Answered step by step

Verified Expert Solution

Question

1 Approved Answer

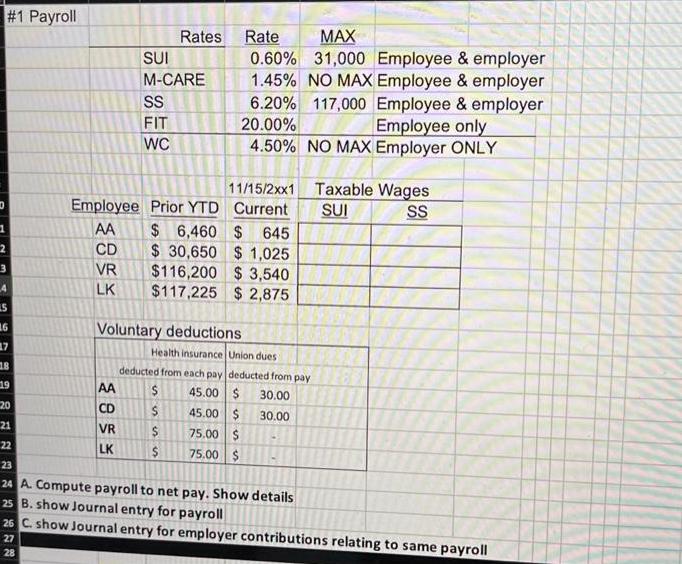

Fill in all empty boxes 0 2 # 1 Payroll 3 4 LS SUI M-CARE SS FIT WC AA CD VR 11/15/2xx1 Employee Prior YTD

Fill in all empty boxes

0 2 # 1 Payroll 3 4 LS SUI M-CARE SS FIT WC AA CD VR 11/15/2xx1 Employee Prior YTD Current $ 6,460 $ 645 $ 30,650 $1,025 AA CD VR $116,200 $3,540 $117,225 $2,875 LK Voluntary deductions Rates 16 17 18 19 20 21 22 23 24 A. Compute payroll to net pay. Show details 25 B. show Journal entry for payroll 26 C. show Journal entry for employer contributions relating to same payroll 27 28 555. Rate MAX 0.60% 31,000 Employee & employer 1.45% NO MAX Employee & employer 6.20% 117,000 Employee & employer 20.00% Employee only 4.50% NO MAX Employer ONLY Health insurance Union dues deducted from each pay deducted from pay 45.00 $ 30.00 $ 45.00 $ 30.00 75.00 $ 75.00 $ $ $ $ Taxable Wages SUI SS

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Payroll AA Wages 6460 SUI 06 of wages 6460 0006 3876 MCare 145 of wages 6460 00145 9367 SS 62 of w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started