Answered step by step

Verified Expert Solution

Question

1 Approved Answer

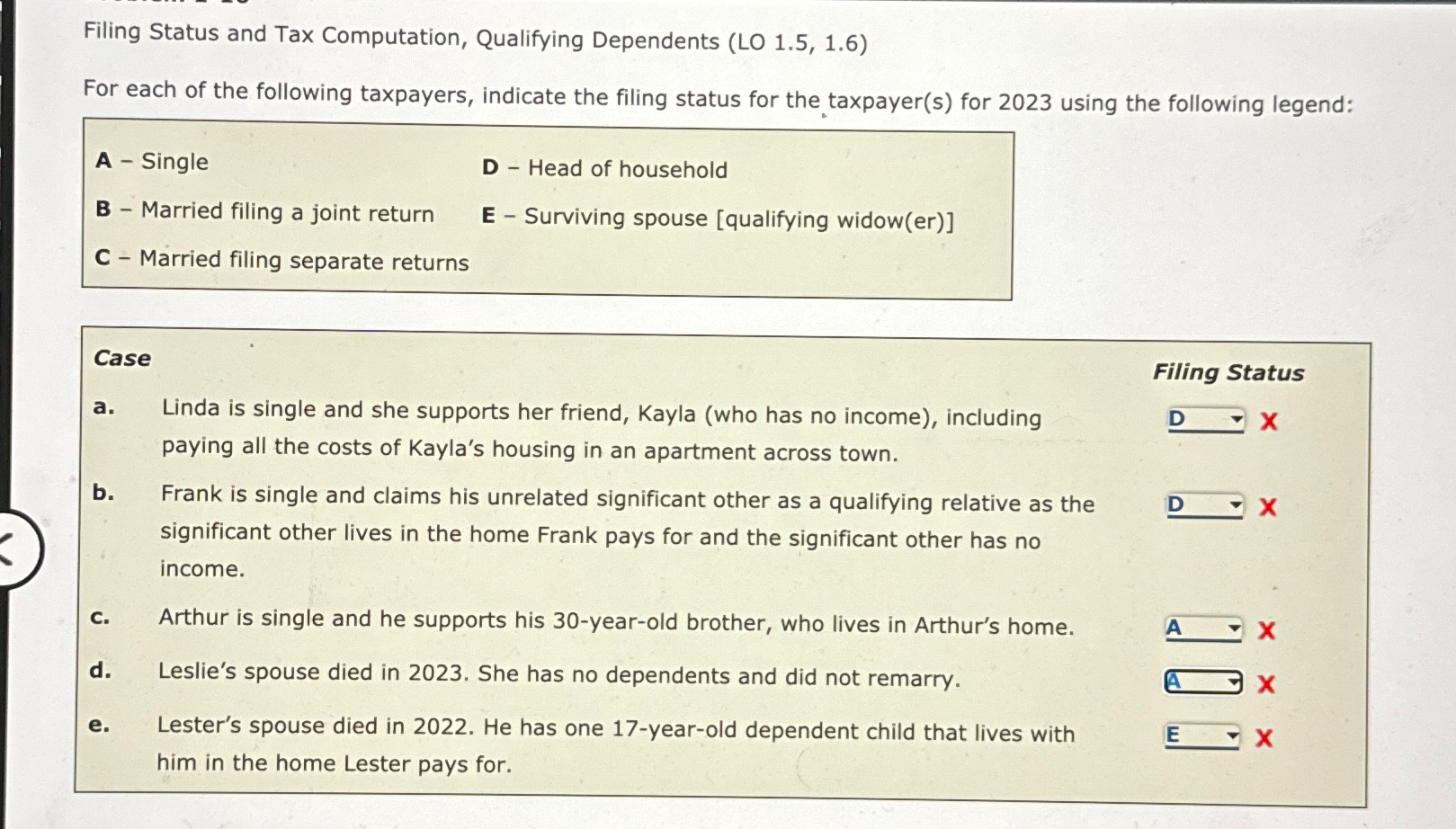

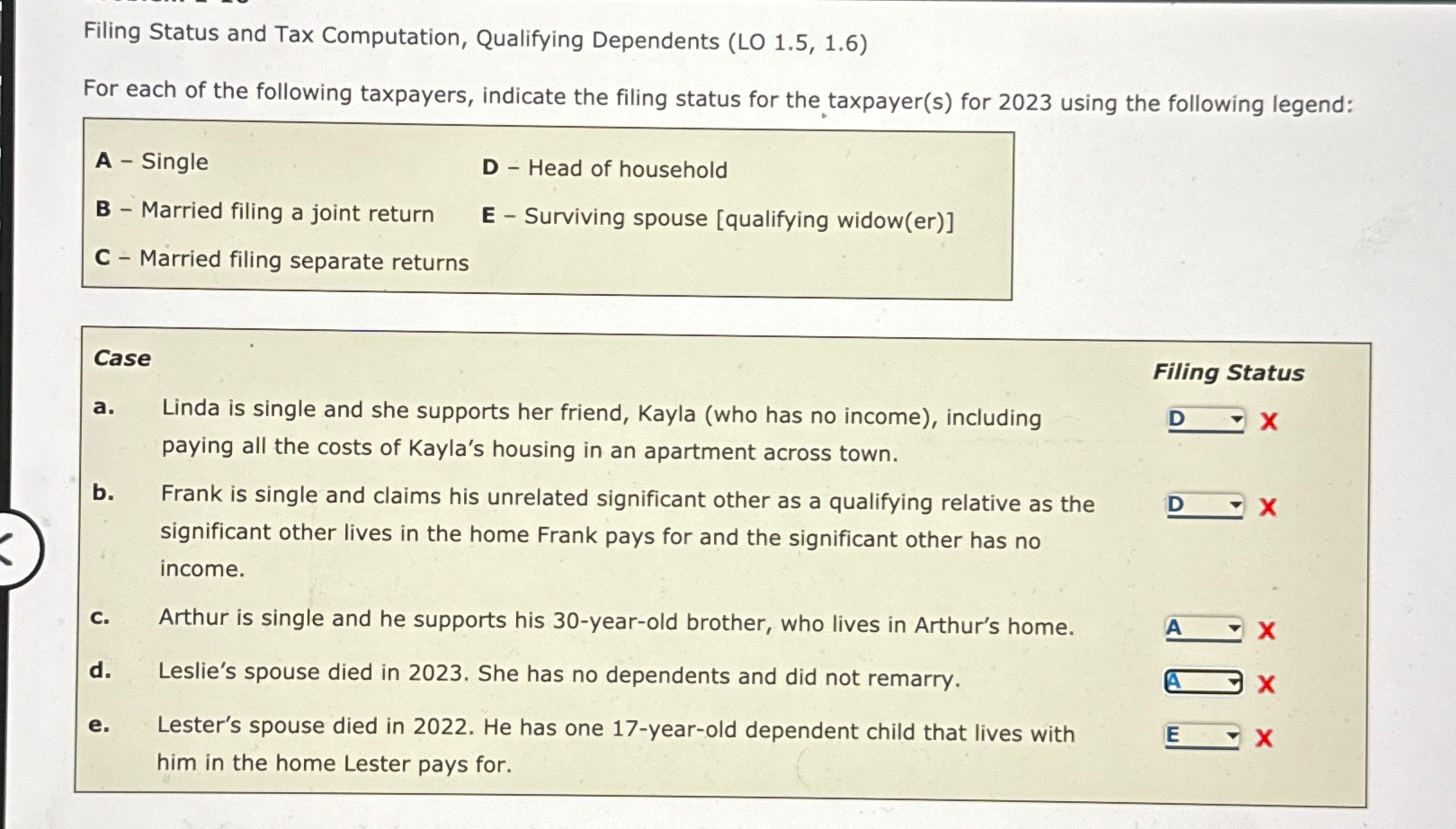

Filing Status and Tax Computation, Qualifying Dependents ( LO 1 . 5 , 1 . 6 ) For each of the following taxpayers, indicate the

Filing Status and Tax Computation, Qualifying Dependents LO

For each of the following taxpayers, indicate the filing status for the taxpayers for using the following legend:

A Single

D Head of household

B Married filing a joint return

E Surviving spouse qualifying widower

Married filing separate returns

Case

a Linda is single and she supports her friend, Kayla who has no income including paying all the costs of Kayla's housing in an apartment across town.

b Frank is single and claims his unrelated significant other as a qualifying relative as the significant other lives in the home Frank pays for and the significant other has no income.

c Arthur is single and he supports his yearold brother, who lives in Arthur's home.

d Leslie's spouse died in She has no dependents and did not remarry.

e Lester's spouse died in He has one yearold dependent child that lives with him in the home Lester pays for.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started