Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill green and Red boxes. Show workings also IBM moves -5% For simplicity, we assume there is no cost to borrow money. -5% Price of

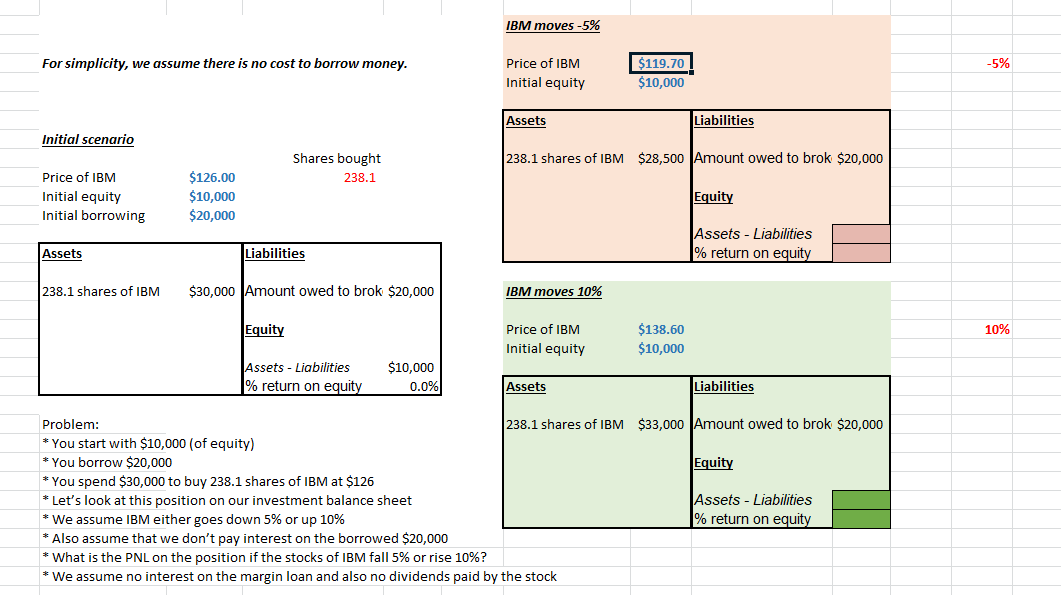

Fill green and Red boxes. Show workings also

IBM moves -5% For simplicity, we assume there is no cost to borrow money. -5% Price of IBM Initial equity $119.70 $10,000 Assets Liabilities Initial scenario 238.1 shares of IBM $28,500 Amount owed to brok $20,000 Shares bought 238.1 Price of IBM Initial equity Initial borrowing $126.00 $10,000 $20,000 Equity Assets - Liabilities % return on equity Assets Liabilities 238.1 shares of IBM $30,000 Amount owed to brok $20,000 IBM moves 10% Equity 10% Price of IBM Initial equity $138.60 $10,000 Assets - Liabilities % return on equity $10,000 0.0% Assets Liabilities Problem: 238.1 shares of IBM $33,000 Amount owed to brok $20,000 * You start with $10,000 (of equity) * You borrow $20,000 Equity * You spend $30,000 to buy 238.1 shares of IBM at $126 * Let's look at this position on our investment balance sheet Assets - Liabilities * We assume IBM either goes down 5% or up 10% % return on equity * Also assume that we don't pay interest on the borrowed $20,000 * What is the PNL on the position if the stocks of IBM fall 5% or rise 10%? * We assume no interest on the margin loan and also no dividends paid by the stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started