Question

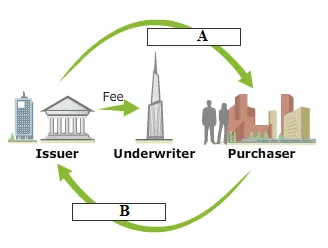

Fill in the blank A: (Coupons / Bond Price) B: (Bond Price / Par Value) The entity issuing the debt obligation is the borrower in

Fill in the blank

A: (Coupons / Bond Price)

B: (Bond Price / Par Value)

The entity issuing the debt obligation is the borrower in the transaction. Some of the biggest issuers in the bond market are (1)(municipial governments / central governments / corporations) ??, such as the U.S. government and the government of U.K.; (2)?government-related agencies, such as Fannie Mae and Freddie Mac; (2)

(corporations / supranational banks / municipal governments), such as the state of California, Sakai City, Japan; (3)

(supranational banks / corporations / central governments), such as British Telecom, and The Walt Disney Co. and (4)

(supranational banks / corporations / central governments), such as the European Investment Bank and the World Bank.

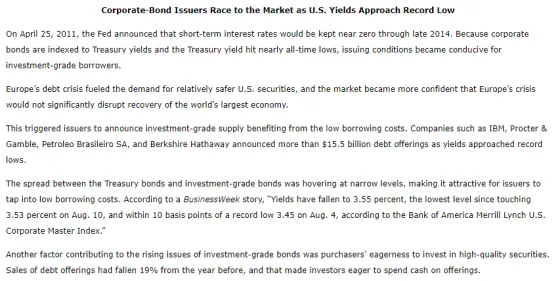

Economies around the world were still recovering during 2012 after the 2008?2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. Federal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds.

In the context of the reasons why entities borrow in the form of bond issues, which statement is correct??Check all that apply.

Issuer Fee A Underwriter B 1 AMITE Purchaser

Step by Step Solution

3.41 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided the correct statements are When equity markets are turbulent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started