Answered step by step

Verified Expert Solution

Question

1 Approved Answer

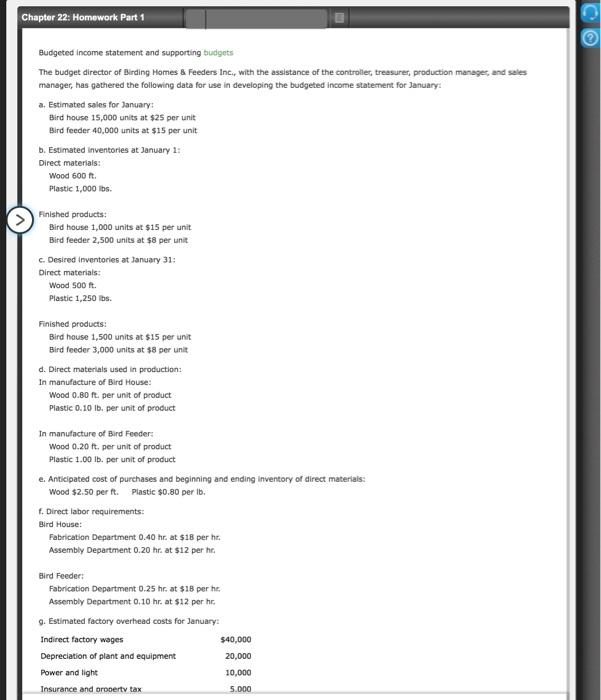

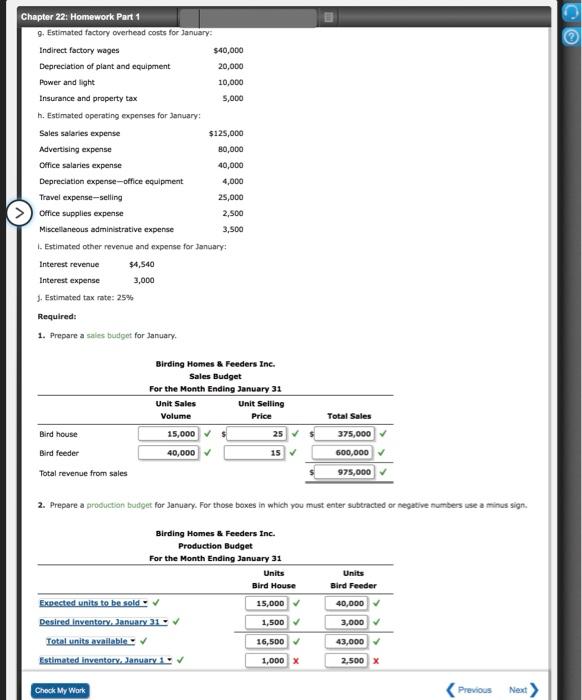

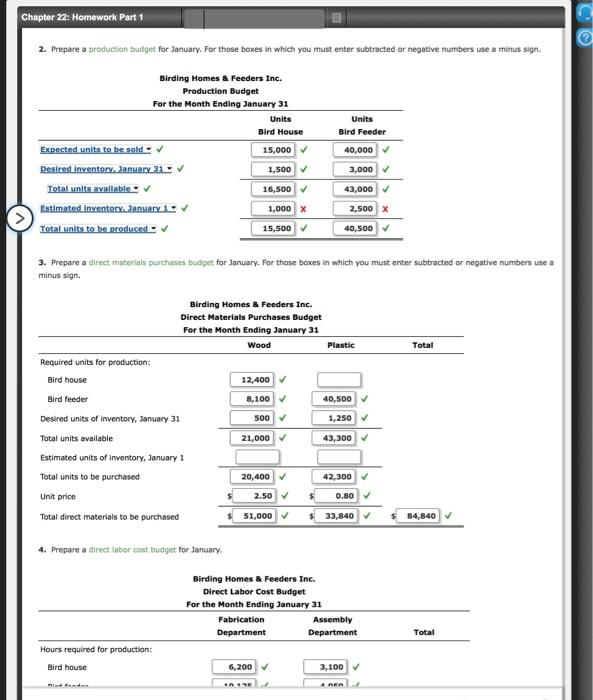

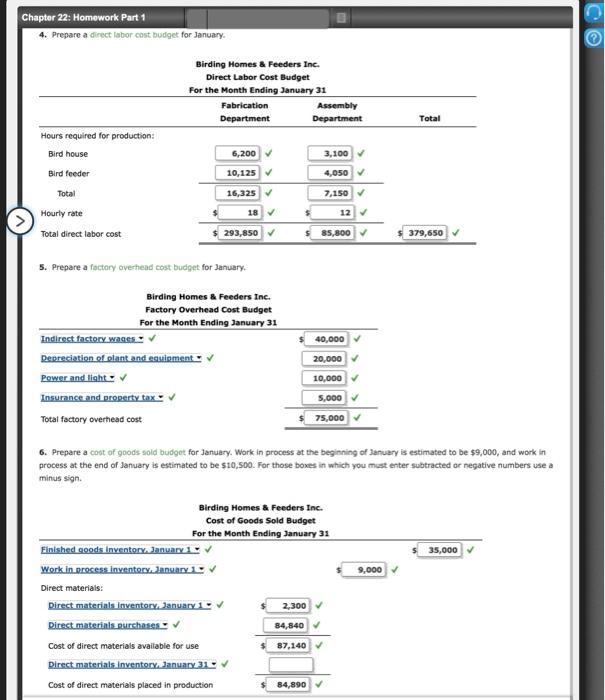

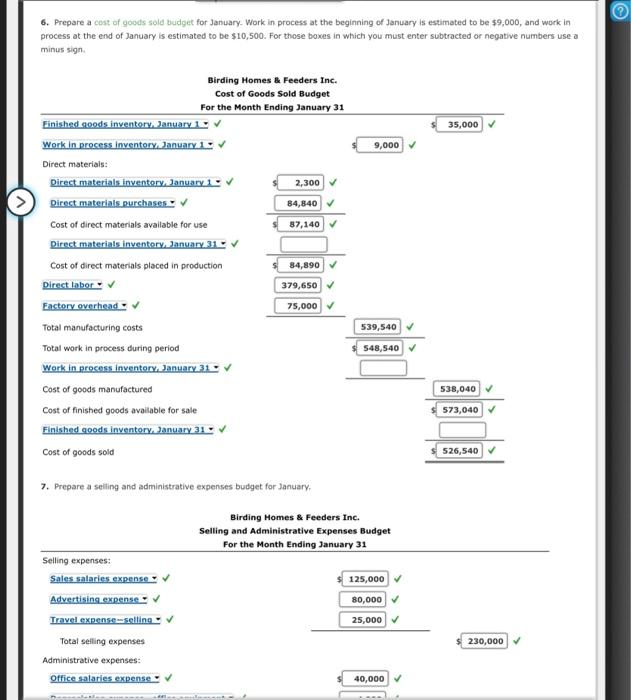

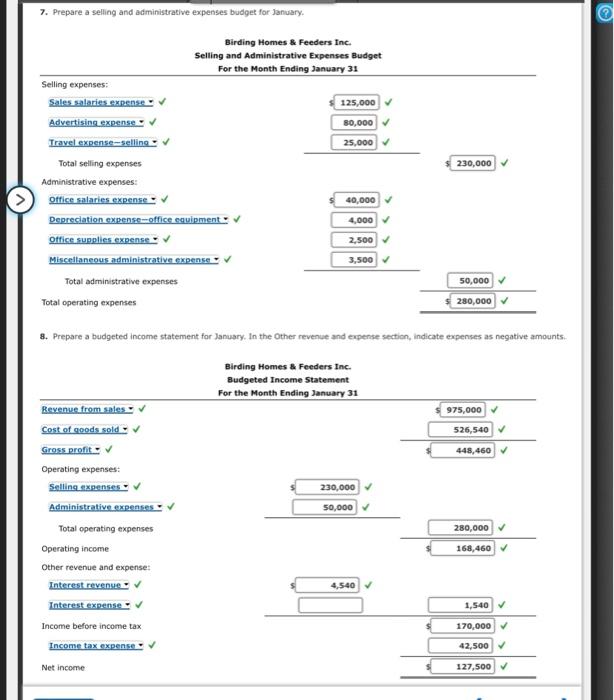

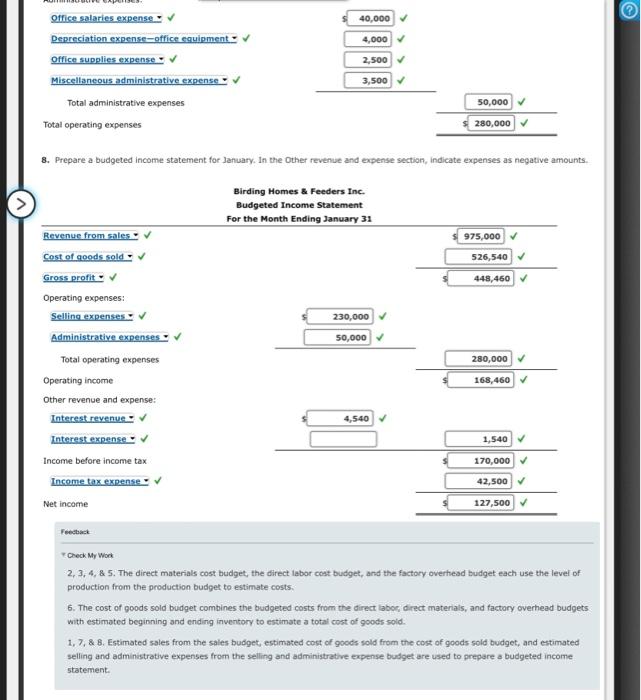

fill in blank Chapter 22: Homework Part 1 Budgeted income statement and supporting budgets The budget director of Birding Homes & Feeders Inc, with the

fill in blank

Chapter 22: Homework Part 1 Budgeted income statement and supporting budgets The budget director of Birding Homes \& Feeders Inc, with the assistance of the controlle, treasures, production manager, and sales manage, has gathered the following data for use in developing the budgeted income statement for January: a. Estimated sales for January: Bird house 15,000 units at $25 per unit Bird feeder 40,000 units at $15 per unit b. Estimated inventories at January 1: Direct materials: Wood 600ft. Plastic 1,000 Ibs. Finished products: Bird house 1,000 units at $15 per unit Bird feeder 2,500 units at $8 per unit c. Desired inventories at January 31: Direct materials: Wood 500ft. Plastic 1,250 ibs. Finished products: Bird house 1,500 units at $15 per unit Bird feeder 3,000 units at $8 per unit d. Direct materials used in production: In manufacture of Bird House: Wood 0.80f. per unit of product Plastic 0.10lb. per unit of product In manufacture of Bird Feeder: Wood 0.20ft. per unit of product Plastic 1.00lb. per unit of product e. Anticipated cost of purchases and beginning and ending inventory of direct materiais: Wood $2.50 per ft. Plastic $0.80 per ib. f. Direct labor requirements: Bird House: Fabrication Department 0.40hr at $18 per ht. Assembly Department 0.20hr at $12 per hr. Bird Feeder: Fabrication Department 0.25hr, at $18 per he. Assembly Department 0.10hr. at $12 per hr. g. Estimated factory overhead costs for January: h. Estimated operating expenses for January: 1. Estimated other revenue and expense for January: 1. Estimated tax rate: 25% Required: 1. Prepare a sales budget for lanuary. 2. Prepare a production butget for January. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 2. Prepare a production budget for January. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 3. Prepare a direct materials purchases budget for January. For those boves in which you must enter subtracted or negative numbers use a minus sign. 4. Prepare a direct labor cost budget for January. 4. Prepare a direct labor cost budget for January. 5. Prepare a factory overthead cost budget for January. 6. Prepare a coot of goods sold budgot for January. Work in process at the beginning of January is estimated to be $9,000, and work in process at the end of January is estimated to be $10,500. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 6. Prepare a cost of goods sold tudget for January. Work in process at the beginning of January is estimated to be $9,000, and work in process at the end of lanuary is estimated to be $10,500. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 7. Prepare a selling and administrative expenses budyet for January. 7. Prepare a selling and administrative expenses budget for January. 3. Prepare a budgeted income statement for January. In the Other revenue and expense section, indicate expenses as negative amounts. rebctakek. r Creck My Work 2,3,4,85. The direct materials cost budget, the direct labor cost budget, and the factory overhesd budget each use the level of production from the production budpet to estimate costs. 6. The cost of goods sold budget combines the budgeted costs from the direct laboc, direct materials, and factory overhead budgets with estimoted beginning and ending inventory to estimate a total cost of goods sold: 1, 7, 8 8. Estimated sales from the sales budget, estimated cost of goods sold from the cost of goods sold budget, and estimated selling and administrative expenses from the selling and administrative expense budget are used to prepare a budgeted income statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started