fill in blank

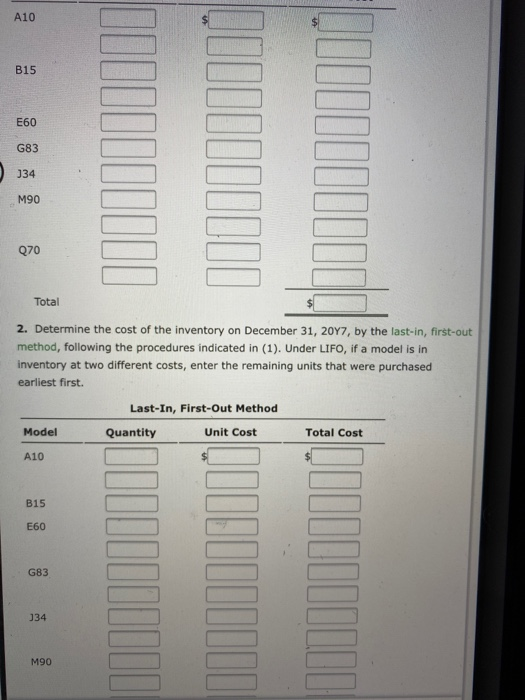

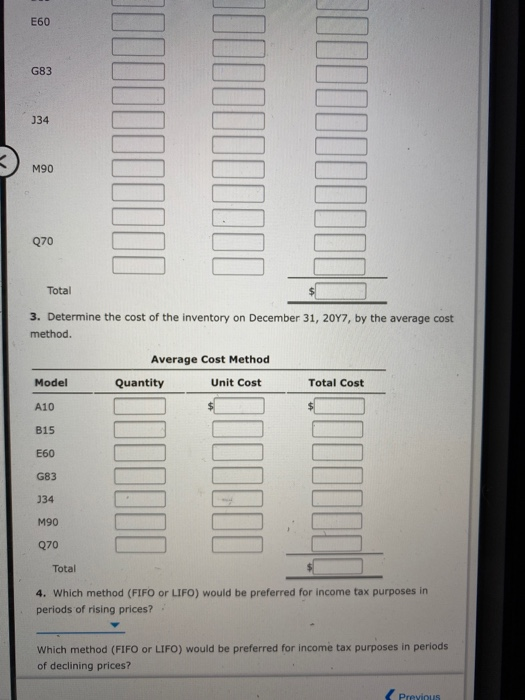

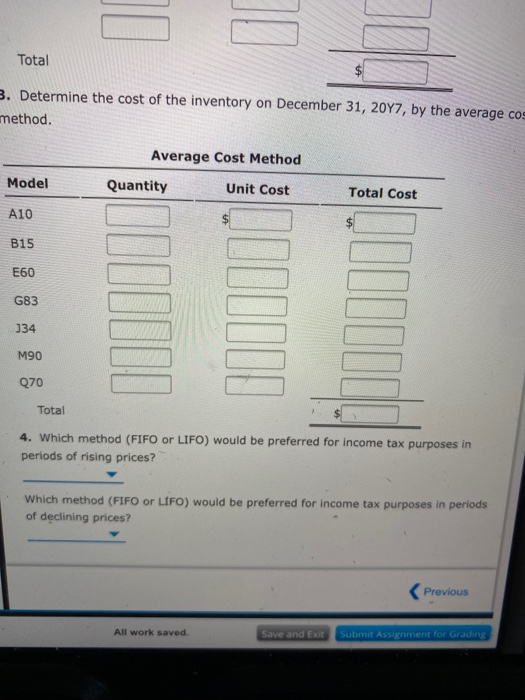

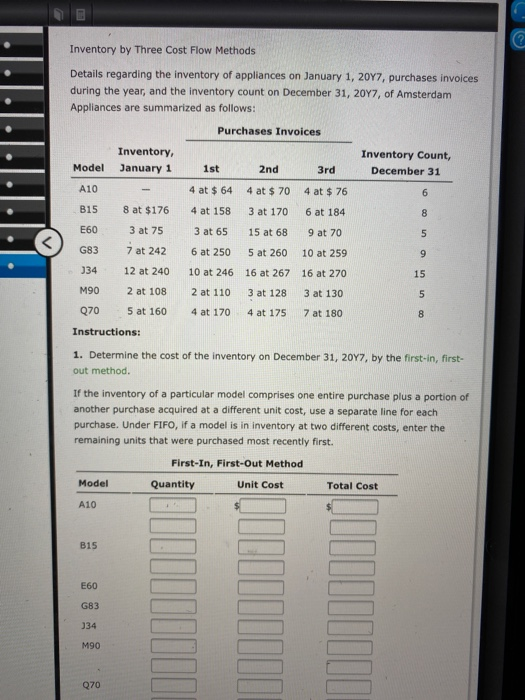

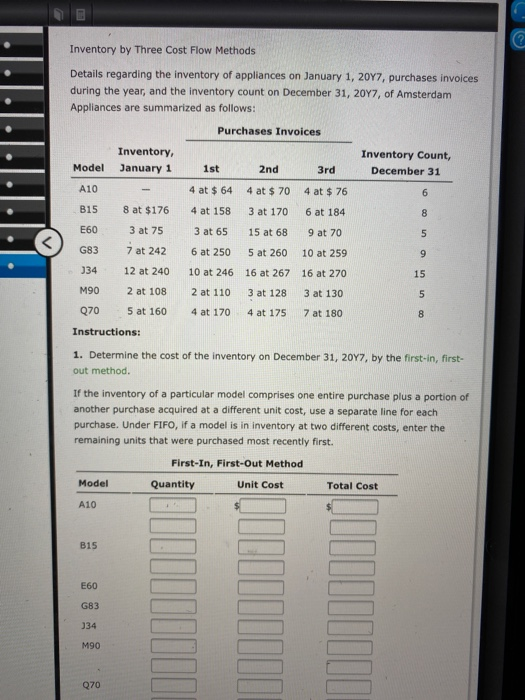

a Inventory by Three Cost Flow Methods Details regarding the inventory of appliances on January 1, 2017, purchases invoices during the year, and the inventory count on December 31, 2017, of Amsterdam Appliances are summarized as follows: Purchases Invoices Inventory, Inventory Count, Model January 1 1st 2nd 3rd December 31 A10 4 at $64 4 at $ 70 4 at $ 76 B15 8 at $176 4 at 158 3 at 170 6 at 184 E60 3 at 75 3 at 65 15 at 689 at 70 G83 7 at 242 6 at 2505 at 260 10 at 259 334 12 at 240 10 at 246 16 at 267 16 at 270 M90 2 at 108 2 at 110 3 at 128 3 at 130 5 at 1604 at 1704 at 1757 at 180 Instructions: o n u i ao 1. Determine the cost of the inventory on December 31, 2017, by the first in, first- out method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. Under FIFO, if a model is in inventory at two different costs, enter the remaining units that were purchased most recently first. First-In, First-Out Method Quantity Unit Cost Total Cost Model A10 A10 B15 E60 G83 J34 M90 070 Total 2. Determine the cost of the inventory on December 31, 2017, by the last-in, first-out method, following the procedures indicated in (1). Under LIFO, if a model is in Inventory at two different costs, enter the remaining units that were purchased earliest first. Last-In, First-Out Method Quantity Unit Cost Model Total Cost A10 B15 E60 G83 M90 Total 3. Determine the cost of the inventory on December 31, 2017, by the average cost method. Average Cost Method Model Quantity Unit Cost Total Cost A10 B15 E60 G83 134 M90 070 Total 4. Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of rising prices? Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of declining prices? Previous Total 3. Determine the cost of the inventory on December 31, 2017, by the average cos method. Average Cost Method Quantity Unit Cost Model Total Cost A10 B15 E60 G83 334 M90 Q70 Total 4. Which method (FIFO or LIFO) would be preferred for income tax purposes in periods of rising prices? which method (FIFO or LIFO) would be preferred for income tax purposes in periods of declining prices? Previous All work saved Save and Exit Submit Assignment for Grading

fill in blank

fill in blank