Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Files > 3:45 AM 14% O This account does not allow editing on your device. For an account... more Sign in Question 1: Recording

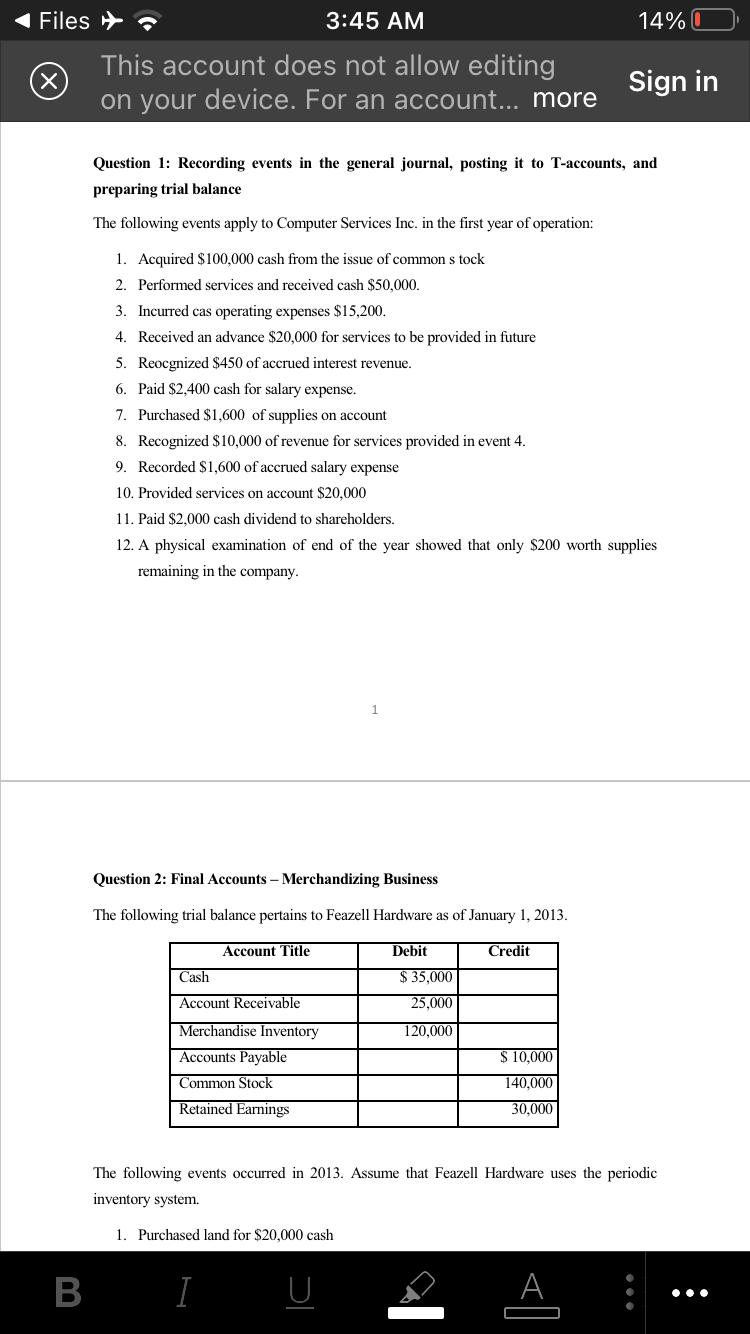

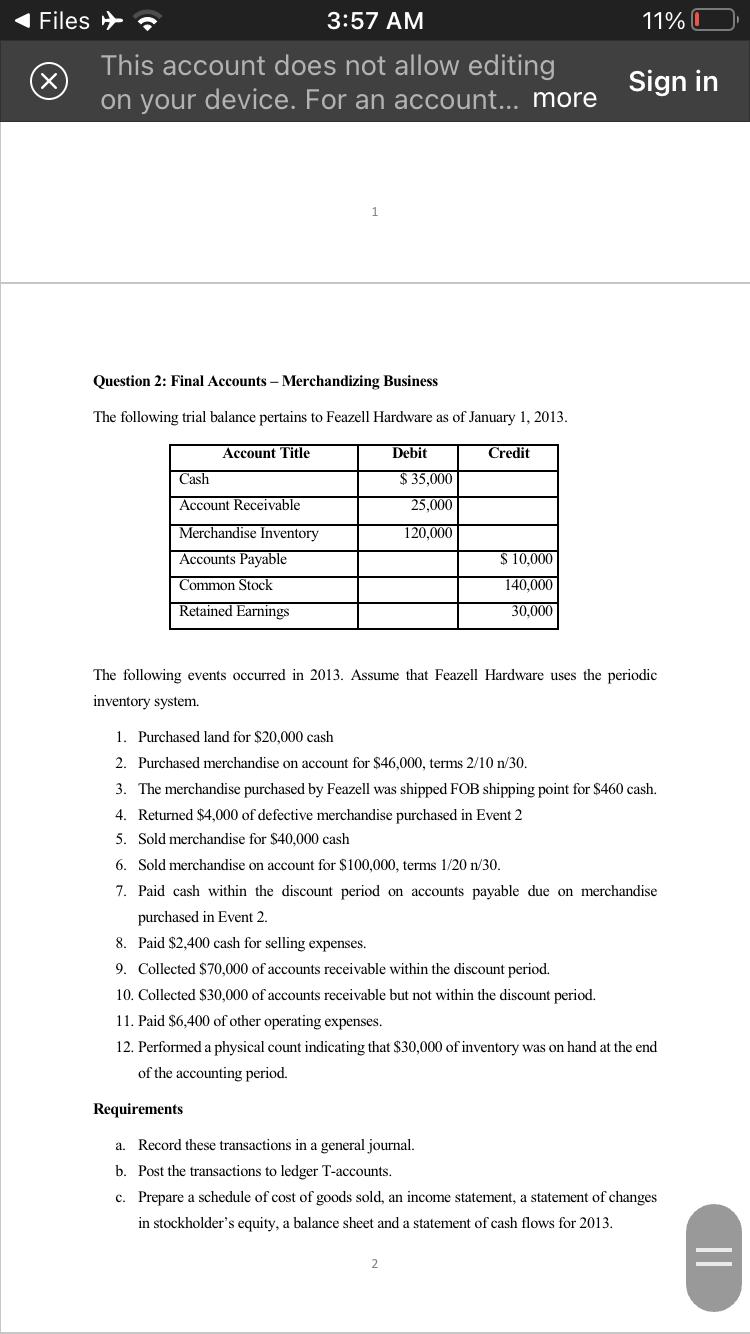

Files > 3:45 AM 14% O This account does not allow editing on your device. For an account... more Sign in Question 1: Recording events in the general journal, posting it to T-accounts, and preparing trial balance The following events apply to Computer Services Inc. in the first year of operation: 1. Acquired $100,000 cash from the issue of commons tock 2. Performed services and received cash $50,000. 3. Incurred cas operating expenses $15,200. 4. Received an advance $20,000 for services to be provided in future 5. Reocgnized $450 of accrued interest revenue. 6. Paid $2,400 cash for salary expense. 7. Purchased $1,600 of supplies on account 8. Recognized $10,000 of revenue for services provided in event 4. 9. Recorded $1,600 of accrued salary expense 10. Provided services on account $20,000 11. Paid $2,000 cash dividend to shareholders. 12. A physical examination of end of the year showed that only $200 worth supplies remaining in the company. 1 Question 2: Final Accounts Merchandizing Business The following trial balance pertains to Feazell Hardware as of January 1, 2013. Account Title Debit Credit Cash $ 35,000 Account Receivable 25,000 Merchandise Inventory 120,000 Accounts Payable S 10.000 Common Stock 140.000 Retained Earnings 30,000 The following events occurred in 2013. Assume that Feazell Hardware uses the periodic inventory system. 1. Purchased land for $20,000 cash B I .. Files > 3:57 AM 11% O This account does not allow editing on your device. For an account... more Sign in 1 Question 2: Final Accounts Merchandizing Business The following trial balance pertains to Feazell Hardware as of January 1, 2013. Account Title Debit Credit Cash $ 35,000 Account Receivable 25,000 Merchandise Inventory 120.000 Accounts Payable $ 10,000 Common Stock 140.000 Retained Earnings 30,000 The following events occurred in 2013. Assume that Feazell Hardware uses the periodic inventory system. 1. Purchased land for $20,000 cash 2. Purchased merchandise on account for $46,000, terms 2/10 n/30. 3. The merchandise purchased by Feazell was shipped FOB shipping point for $460 cash. 4. Returned $4,000 of defective merchandise purchased in Event 2 5. Sold merchandise for $40,000 cash 6. Sold merchandise on account for $100,000, terms 1/20 n/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid $2,400 cash for selling expenses. 9. Collected $70,000 of accounts receivable within the discount period. 10. Collected $30,000 of accounts receivable but not within the discount period. 11. Paid $6,400 of other operating expenses. 12. Performed a physical count indicating that $30,000 of inventory was on hand at the end of the accounting period. Requirements a. Record these transactions in a general journal. b. Post the transactions to ledger T-accounts. c. Prepare a schedule of cost of goods sold, an income statement, a statement of changes in stockholder's equity, a balance sheet and a statement of cash flows for 2013. ||

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries DEBIT CREDIT Cash 100000 Common stock 100000 To record cash received on issue of common stock Cash 50000 Services revenue 50000 To record revenue received for services offered Operatin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started