle-The Model 3 Tesla's Model Y Crossover SUV The idea behind the Model 3 was to incorporate all the company had learned from the development and production of the Roadster, Model In 2017, Elon Musk announced that Tesla had launched plans for the development and production of an all-electric crossover SUV that S, and Model X to create the world's first mass-market electric vehicle priced on par with its gasoline-powered equivalents. The Model 3 was would be built on the same platform as the Model 3. The Model Y SUV was to be a smaller version of the Model X SUV and carry price attractively styled, with seating for five adults, a driving range of 210 to 310 miles depending on drive train selection, and 0 to 60 mph acceleration capability of less than six seconds. While the stated base price was $35,000, the range of available upgrades and options could tags comparable to the Model 3. In May 2018, while Tesla was struggling with all of its Model 3 production problems, Musk said he was up the price to $55,000 or more. The average selling price of the Model 3 in 2018 exceeded $45,000 and as of June 2019 Tesla had produced planning for the production of the Model Y to be a "manufacturing revolution," with a simplified manufacturing process and greater use of very few of the $35,000 base-price Model 3 versions (since it was far more profitable to sell more fully equipped Model 3s). robots.25 Tesla unveiled a prototype of its Model Y SUV in March 2019 and announced a target volume production date of late 2020 for North America and early 2021 for beginning deliveries to Europe and China. Elon Musk in May 2019 said that Tesla's current "default plan" Going into 2018, at least 300,000 people had paid $1.000 to reserve a Model 3 and were waiting in line for delivery. From the outset, the was to produce the Model Y SUV at the Tesla Factory in Fremont, with a target volume production date of late 2020 for North America and Model 3 had been designed to enable efficient, high-volume production. However, the Model 3 posed a much tougher production cost early 2021 for deliveries to Europe and China. Industry observers speculated that Tesla would show prototypes of the Model Y in the second challenge than Tesla's three previous models, all of which had prices in the $80,000 to $130,000 range. The Model 3's profitability hinged on half of 2018, after hearing Musk say in May 2018 that the company would announce no later than the fourth quarter of 2018 where a being able to drive production costs per unit down more than 50 percent below what had been achieved with prior models. Of particular production facility for the Model Y SUV would be located. Because Musk was aiming for production of one million Model Y's annually, concern was the lithium-ion battery pack. the single biggest cost component in the Model S and Model X. which had an estimated cost of industry observers speculated that Tesla would need to establish a second manufacturing facility in the United States and that Tesla might $209 per kilowatt-hour as of December 2017.23 Part of the solution was equipping the Model 3 with less powerful electric motors, but a host purchase an existing plant from an automaker, since sedan production in the United States was dropping rapidly due to an accelerating shift of other cost-saving efficiencies had to be achieved as well for Tesla to make a profit on Model 3s equipped with minimal options. in buyer preferences away from sedans and toward SUVs and light trucks. Ford Motor had announced it would cease production of four of One factor likely to prove problematic for many prospective Model 3 buyers in the United States in 2019 (as well as for the buyers of Model its slow-selling traditional passenger cars (Taurus, Fusion, Focus, and Fiesta) by 2020; General Motors was expected to cease production of its Chevrolet Cruze compact and possibly its Chevrolet Sonic and Impala sedans at the end of their current product cycles. Fiat Chrysler S and Model X) was a provision in the federal legislation stating that once the cumulative sales volume of a manufacturer's zero emission had already killed its Dodge Dart and Chrysler 200 sedan models. vehicles in the United States reached 200.000 vehicles, the size of the $7.500 federal tax credit entered a one-year phase-out period where buyers of qualifying vehicles were "eligible for 50 percent of the credit if acquired in the first two quarters of the phase-out period and 25 The 300-mile range version of the Model Y was scheduled to be priced at $48,000. roughly $20,000 less than other all-electric SUVs. Plans percent of the credit if acquired in the third or fourth quarter of the phase-out period."24 Purchasers of that manufacturer's vehicles were called for it to have well-appointed standard equipment, superior acceleration and handling, a roomy interior, and an assortment of optional not eligible for any federal tax credit after the phase-out period. Tesla's cumulative sales in the United States would almost certainly exceed extras. Because the Model Y was expected to appeal to a large market segment, Elon Musk expected that the Model Y would ultimately have higher annual sales than Model S, Model X, and Model 3 combined. 200,000 vehicles sometime in 2018 (probably sometime before July 1), meaning that a hefty percentage of people with Model 3 reservations would qualify for only some or none of the $7.500 tax credit. Buyers who leased a Tesla were not eligible for the tax credit (the credit went to the company offering the lease; the tax credits were also based on the size of the battery). Some states also offered tax credits for the purchases of plug-in electric vehicles. There were also a variety of other tax credits offered by states. The governments of China, Japan, Norway. United Kingdom, and several other European countries offered tax incentives for electric vehicle purchases as well. In 2018, Canada discontinued the use of incentives for electric vehicles with a manufacturer's suggested list price of price greater than C$75,000 (US$58,500) and Norway had phased out tax credits as well. SCREENS 19-20 OF 37 + 156% Type here to search O N 2:30 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) The Tesla Semi Truck Distribution Strategy: A Company-Owned and -Operated Network of Retail Mention was made of a semi truck in Tesla's 2016 master plan. But behind the scenes Tesla had moved swiftly to come up with not only a design but also prototypes. The Semi was unveiled with much fanfare at a press conference on November 16, 2017. The company described Stores and Service Centers the Semi as a Class 8 semi-trailer truck prototype that would be powered by four electric motors of the type used in the Model 3; have Tesla Tesla sold its vehicles directly to buyers and also provided them with after-sale service through a network of company-owned sales galleries Autopilot, which permitted semi-autonomous driving, as standard equipment; and have a driving range of up to a range of 500 miles (805 and service centers. This contrasted sharply with the strategy of rival motor vehicle manufacturers, all of whom sold vehicles and km) on a full charge. Elon Musk said the 500-mile version, equipped with Tesla's latest battery design, would be able to run for 400 miles replacement parts at wholesale prices to their networks of franchised dealerships that in turn handled retail sales, maintenance and service, (640 km) after an 80 percent charge in 30 minutes using a solar-powered Tesla Megacharger charging station. He also said the Semi would and warranty repairs. Management believed that integrating forward into the business of traditional automobile dealers and operating its be able to accelerate from 0 to 60 mph in 5 seconds unloaded and in 20 seconds fully loaded. Tesla expected to offer a warranty for a million own retail sales and service network had three important advantages: miles and said maintenance would be simpler than for a diesel truck. A week later, Musk said that the regular production versions for the 300-mile range version of the Semi would be priced at $150,000 and the 500-mile range version would be priced at $180,000; the company 1. The ability to create and control its own version of a compelling buying customer experience, one that was differentiated from the buying also said it planned to offer a Founder's Series Semi at $200,000. Scores of companies, including Walmart, United Parcel Service, Anheuser- experience consumers had with sales and service locations of franchised automobile dealers. Having customers deal directly with Tesla- Busch, J.B. Hunt Trucking Co, and PepsiCo, immediately lined up to place pre-orders for 5 to 150 Semis (at an initial reservation price of employed sales and service personnel enabled Tesla to (a) engage and inform potential customers about electric vehicles in general and $5,000, which was quickly raised to $20,000 per reservation) so they could conduct tests of how well the Semi would perform in their the advantages of owning a Tesla in particular and (b) build a more personal relationship with customers and, hopefully, instill a lasting operations. In March 2018, Tesla began testing the Semi with real cargo, hauling battery packs from Gigafactory I in Nevada to the Tesla and favorable impression of Tesla Motors, its mission, and the caliber and performance of its vehicles. Factory in Fremont, California. Pictures of the Semi being loaded with cargo at the Nevada Gigafactory and traveling on the highways were immediately publicized in the media and posted on the Internet and social media. Production of the Semi was originally scheduled to begin 2. The ability to achieve greater operating economies in performing sales and service activities. Management believed that a company-operated in 2019 but it appeared the schedule would likely be pushed back until 2020. sales and service network offered substantial opportunities to better control inventory costs of both vehicles and replacement parts. manage warranty service and pricing, maintain and strengthen the Tesla brand, and obtain rapid customer feedback In Elon Musk's Q1 2018 Update Letter to Shareholders on May 2. 2018, no mention was made of the Tesla Semi; however, in a later conference call with Wall Street analysts that same day. Musk did say the company had about 2,000 reservations for the Semi. Observers 3. The opportunity to capture the sales and service revenues of traditional automobile dealerships. Rival motor vehicle manufacturers sold speculated that near-term plans for the Semi had moved to the back burner temporarily due to the company's decision to accelerate vehicles and replacement parts at wholesale prices to their networks of franchised dealerships that in turn handled retail sales, production of the Model Y and Tesla's lack of capital to fund further development and build a new production facility for the Semi. maintenance and service, and warranty repairs. But when Tesla buyers purchased a vehicle at a Tesla-owned sales gallery, Tesla captured the full retail sales price, roughly 10 percent greater than the wholesale price realized by vehicle manufacturers selling through franchised The Tesla Pickup Truck dealers. And, by operating its own service centers, it captured service revenues not available to vehicle manufacturers who relied upon their franchised dealers to provide needed maintenance and repairs. Furthermore, Tesla management believed that company-owned While Elon Musk began talking about Tesla making an all-electric pickup truck (and an all-electric cargo van on the same chassis) in 2016, service centers avoided the conflict of interest between vehicle manufacturers and their franchised dealers where the sale of warranty the company was still in the early stages of designing the vehicle and settling on its features as of June 2019. Elon Musk confirmed in a parts and repairs by a dealer were a key source of revenue and profit for the dealer but where warranty-related costs were typically a podcast in early June that Tesla wanted to keep the starting price below $50,000 and make sure the truck was highly functional from a load- substantial expense for the vehicle manufacturer. carrying standpoint, saying: It's going to be a truck that is more capable than other trucks. The goal is to be a better truck than a [ Ford] F-150 in terms of truck-like Tesla Sales Galleries and Showrooms functionality and be a better sports car than a standard [Porsche] 911. That's the aspiration."26 Going into 2019, all of Tesla's sales galleries and showrooms were in or near major metropolitan areas; some were in prominent regional Musk went on to say that the truck's appearance would be pretty sci-fi and not be for everyone. Further, buyers of the truck would have a shopping malls and others were on highly visible sites along busy thoroughfares. Most sales locations had only several vehicles in stock that range of optional extras that could push the price up close to $70,000 (on a par with current roomy, luxurious pickups with powerful were available for immediate sale. The vast majority of Tesla buyers, however, preferred to customize their vehicle by placing an order via the engines). He indicated the truck would be unveiled in late 2019. Internet, either while in a sales gallery or at home. SCREENS 21-22 OF 37 + 156% Type here to search O 2:30 AM ENG 5/6/2021FILE TOOLS VIEW 6401819_1_writing-case--4 - Word (Product Activation Failed) In years past, Tesla had aggressively expanded its network of sales galleries and service centers to broaden its geographical presence and to Tesla Service Centers provide better maintenance and repair service in areas with a high concentration of Tesla owners. In 2013, Tesla began combining its sales and service activities at a single location (rather than having separate locations, as earlier had been the case); experience indicated that Tesla Roadster owners could upload data from their vehicle and send it to a service center on a memory card; all other Tesla owners had an combination sales and service locations were more cost efficient and facilitated faster expansion of the company's retail footprint. At the end on-board system that could communicate directly with a service center, allowing service technicians to diagnose and remedy many problems of 2018. Tesla had over 350 sales and service locations around the world. Tesla's goal was to have sufficient service locations to ensure that before ever looking at the vehicle. When maintenance or service was required, a customer could schedule service by contacting a Tesla after-sale services were available to owners when and where needed. service center. Some service locations offered valet service, where the owner's car was picked up, replaced with a well-equipped loaner car. and then returned when the service